The crypto market is preparing for potential temporary turbulence, with over $2.2 billion in Bitcoin (BTC) and Ethereum (ETH) options set to expire today.

Can the expiration cause greater volatility in the market, and will it affect the price of the two leading cryptocurrencies?

Examining the Impending Options Expiration for Bitcoin and Ethereum

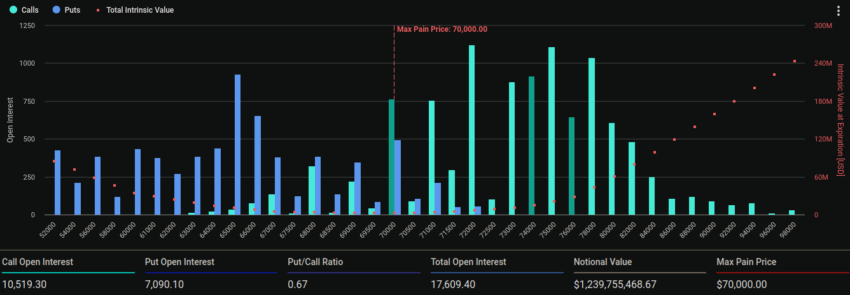

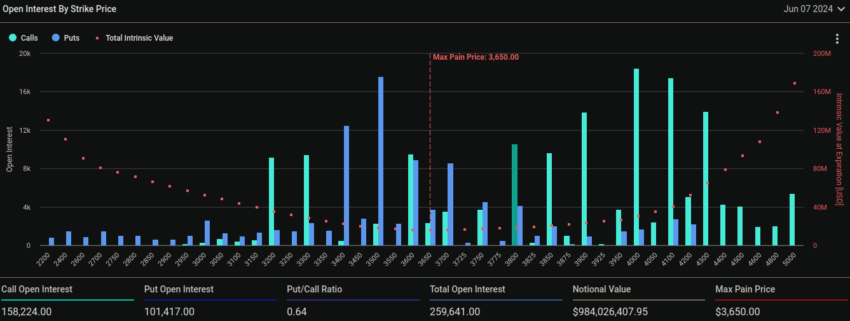

Approximately $1.24 billion in Bitcoin options contracts and $984 million in Ethereum options contracts are due to expire. Depending on how traders react to the event, the expiration of these options contracts could trigger a new wave of sell-offs or buying pressure.

According to Deribit data, 17,609 Bitcoin contracts are set to expire, with a put-to-call ratio of 0.67. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

Read more: An Introduction to Crypto Options Trading

Meanwhile, Bitcoin’s maximum pain point is around $70,000. The maximum pain point is the price level at which the asset will cause financial losses to the greatest number of holders.

Analysts at crypto option trading tools provider, Greeks.Live, have suggested a positive outlook for Bitcoin and Ethereum prices despite the upcoming options expiration. They explained that the crypto market, particularly Bitcoin, has shown signs of strength following the announcement of interest rate cuts by the Bank of Canada (BOC) and the European Central Bank (ECB).

“US Non-Farm Payrolls and Unemployment Rate have also become more interesting, with The Fed rate cut expectations now at the center of macro trading. Short-term [implied volatility] IV is now clearly rising, with the weekly [at-the-money] ATM IV back above 50% but still below 50% at the end of the week, just as traders are betting on [today’s] data to exceed expectations, with slightly stronger bullish forces,” they noted.

In the Ethereum market, 259,641 contracts are set to expire. The put-to-call ratio stands at 0.64. Ethereum’s maximum pain point is $3,650.

Read more: 9 Best Crypto Options Trading Platforms

While options expirations can cause temporary market disruptions, they are often followed by stabilization. Traders should remain vigilant, analyzing technical indicators and market sentiment to navigate the anticipated volatility effectively.

As the week concludes, Bitcoin and Ethereum have shown resilience. Bitcoin reached a two-month high of $71,713 before slightly retreating. On the other hand, Ethereum is trading at $3,805, having experienced a minor decline.