Major on-chain metrics and activity for Bitcoin and Ethereum have been in decline over the past month according to recent analytics.

According to research from The Block, key on-chain metrics for Bitcoin and Ethereum are still showing negative trends so far this year.

Bitcoin and Ethereum on-chain volume overview

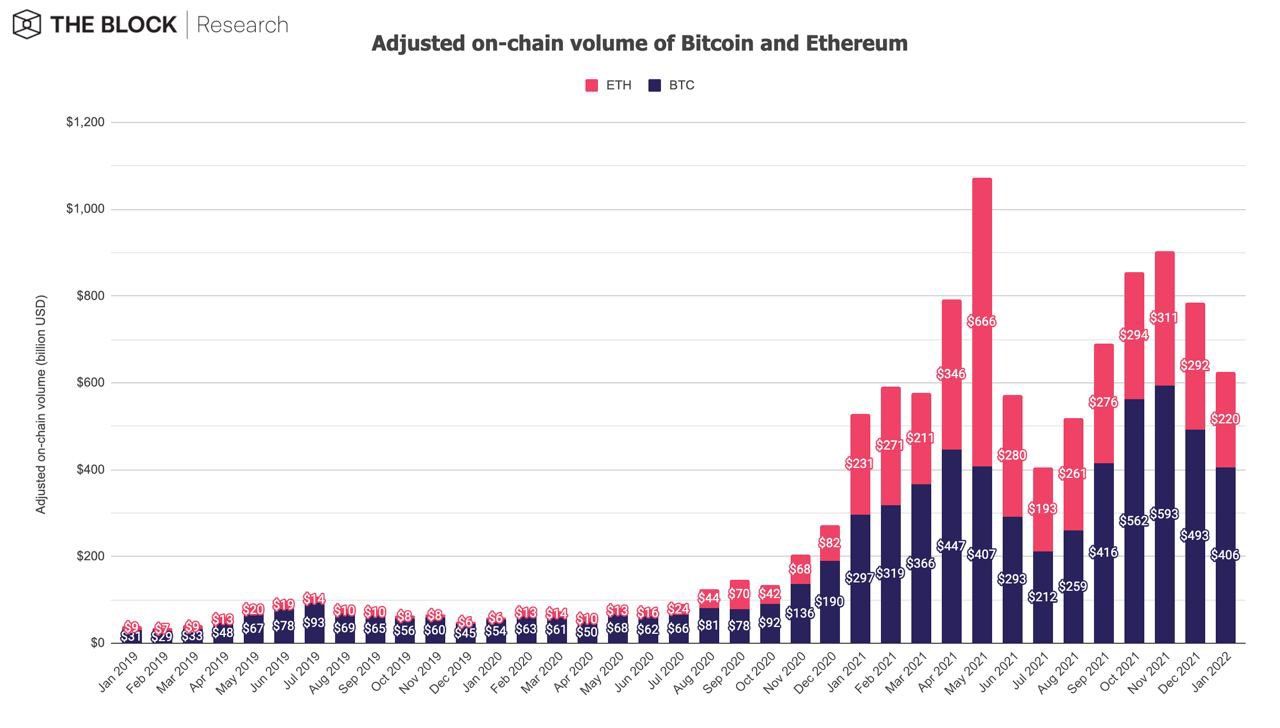

The findings were posted on Feb 1, with the researcher stating that the total adjusted on-chain volume for both assets has decreased by 20% from December’s $785 billion to $626 billion in January. According to its research, the peak figure for total adjusted on-chain volume for Bitcoin and Ethereum came in May 2021 at $1.07 trillion.

Sponsored

Just like crypto markets themselves, the metric has been in decline since November. Over the same period, the total crypto market capitalization has shrunk by 40% or $1.23 trillion to current levels which are around $1.85 trillion.

More falling metrics

The research went on to list a number of other on-chain metrics that have also fallen from their peaks last year.

The adjusted on-chain transaction volume of stablecoins has decreased by 32.8% to $541 billion in January. This metric hit a peak of a little over $800 billion in December. However, stablecoin issuance has increased pushing the total market capitalization for all stablecoins to a near all-time high of around $176 billion, representing 9.5% of the entire crypto market cap.

Ethereum miner revenue also fell in January, dropping by 22.8% to $1.42 billion, while Bitcoin miner revenue decreased by 15.4% to $1.21 billion. “This is the ninth consecutive month where ETH miner revenue exceeded BTC miner revenue,” the researchers noted.

Legitimate centralized exchange spot volumes decreased by 20% to $833.5 billion in January from just over $1 trillion in December.

There were also marked declines in derivatives volumes and open interest for both Bitcoin and Ethereum in January.

NFTs buck the trend

Going against the grain of down trending Bitcoin and Ethereum metrics was the NFT sector. Monthly NFT marketplace volumes on Ethereum increased by 210% to a new all-time high of $7 billion in January. The research did note that there was “significant wash trading” on the LooksRare marketplace due to its incentive program.

Dune Analytics has reported that the leading NFT marketplace OpenSea recorded a record month for Ethereum-based NFT volume in January with $4.9 billion. This represents an increase of 95% over the previous month and is 48% higher than its previous record-setting month in August which saw a volume of $3.42 billion.