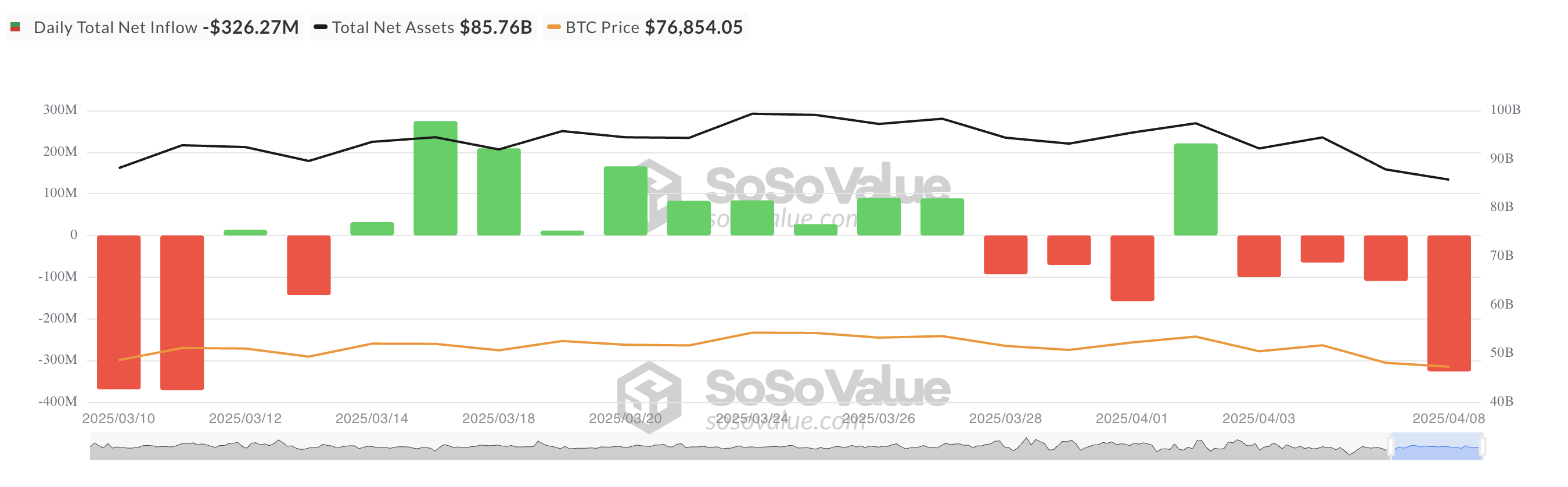

Institutional investors are increasingly risk-averse, shifting capital away from Bitcoin ETF products. This shift in sentiment has led to a sharp spike in capital exit, with US-listed spot Bitcoin ETFs recording another day of outflows on Tuesday.

This trend signals sustained bearish pressure and a lack of conviction from institutional players who had previously fueled bullish momentum in the ETF market.

Bitcoin Sees Sharpest Fund Outflows Since March

On Tuesday, fund outflows from spot BTC ETFs totaled $326.27 million, marking four consecutive days of consistent outflows. Yesterday’s figure also represented the highest single-day outflow from spot BTC ETFs since March 10, signaling a notable shift in sentiment.

This sustained capital flight suggests that large investors are de-risking their portfolios in response to macroeconomic pressures triggered by Donald Trump’s trader wars. The trend is significant considering the role institutional flows have played in driving BTC’s rally through ETF demand in the past.

According to SosoValue, BlackRock’s ETF IBIT saw the highest net outflow on Tuesday, totaling $252.29 million, bringing its total historical net inflow to $39.66 billion.

Bitwise’s ETF BITB came second with a daily net outflow of $21.27 million. As of this writing, the ETF’s total historical net inflow still stands at $1.97 billion.

For the second time this week, none of the twelve US-listed spot Bitcoin ETFs recorded a single net inflow.

