The Bitcoin (BTC) price has been increasing since Jan. 12, and is currently consolidating above $36,000 inside a symmetrical triangle.

Bitcoin is expected to find resistance at $37,700. A breakout above $40,112 would suggest that BTC is still in a bullish impulse instead of being in a corrective phase.

Bitcoin Continues its Ascent

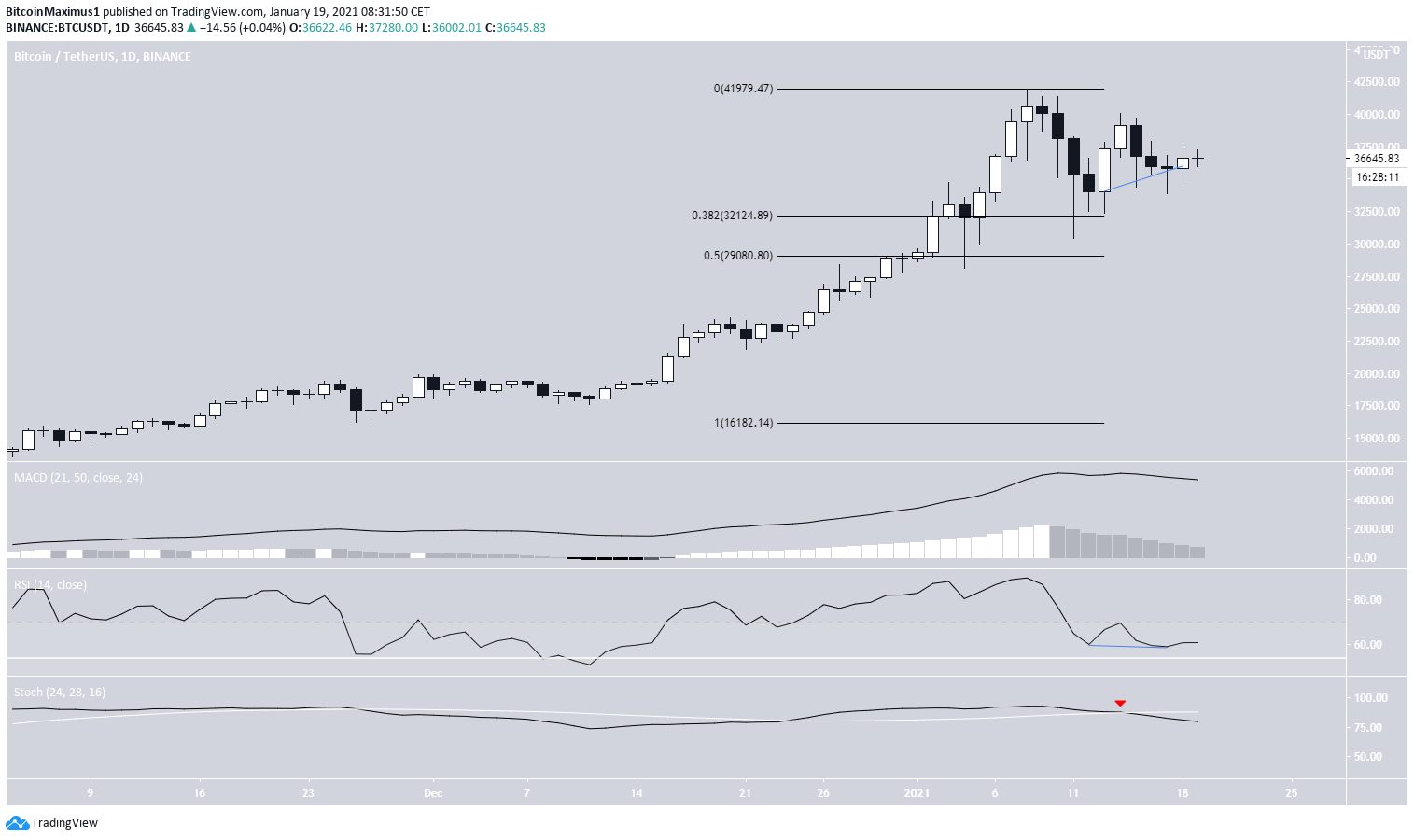

Bitcoin has been increasing since bouncing at the 0.382 Fib retracement support level at $32,124 on Jan. 11. The increase has been relatively gradual and choppy, more akin to a corrective pattern than a bullish impulse.

Despite the hidden bullish divergence in the RSI, the rest of the technical indicators from the daily time-frame are bearish. The Stochastic oscillator has made a bearish cross and the MACD has almost turned negative.

If BTC were to break down, the next closest support area would be found at $29,080 (0.5 Fib retracement).

Symmetrical Triangle

The six-hour chart shows that BTC has been trading inside a symmetrical triangle since Jan. 4. The point of convergence between support and resistance is approaching, so a decisive move is expected to occur.

There is strong resistance at $37,709. This level is the 0.618 Fib retracement level, a horizontal resistance area, and also coincides with the descending resistance line from the triangle.

