Bitcoin Cash’s (BCH) price shows signs of recovery, which is important if the altcoin intends to reach $450 again.

Supporting this potential bullish outcome are the investors who have moved away from selling for now.

Bitcoin Cash Investors See Growth

Bitcoin Cash’s price is currently trading at $430, above key support. This support level has signaled recoveries in the past, and the same is anticipated in the coming days. Backing this potential are the BCH holders, who have been acting bullishly over the past couple of days.

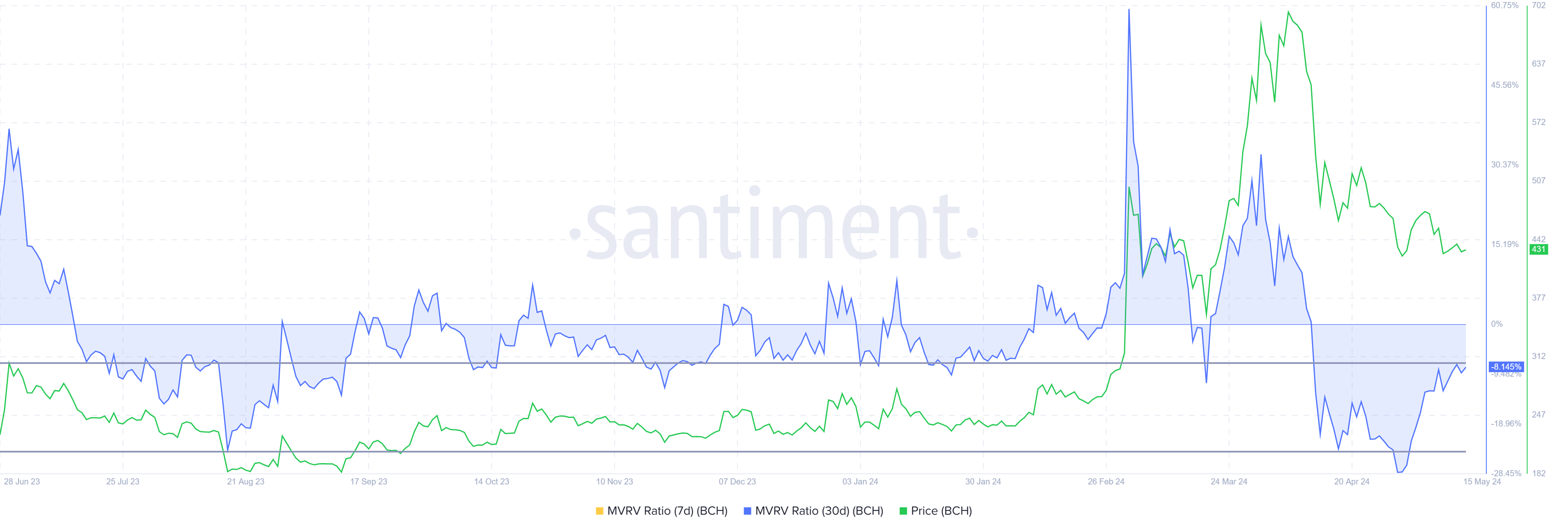

The Market Value to Realized Value (MVRV) ratio is still under the zero line. The MVRV ratio tracks investor gains/losses. Bitcoin Cash’s 30-day MVRV of -8.1% suggests losses, possibly prompting accumulation. Historically, BCH corrects at MVRV levels of -6% and -24%, labeling it an accumulation opportunity zone.

This signals that Bitcoin Cash’s price could see some increase.

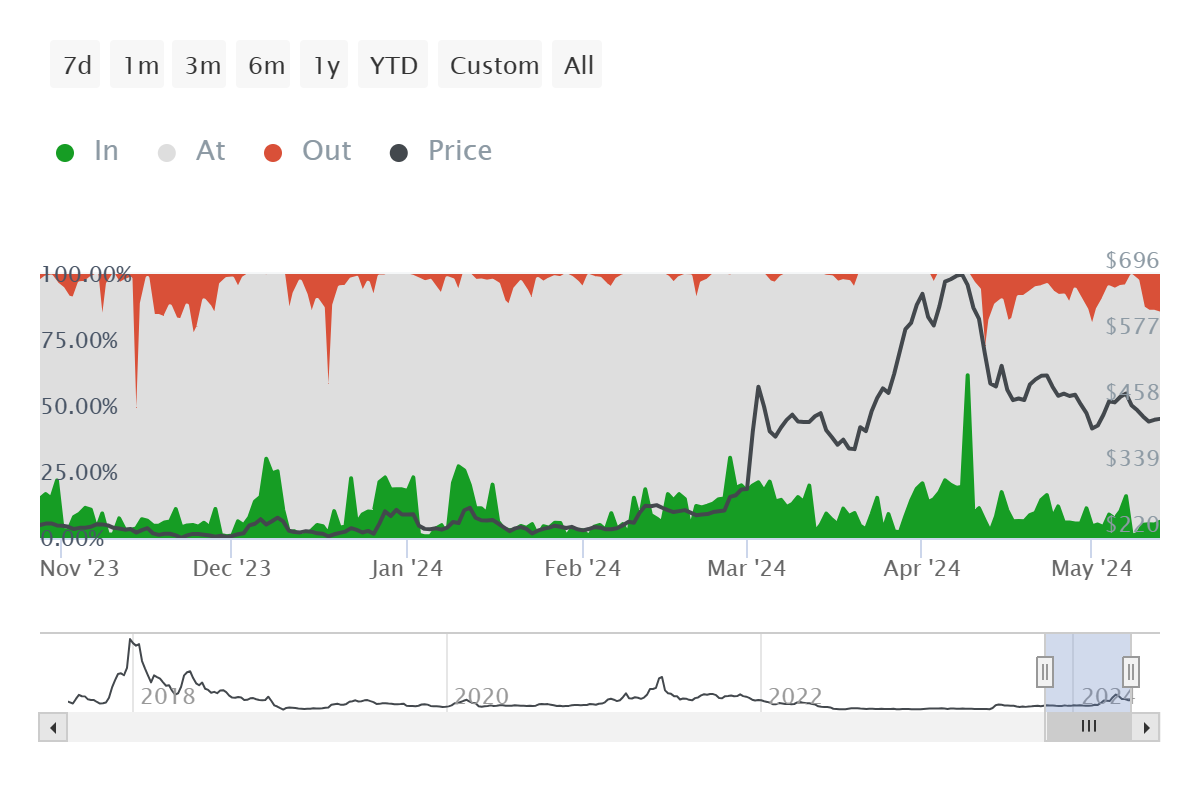

Further substantiating this are the investors’ actions, which are looking positive right now. Upon distributing the active addresses by profitability, one can notice that most of the transactions conducted are by those looking for profits.

BCH holders that are already in profit account for only 6% of all active addresses. This shows that participation is not dominated by investors looking to sell their assets to secure gains.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

This is a signal that the investors are pining for a rise.

BCH Price Prediction: Key Level in Support

Bitcoin Cash’s price has surpassed the crucial 23.6% Fibonacci Retracement level set at $430. This level is pivotal as it serves as the bear market support floor, historically yielding recoveries when tested.

The same outcome is anticipated this time, given the altcoin is seeing support from its investors. The potential uptick could push BCH toward $450, right above the 38.2% Fibonacci Retracement.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

This is an important psychological support level and could further the rise.

However, a breach has already failed once this month, and another failed breach could send Bitcoin Cash back to $430. If Bitcoin Cash’s price falls below this line, it is likely to experience a drawdown to $410 or $400, thereby invalidating the bullish thesis.