Bitcoin is trading at a AU$9,000 discount on Binance Australia compared to another Australian exchanges and overseas markets.

On Tuesday, Bitcoin (BTC) on Binance was trading at AU$34,000 ($23,062), roughly a AU$9,000 discount compared to its AU$43,000 tag on BTC Markets. Its price was $27,790 in overseas territories.

Bitcoin Discount Caused by Banking Ban and Spot Pair Delistings?

The exchange experienced headwinds after Australian banks recently closed access to a payment portal this month.

Experts pointed out earlier this year that Bitcoin could not sustain its rally amid the U.S. banking crisis due to a lack of liquidity caused by the collapse of Alameda Research. In a thinly-traded market, smaller trades can move prices.

Crypto prices vary on different exchanges. They are calculated using the highest bid and the lowest ask prices on the exchange’s order book.

Traders profit from minute differences in the price of a single crypto asset on different exchanges in a process called arbitrage.

Ask prices and bids represent supply and demand for an asset. Former FTX CEO Sam Bankman-Fried exploited Bitcoin arbitrage opportunities through the Bitcoin price differences in Korea, Japan, and the U.S. to grow his FTX empire.

The cancellation of Binance’s banking services could have lowered demand for Bitcoin and a subsequent oversupply at the Australian exchange affecting ask and bid prices.

Binance does not specify whether its different geographies use different order books.

In a recent Bankless interview, Binance CEO Changpeng Zhao said the exchange must control its visibility to protect corporate partners.

The exchange also delisted eight Australian dollar spot trading pairs, which could have reduced volumes.

In April, Binance asked the Australian Securities Commission to cancel its derivatives license.

This request came after the watchdog probed its ability to distinguish between retail and wholesale traders.

Australia only allows wholesale traders to trade derivatives.

Binance Lower BTC Volumes in Bear Market

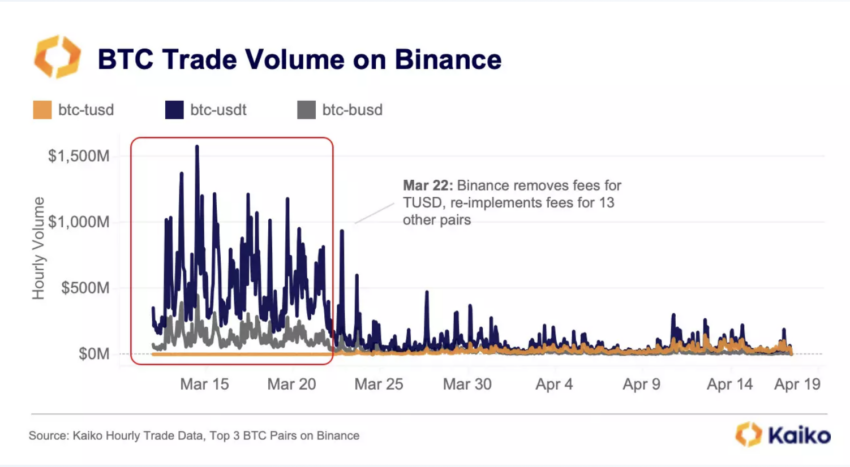

Earlier this month, Kaiko reported that Binance’s BTC volumes plummeted after it removed its zero-fee promotion for spot trading pairs except for BTC/TUSD.

The exchange lost market share to other Asian exchanges, Huobi, Upbit, and OKX.

It introduced the promotion in August 2022 amid last year’s crypto winter.

In the interview, Zhao said the exchange focused on survival in the bear market.

“A bear market is about survival. When others were failing, we just stayed steady, we just stayed secure.”

He added that the bear market results in more consolidation and sees crypto’s future in decentralized finance.

He said that people emotionally affected by the bear market should reduce their investment size.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.