The Bitcoin (BTC) price is trading slightly above an important moving average (MA), but slightly below a crucial support area found at $9,250.

Today is the seventh day that the price has been hovering around this level.

Bitcoin Long-Term Support

The main support area for BTC is found at $9,250. The area acted as support throughout most of June before breaking down and validating it as resistance. However, the price broke out once more on July 6 and the area has been acting as support since. While the price is trading in the lower portion of this support, the movement relative to the 50-day MA is bullish. The price has created five long lower-wicks below the MA, the last of them being a bullish hammer. All of these are signs of buying pressure, suggesting that the price will go upwards. However, the daily RSI has been rejected by the 50-line and is in the process of moving downwards—a bearish sign. The signals are conflicting so the direction of the trend is not yet completely clear.

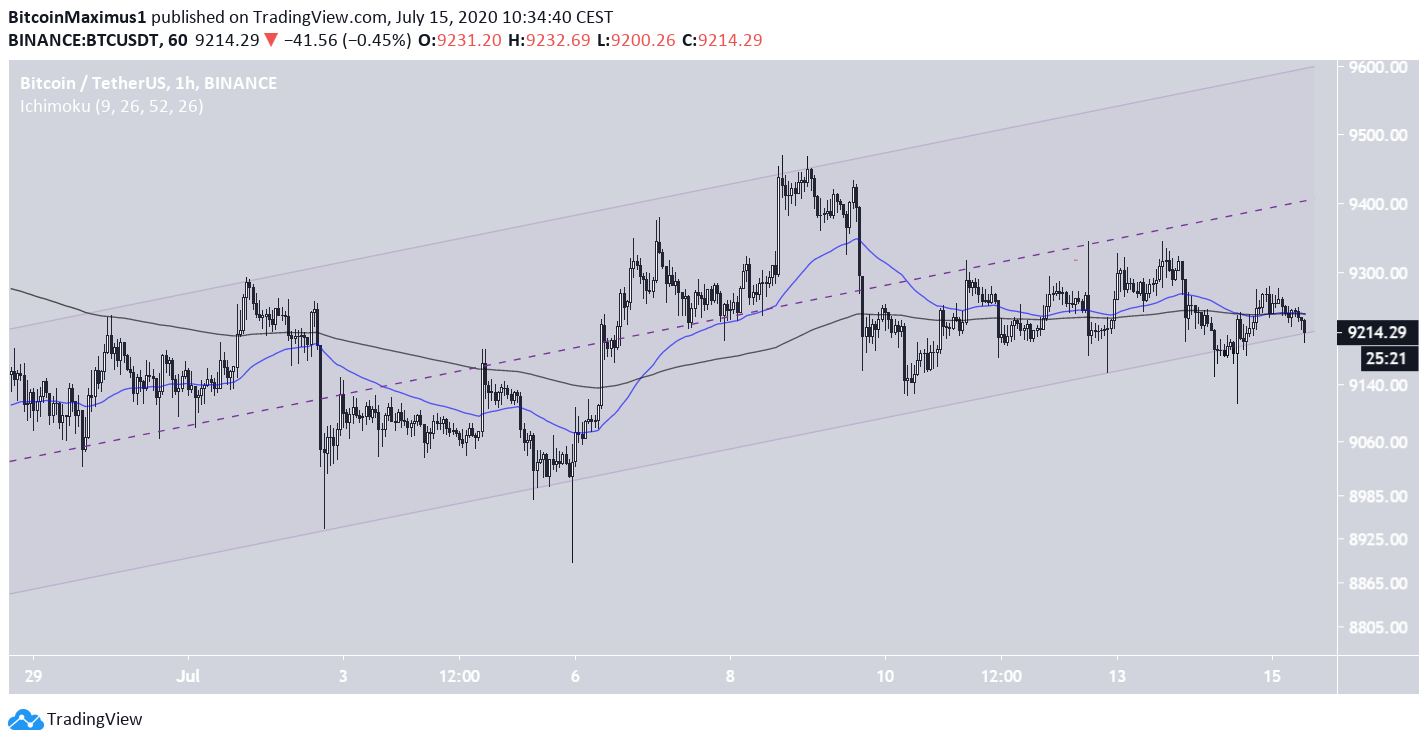

Ascending Channel

The hourly chart shows that the price has been trading inside a parallel ascending channel since June 28. Since parallel lines often contain corrective movements, a breakdown from this pattern would be the most likely scenario. At the time of writing, the price was trading right at the support line of the channel. While it decreased considerably below it yesterday, it has since reclaimed the support line. The 50 and 200-hour MAs have made a bearish cross and the price is trading below both and also validated them as resistance. Since the previous bullish cross between these same MAs marked an uptrend, this bearish cross could indicate that the uptrend is over and the price is now heading downwards towards the previously mentioned $8,950 support area.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored