The Bitcoin (BTC) price dropped considerably during the week of Jan 11-18 and created a bearish candlestick in the process.

Nevertheless, Bitcoin is still trading above short/medium-term support, failing to confirm the bearish trend reversal.

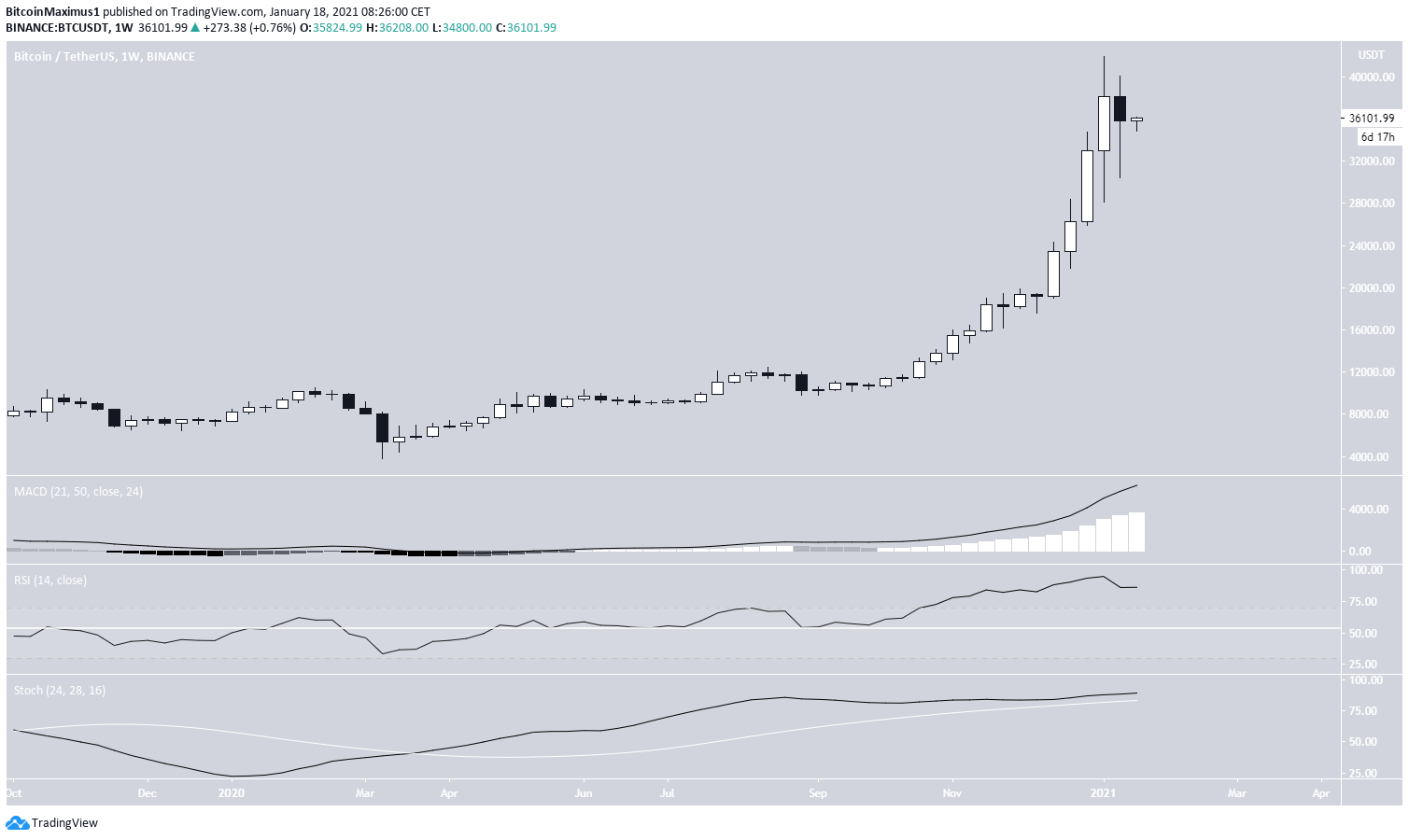

Bitcoin Hanging Man Candle

During the week of Jan 11-18, Bitcoin created a hanging man candlestick, which is normally considered a bearish reversal sign when appearing during an upward trend.

Nevertheless, technical indicators do not yet confirm the trend reversal.

The MACD, RSI, and Stochastic oscillator are all increasing, and none of them has generated bearish divergences despite being in overbought territory.

The daily chart looks more bearish than its weekly counterpart. While BTC has bounced at the 0.382 Fib retracement support at $32,125 and generated a hidden bullish divergence in the RSI, the rest of the readings are bearish.

BTC has already created a lower high and the Stochastic oscillator has made a bearish cross. Adding to this, the MACD is moving downwards and has nearly crossed into negative territory.

If BTC were to break down from the current support area, the next support would likely be found at $29,080 (0.5 Fib retracement level).

Symmetrical Triangle

The six-hour chart shows that BTC has been following an ascending support line since Dec. 14 and is possibly trading inside a symmetrical triangle. This pattern is normally considered to be neutral.

Technical indicators are also neutral, failing to confirm the direction of the trend.

The two-hour chart shows that BTC has bounced at the 0.618 Fib retracement level of the previous upward move and is currently heading higher after creating a higher low. The two-hour MACD supports the continuation of the upward movement.

BTC is expected to find resistance at $37,700. This level is a combination of the 0.618 Fib retracement level, a horizontal resistance area, and possibly the descending resistance line of the triangle.

Whether BTC breaks out or down from the triangle is likely to determine the direction of the trend. Due to the possibility of a long-term correction, an eventual breakdown seems more likely.

Conclusion

While Bitcoin is expected to increase towards $37,700 to reach the resistance line of the triangle, the trend is undetermined until a breakout or breakdown occurs.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.