Bitcoin and Ethereum miners saw a steep decline in revenue during the month of May as prices of both cryptocurrencies fell to new local lows.

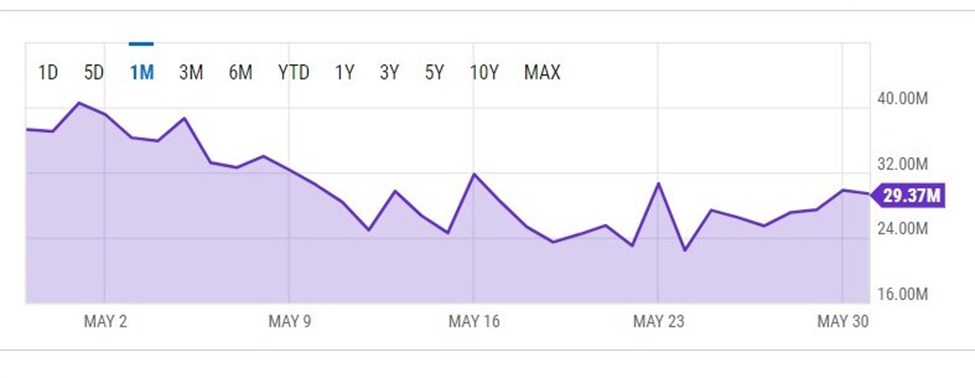

May proved to be one of the worst months for Bitcoin miners in 2022. According to Be[In]Crypto research, BTC miners were able to generate approximately $906.19 million in revenue during the fifth month of the year.

Bitcoin miners’ revenue for May was down $253.81 million from April 2022’s value of around $1.16 billion.

The total profitability of Bitcoin over the past year was down by 37% since May 2021, which saw $1.45 billion in revenue recorded.

The single-day high for May 2022 was 11% below the best day high in April. The single-day high for April was $46.01 million, according to data from YCharts. The single-day high for May was in the region of $40.53 million and this was 32% lower than the best day high of $60.16 million in January 2022.

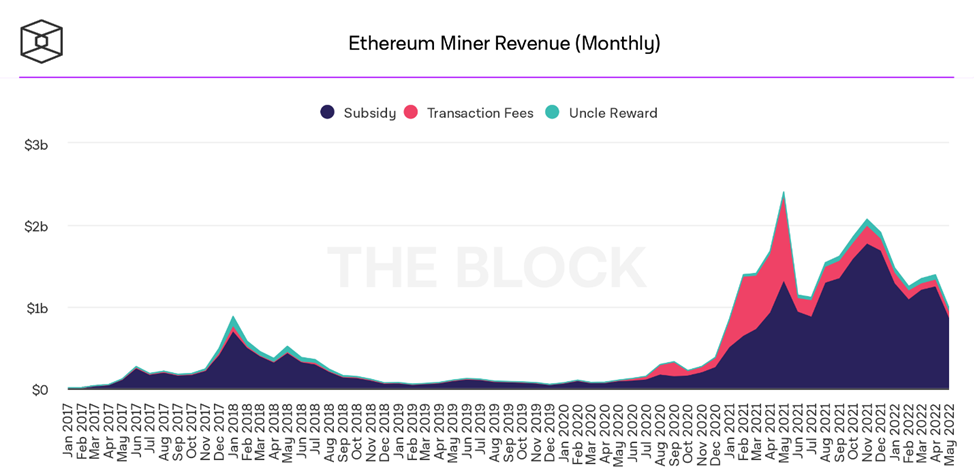

Ethereum outpaces Bitcoin mining revenue for the fifth consecutive month

While Bitcoin miners managed $906.19 million in May revenue, Ethereum miners generated around $1.01 billion.

Like Bitcoin, Ethereum’s revenue decreased by 27% from April. April 2022 saw Ethereum mining bring forth total revenue of $1.39 billion. Ethereum mining also saw a year-over-year monthly decline in May. May 2021 saw approximately $2.4 billion in revenue generated, while 2022’s figure dipped by 57%.

Miners still profit more from Ethereum in May 2022

Despite the market crash of May 2022, Bitcoin remains the largest cryptocurrency by market capitalization. With that said, miners continued to benefit more from Ethereum than Bitcoin.

Before Ethereum miners’ revenue surpassed Bitcoin in May, ETH outpaced BTC by $260 million in January, $190 million in February, $130 million in March, and more than $230 million in April.

What caused the crash in mining revenue?

To understand the crash in mining revenue, we should discuss how mining revenue is calculated. We calculate miners’ revenue by multiplying the price of a coin (BTC or ETH) by the total number of coins earned in a given period.

Sinking cryptocurrency prices caused by the market crash of May can be credited as the primary cause for waning mining revenues.

Ethereum mining revenue decreased from April 2022 because of trading in the range of $2,000 to $3,000 in the first 11 days of May. The last 20 days saw ETH trading more in the range of $1,700 to $2,000.

In April 2022, Ethereum traded in the range of $3,000 to $4,000 per coin for the majority of days. Overall, ETH opened at $2,730 on May 1, and closed May 31, at $1,942. This equated to a 28% decline in Ethereum’s opening and closing price in May.

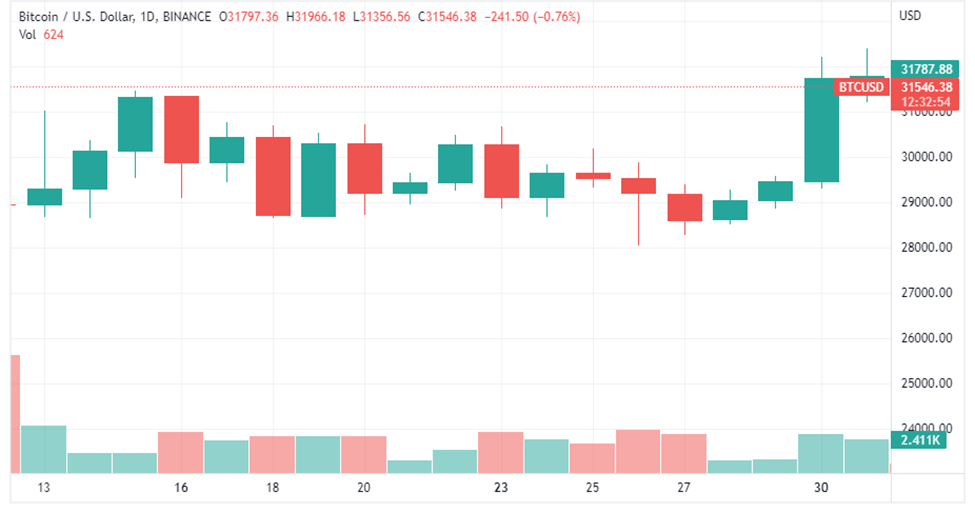

On the other hand, Bitcoin spent the first nine days of May trading in the range of $30,000 to $40,000. In the last 22 days, BTC traded more in the price range of $25,000 to $32,000. In April 2022, Bitcoin spent the majority of its days trading between $37,000 and $44,000. Overall, BTC opened at $37,713 on May 1 and closed at $31,792 on May 31. There was a 15% drop in BTCs opening and closing price in May.