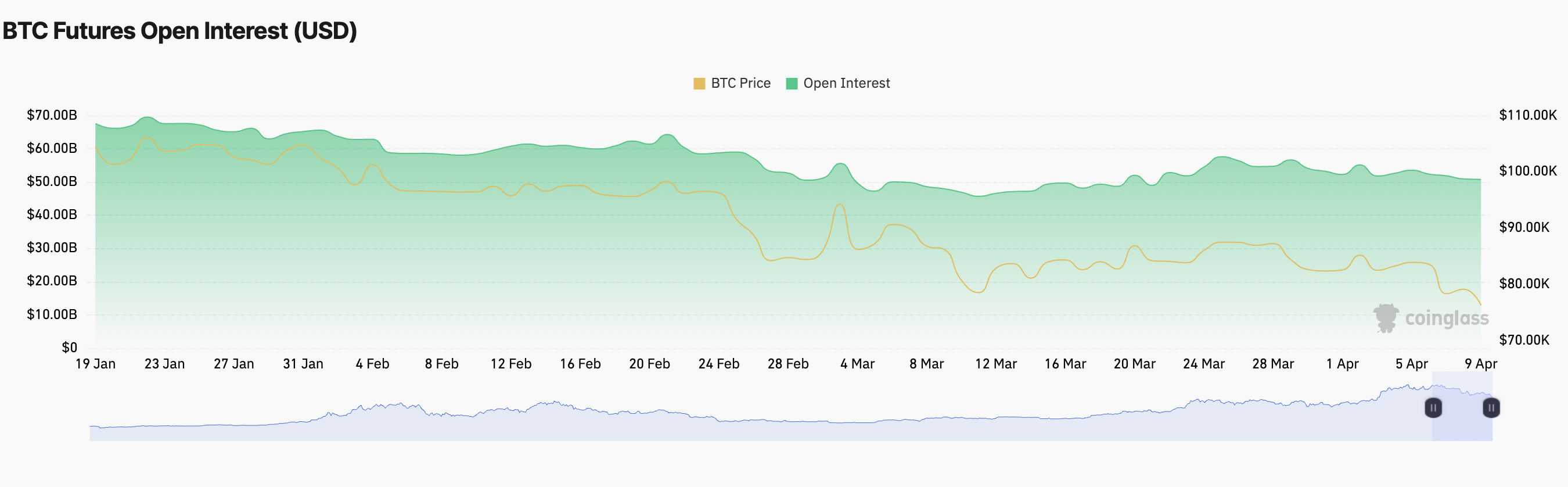

Bitcoin Futures Cool Off as Options Traders Bet on a Rebound

At the same time, open interest (OI) in BTC futures remains suppressed, a sign that conviction among leveraged traders has not returned. At press time, this is at $50.81 billion, falling by 0.27% over the past day.

When BTC’s OI falls, existing futures contracts are being closed out or liquidated faster than new ones are being opened. This signals reduced trader participation or waning conviction in the current market trend.

Despite this, many futures traders remain optimistic, as reflected by the coin’s positive funding rate, which stands at 0.0090% at press time. BTC’s falling OI and positive funding rate suggest that its traders still pay a premium to hold long positions, but overall market participation is declining.

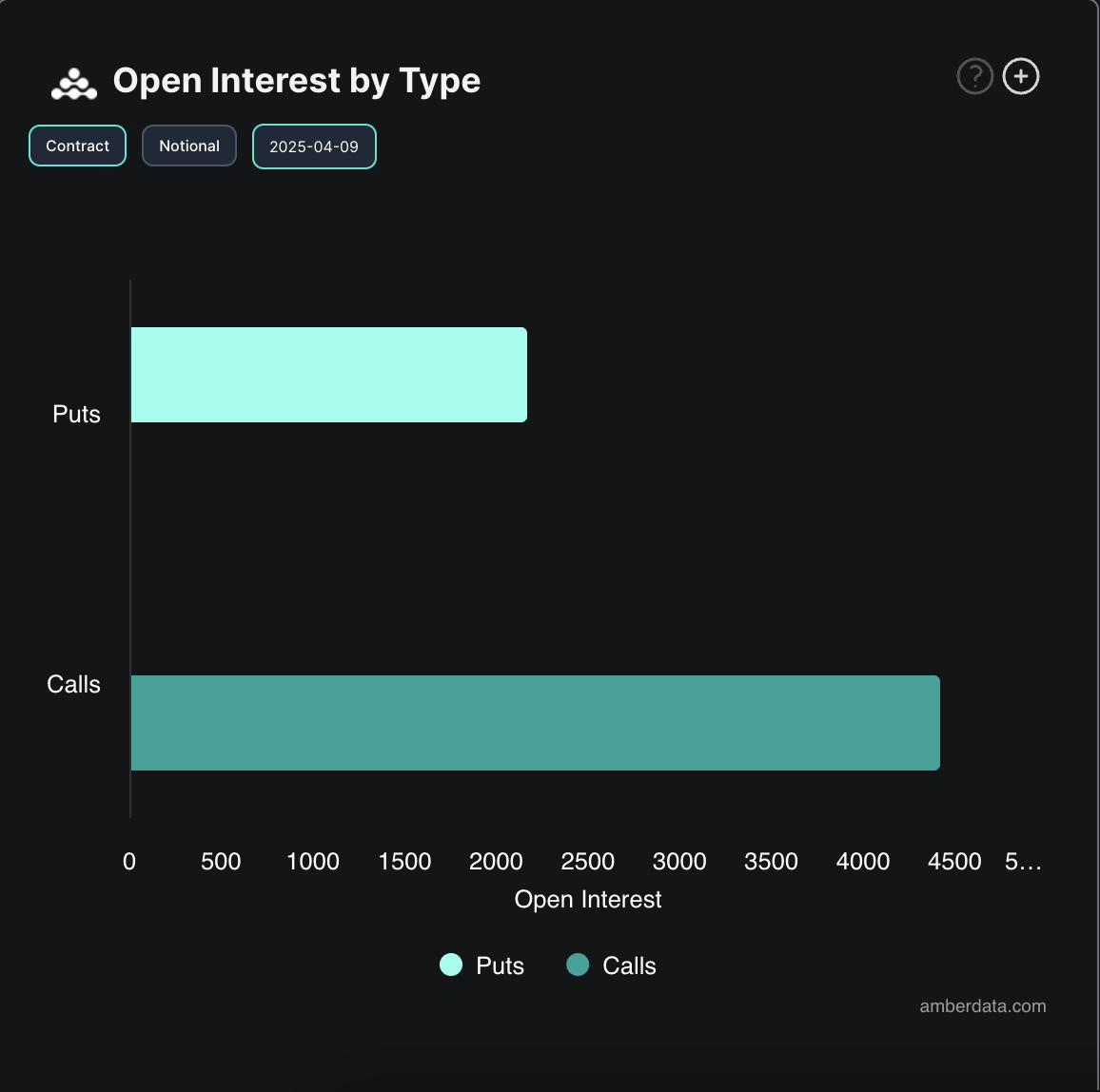

Notably, on the options side, the demand for call contracts has now exceeded puts.

This means that more traders are betting on or hedging for price increases. It indicates an increased demand for upside exposure, suggesting confidence in a potential rally.