Capital flowing into Bitcoin markets has moved a large amount of it back into unrealized profit. Additionally, on-chain signals are similar to those present in the early stages of a bull market.

In its Week on Chain report on April 24, analytics firm Glassnode expressed more confidence in a return to bullish market sentiment.

Bitcoin prices are currently correcting from their 2023 high of just below $31,000 on April 14. However, the asset is still printing a gain of 66% since the beginning of the year.

“The aggregate market has confidently transitioned out of a regime of unrealized loss, towards one of unrealized profit,” noted the firm.

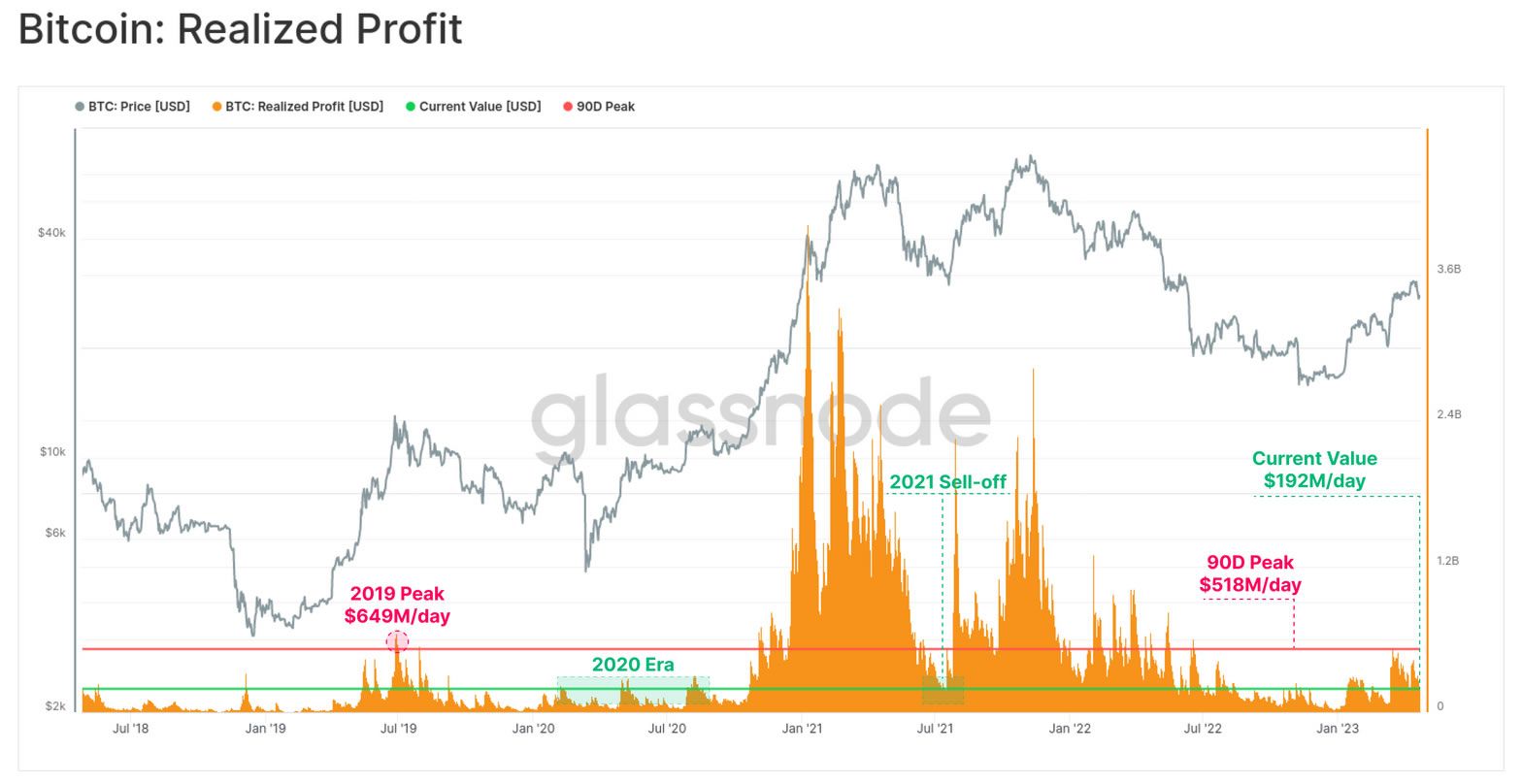

It also noted that the magnitude of USD-denominated profit taken this year remains well below 2021 cycle highs. It is of a similar scale to that observed in 2019 when BTC rallied from $4,000 to $14,000.

Bitcoin Realized Gains Up

Furthermore, the report noted that total losses remain quite low relative to all major sell-off events throughout 2021 and 2022. The March 2020 Covid-crash, Bitcoin miner migration, Terra/Luna collapse, and the FTX implosion were all major realized loss-inducing events.

2023 has not seen anything anywhere near that scale despite the U.S. regulatory war on crypto.

“This does suggest that a degree of sell-exhaustion has been reached at a macro scale, at least from the lens of wide-scale holders locking in significant losses,”

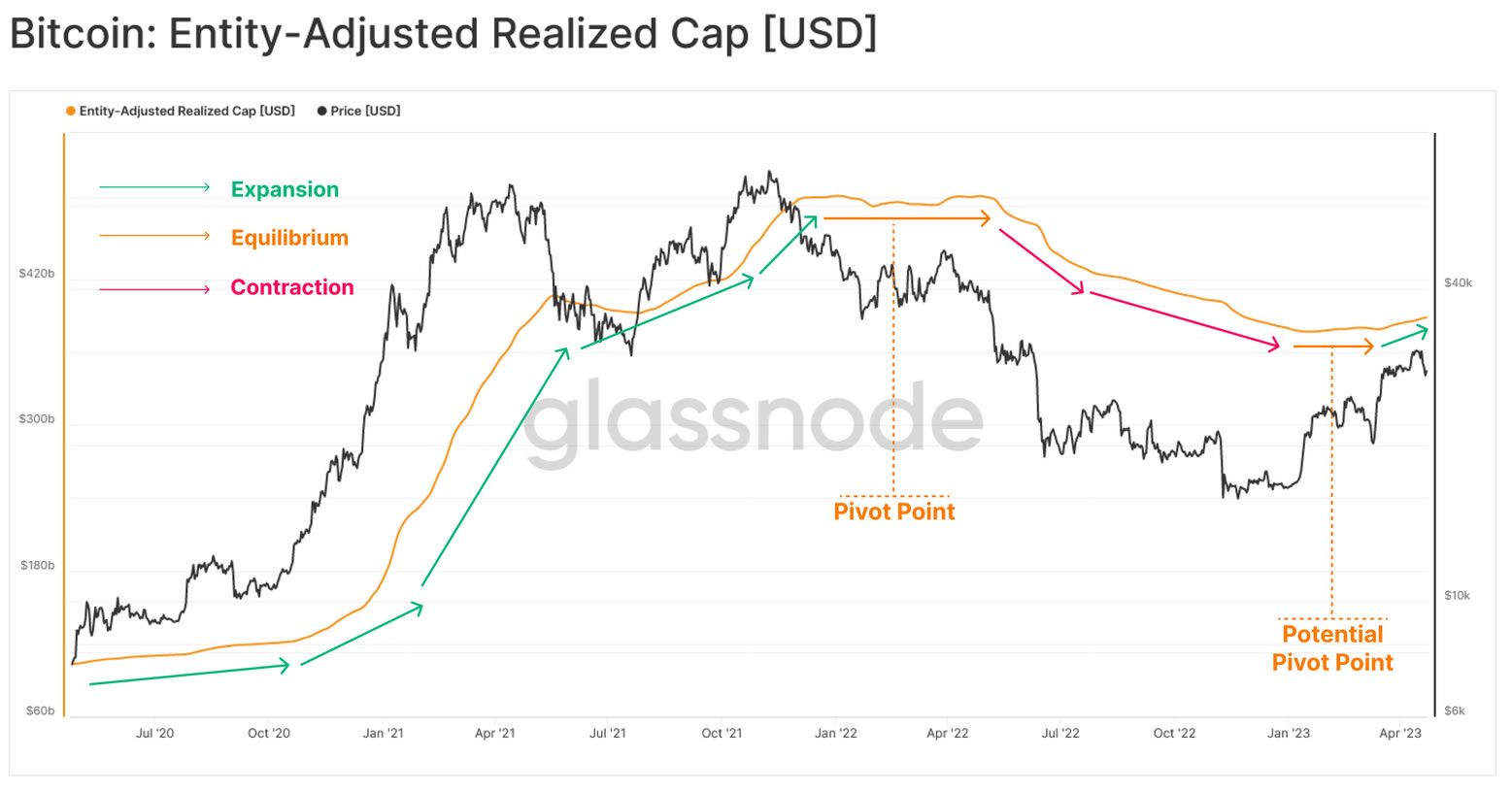

The Realized Cap metric is the cumulative sum of all realized profit and loss events. This has stabilized from the massive outflows in 2022 and has gone through a potential pivot point, according to Glassnode.

In the wake of solid Bitcoin price performance this year, a very large cross-section of the market is seeing their holdings recover above the acquisition price. This is “creating a more favorable and profitable environment,” the report concluded.

BTC Bulls Not Ready to Run Yet

However, an inevitable market correction has started and prices are in retreat once again. Glassnode stated that this suggests there is still indecisiveness among digital asset investors so a bull market may be a while yet.

“With accumulation and distribution behavior across several wallet cohorts mixed at the moment, the market appears less decisive than it has been in the first quarter of the year.”

Bitcoin is currently trading down 1% on the day. As a result, the asset was changing hands for $27,443 at the time of writing.

Furthermore, it has entered a short-term range-bound channel for the past three days at this price level where there is support.

The next leg down finds more support at around $25,000 should the correction deepen.