After weeks of outflows, Bitcoin exchange-traded funds (ETFs) have finally reversed course, recording $274.6 million in inflows on March 17.

This marks the largest single-day net inflow in 41 days, hinting at renewed investor interest. While one positive day does not confirm a trend, it raises an important question: Is demand returning to Bitcoin ETFs, or is this just a temporary reprieve?

Bitcoin ETFs See First Major Inflows in Weeks

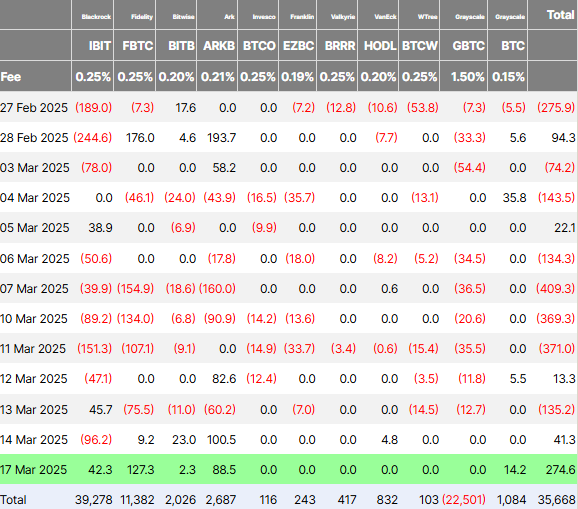

According to the latest data on Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) recorded $42.3 million in inflows on Monday. Despite the positive flows, IBIT failed to lead the way amid ongoing headwinds due to stock market correlation.

Fidelity’s Bitcoin ETF (FBTC) attracted $127.28 million, making it the day’s biggest gainer. The ARK Bitcoin ETF (ARKB), managed by ARK Invest and 21Shares, also saw significant interest, pulling in $88.5 million.

On the other hand, the Grayscale Bitcoin Trust (GBTC), which has been at the center of major outflows, remained flat at $0 million. This is notable because GBTC has lost billions in assets since transitioning to a spot ETF.

Meanwhile, Grayscale’s other Bitcoin product saw a modest inflow of $14.22 million. Other Bitcoin ETFs, including those from Valkyrie, Invesco, Franklin, and WisdomTree, recorded no daily inflows.

However, while Bitcoin ETFs had a strong showing, Ethereum-based spot ETFs continued their downward trajectory. Data on Farside investors showed they logged their ninth consecutive day of net outflows at $7.3 million.

“Bitcoin spot ETFs attract $275 million in inflows, while Ethereum ETFs experience outflows, reflecting shifting investor preferences,” one user on X suggested.

Notably, while this could suggest the returning demand for Bitcoin ETFs after weeks of outflows, analysts say one green day does not make a trend. Nevertheless, it is a shift worth watching.

Bitcoin ETFs Have Lost Billions in Recent Weeks

Just a week ago, Bitcoin ETFs had recorded four straight weeks of net outflows totaling more than $4.5 billion. Profit-taking, regulatory concerns, and broader economic uncertainty fueled the shift in investor sentiment.

The crypto market as a whole has also seen capital flight. As BeInCrypto reported, total crypto outflows exceeded $800 million last week, signaling strong negative sentiment among institutional investors.

With this context, while Monday’s inflow of $274 million could be seen as a sign of stabilization, it is too early to determine whether this marks the beginning of a broader recovery.

Nevertheless, the sudden surge in ETF inflows raises the question of whether this is a resurgence of the so-called “Trump crypto boom” or a case of fear of missing out (FOMO). Some analysts believe hedge funds and institutional players drive the action more than retail investors.

Crypto entrepreneur Kyle Chassé has previously argued that hedge funds play a major role in Bitcoin’s ETF flows. He claims that large investors strategically withdraw and reinvest capital to manipulate price movements, making it difficult to determine organic demand.

“The ETF “demand” was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” the analyst explained.

If true, the latest ETF inflows might not represent new buyers. Rather, it could mean recycling institutional capital to capitalize on short-term price swings.

Adding to the uncertainty, many investors are considering the Federal Reserve’s upcoming policy decisions. Some have speculated that the Fed will pivot toward monetary easing (QE) soon, but industry experts warn that such expectations are misguided.

Nic Puckrin, a financial analyst and founder of The Coin Bureau, believes those anticipating imminent QE are “deluded.” He notes that the Fed’s fund rate remains at 4.25-4.5%, and historically, QE does not begin until rates approach zero.

“…why is anyone suddenly expecting a massive injection of liquidity into the system? Realistically, if large-scale monetary stimulus is going to come from anywhere, it will be China or Europe, both of which have already implemented monetary easing measures. The most we can expect from Powell tomorrow is a hint at the timing of the next interest rate cut, but we may not even get that. And so, investors should prepare for the markets to throw another tantrum this week,” Puckrin told BeInCrypto.

.