Since reaching a local low of $9,825 on Sept 8, the BTC price has been trading inside a symmetrical triangle and is quickly approaching the point of convergence between resistance and support.

Bitcoin Continues Inside Symmetrical Triangle

Besides the fact that the triangle is normally considered a neutral pattern, technical indicators are also neutral. This is illustrated by the RSI movement above and below 50 and the MACD movement above and below 0. This is customary during consolidations prior to a big move in one or the other direction.

The shorter-term 30-minute chart is more bearish as it shows a rejection from both a descending resistance line and a minor resistance area found at $10,670.

Since there is no clear support structure, it would make sense for BTC to decrease towards the closest support area at $10,540.

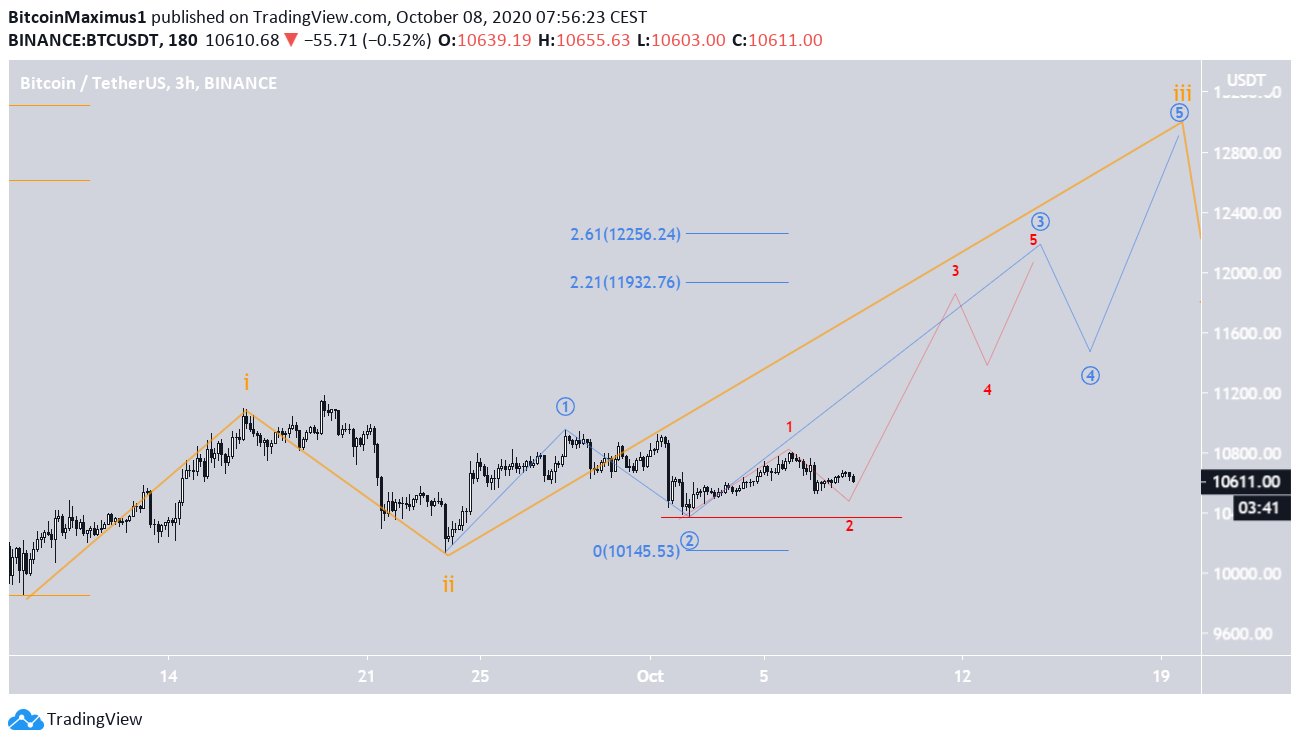

Wave Count

In BeInCrypto’s Oct 6 Bitcoin analysis, it was stated that:

“BTC likely began a bullish impulse on Sept 9 and now looks to currently be in wave 3.”

If the count is correct, BTC would currently be in sub-wave 3 (blue), which is likely to become extended and end between $11,932-$12,256.

A decrease below the $10,380 low on Oct 2 would invalidate this particular count.

If the count is invalidated, the most likely possibility would be a bearish triangle. The movement inside the triangle would suggest that an entire A-B-C-D-E formation (in red) is complete, and the price will soon break down from the symmetrical triangle to head towards new lows.

An increase above the wave E high at $10,800 (red line) would invalidate this wave count.

To conclude, the direction of the future movement cannot be accurately determined until BTC moves out from its current pattern. Whether the price breaks over $10,800 or dips below $10,380 first will be crucial in determining the trend.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.