Technical indicators in the short-term are bullish, but because of the bearishness from higher time-frames, we cannot confidently predict a breakout.

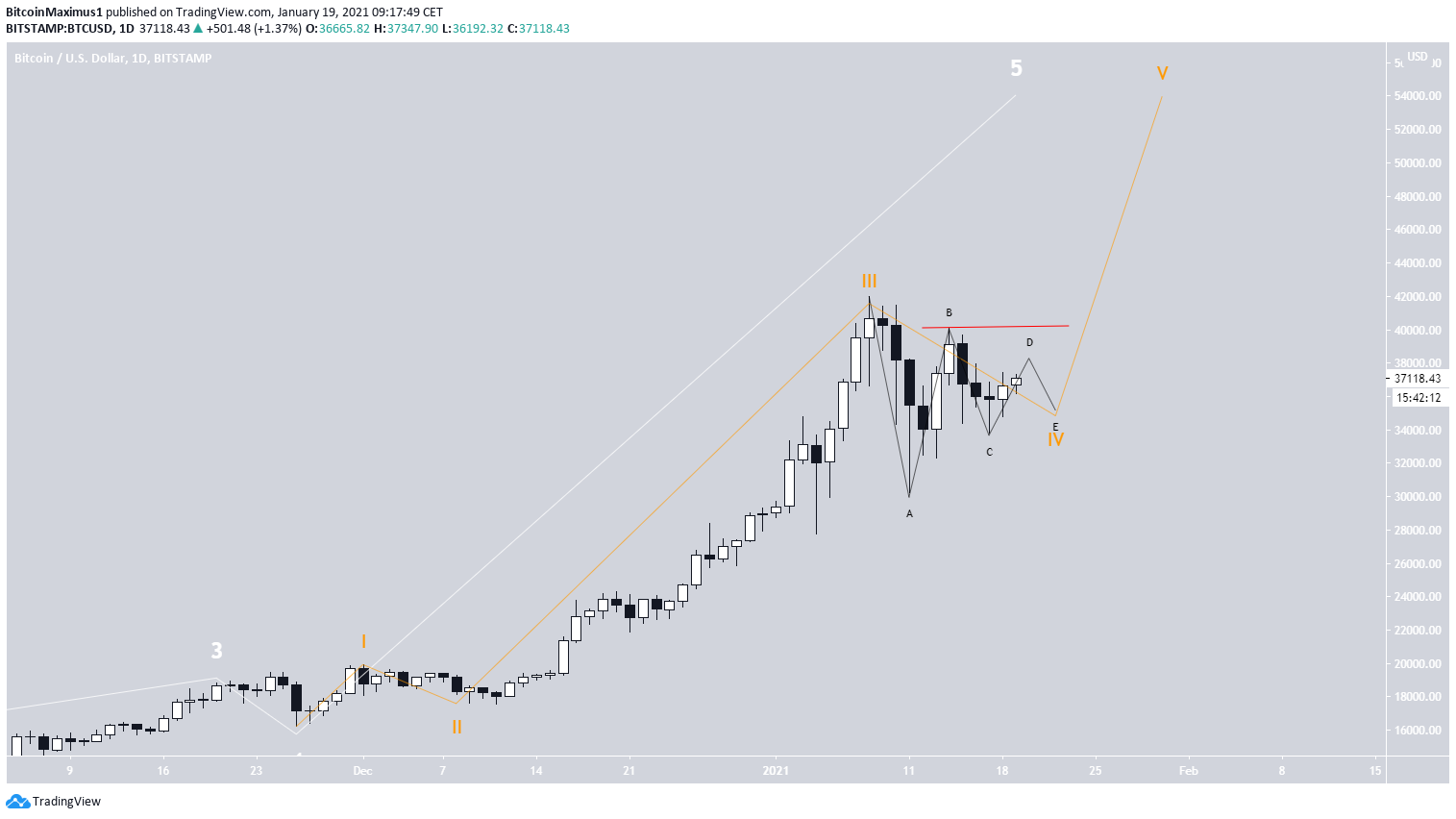

BTC Wave Count

The wave count suggests that BTC is trading inside a complex W-X-Y correction (shown in orange below), in which the X wave is a triangle. This also fits with the longer-term count, which suggests that BTC is correcting from the upward movement beginning in September 2020.

A breakdown from the triangle would likely take BTC to the aforementioned 0.5 Fib retracement support at $29,000, and possibly even the 0.618 Fib at $26,000.

The sub-wave count is given in black A decrease below the B sub-wave low at $33,822 would confirm that this is the correct count.

Since this is almost definitely a triangle, the only other possibility would be this being the fourth wave, which could break upwards and take BTC toward $50,000.

However, this does not fit with the longer-term count, Unless BTC manages to break above the B sub-wave high of $40,112, this scenario is unlikely.

Conclusion

Bitcoin is expected to gradually increase to $37,700. A breakout above $40,112 would suggest that BTC is still in a bullish impulse while a decrease below $33,822 would confirm that the trend is bearish.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.