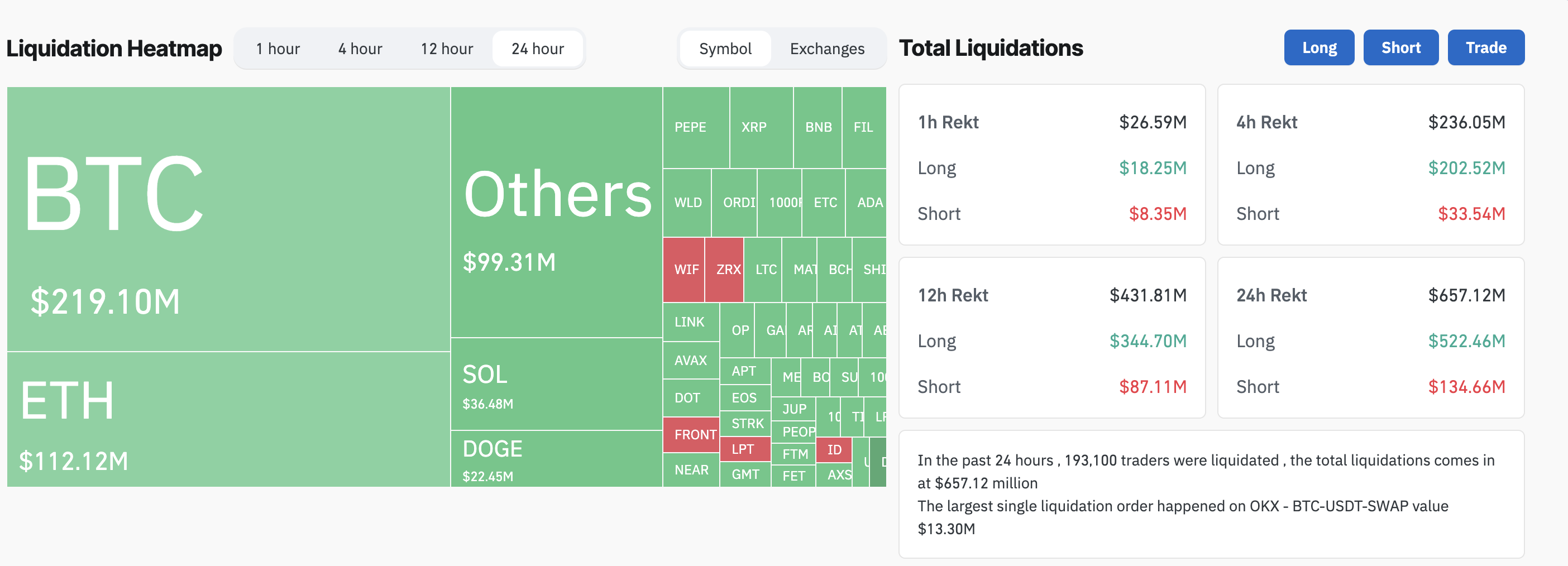

In the last 24 hours, the cryptocurrency market witnessed significant upheaval. Bitcoin’s (BTC) value plummeted below $67,000, sparking widespread liquidation. This event erased over $650 million, affecting both long and short traders.

The market’s instability highlights the high-risk nature of cryptocurrency investments.

Will Bitcoin Continue the Decline?

