Bitcoin spot ETFs (exchange-traded funds) in the US hit a multi-month high, reaching a massive $7.22 billion in trading volume on November 11.

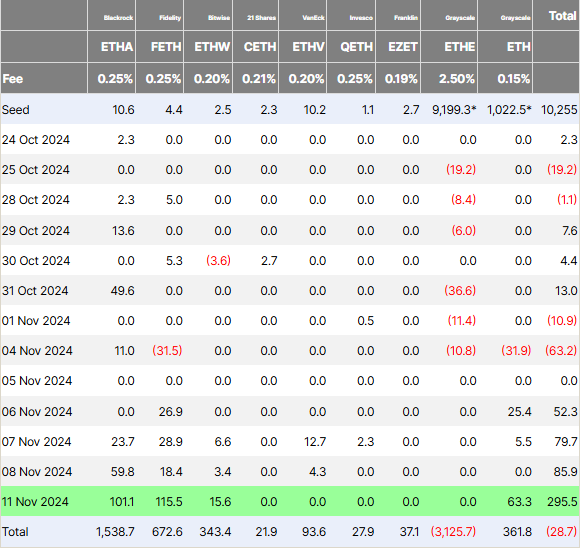

Meanwhile, Ethereum ETFs set a new peak on inflow metrics, recording over $295 million amid a remarkable surge for crypto-based exchange-traded funds.

Bitcoin ETFs Hit Multi-Month High With $7 Billion Trading Volume

This marks the sixth-highest volume day for Bitcoin ETFs on record. According to Bloomberg ETF analyst James Seyffart, this represents the highest daily volume since March 14. BlackRock’s iShares Bitcoin Trust (IBIT) ETF led the charge.

“Massive $7.22 billion trading day for the US spot Bitcoin ETFs. Highest volume day since March 14 and the sixth highest day of all time. BlackRock’s IBIT leads the way with $4.6 billion followed by Fidelity’s FBTC also squeaking past the $1 billion level,” Seyffart wrote.

The trading volume spike, observed across major Bitcoin ETFs, aligns with increased post-election enthusiasm in the US market. It comes as the crypto community expects favorable regulatory outlooks and broader institutional adoption.

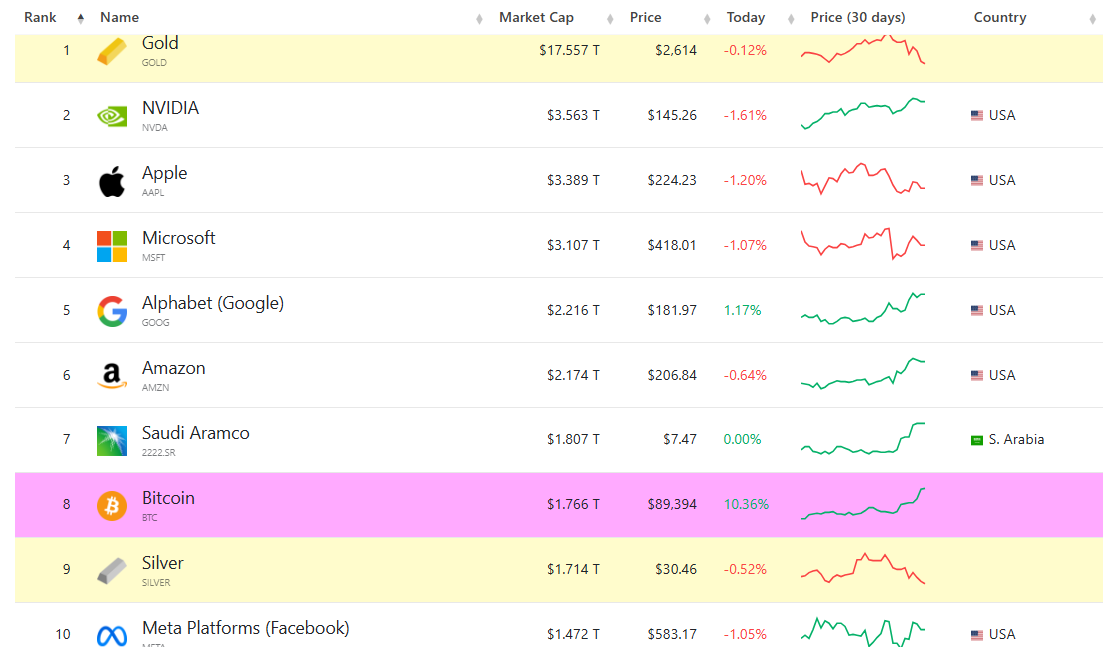

The trading activity observed could also be driven by Bitcoin’s recent price rally, which saw it break past $88,000. With this surge, it surpassed silver in market capitalization and made Bitcoin the eighth-largest global asset at $1.736 trillion.

The momentum behind IBIT and other spot Bitcoin ETFs highlights the growing institutional appetite for Bitcoin exposure. BlackRock’s IBIT ETF has consistently attracted substantial trading volumes since its launch, and recent data highlights its pivotal role in leading the market’s Bitcoin ETF growth.

Notably, IBIT’s volume topped $4 billion for two consecutive high-volume days last week, with one day resulting in net outflows of $69 million. This was followed by a record net inflow of over $1 billion the next day — its largest capital injection since inception. According to data on SoSoValue, the financial instrument recorded net inflows of $756.45 million, adding to the streak of positive performances.

Experts caution, however, that while high trading volumes signal strong demand, they can also indicate selling activity. Bloomberg’s ETF expert Eric Balchunas has pointed out that it might take several days to interpret these volumes in terms of sustained net inflows.

For now, Bitcoin’s surging ETF activity signifies a powerful post-election rally. Many investors are watching to see whether this bullish momentum will continue to solidify in the weeks ahead.

Ethereum ETFs See Record-Setting Inflows as Institutional Interest Peaks

As Bitcoin ETFs enjoyed a surge in trading volume, Ethereum ETFs have simultaneously broken records for inflows. For the week ending November 10, US-based Ethereum ETFs saw total inflows exceed $295 million, setting an all-time high.

BlackRock’s Ethereum Trust (ETHA) led with inflows of $101 million, closely followed by Fidelity’s Ethereum Trust (FETH), which recorded $115 million in new capital, as BeInCrypto reported.

The recent activity reflects a broader market recovery for cryptocurrency ETFs. Both Bitcoin and Ethereum funds have experienced multi-week highs in trading volume and inflows, driven by optimistic market sentiment.

Institutional interest in Ethereum ETFs has been steadily growing. Recent data shows a noteworthy endorsement from Michigan’s largest public pension fund, among other similar entities.

Specifically, it became one of the first institutional investors to allocate funds to Ethereum ETFs. This move by a prominent pension fund marks a significant step in Ethereum’s journey toward mainstream acceptance.

As the excitement around the US elections fades, the market is closely watching for signs of steady interest and new capital coming in. These shifts show a big step forward in the adoption of crypto assets, with more investors starting to include Bitcoin and Ethereum ETFs in their portfolios. This trend is helping cement cryptocurrency’s place as a recognized asset class in institutional finance.