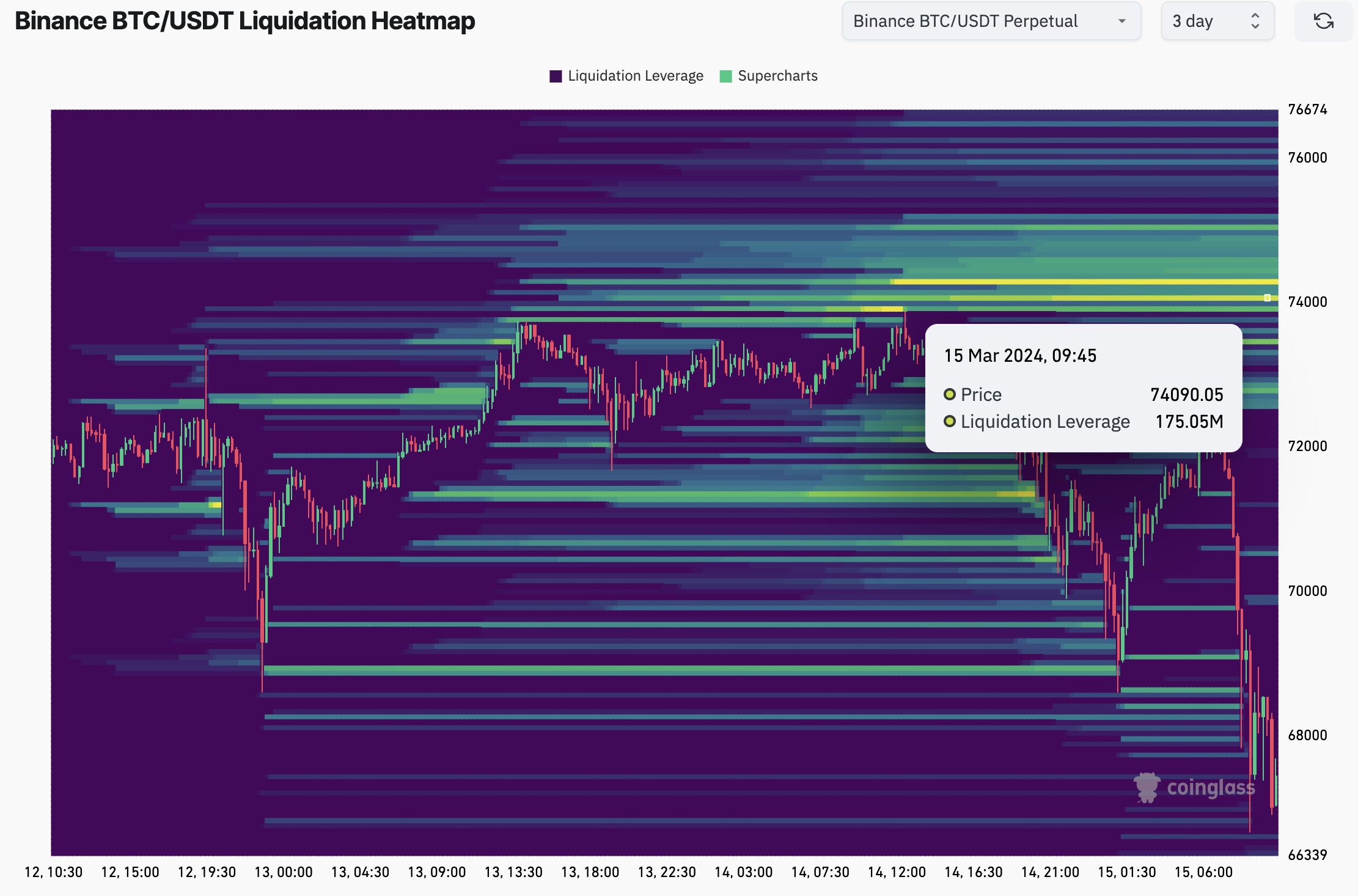

After reaching a record high of $73,700, Bitcoin’s value took an 8% nosedive. This decline, however, was not linear. Initially, Bitcoin rebounded from $68,500 to $72,400.

This recovery phase, primarily during early Friday in Asia, led to substantial short trader liquidations.

Subsequently, Bitcoin encountered resistance at $72,400. Then, it swiftly fell to $66,700.

This sharp decrease resulted in the liquidation of $657 million. Data from Coinglass reveals that this affected 193,100 traders. Thus, the market’s volatility remains a significant concern for investors.

Read more: Bitcoin Price Prediction 2024/2025/2030

Moreover, Bitcoin’s withdrawal from its recent peak has intensified discussions about speculative trends in cryptocurrencies. Michael Hartnett, Chief Investment Strategist at Bank of America Corp., expressed concerns on Bloomberg Television.

He suggested that the market might be exhibiting bubble characteristics. This is evident in the tech sector’s ‘Magnificent Seven’ stocks and crypto’s all-time highs.

Additionally, BTC’s fall below the critical support level of $68,600 signals potential further declines. It might even test the next support at the $65,000 to $66,000 range. This development has caused alarm among market participants, given its implications for future price movements.

BTC analyst Jesse Myers offered insights into the market’s dynamics. He highlighted the potential for a short squeeze at $74,000.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

“But also plenty of supply available to scoop up by liquidating longs at $66,000 first,” Myers warned.