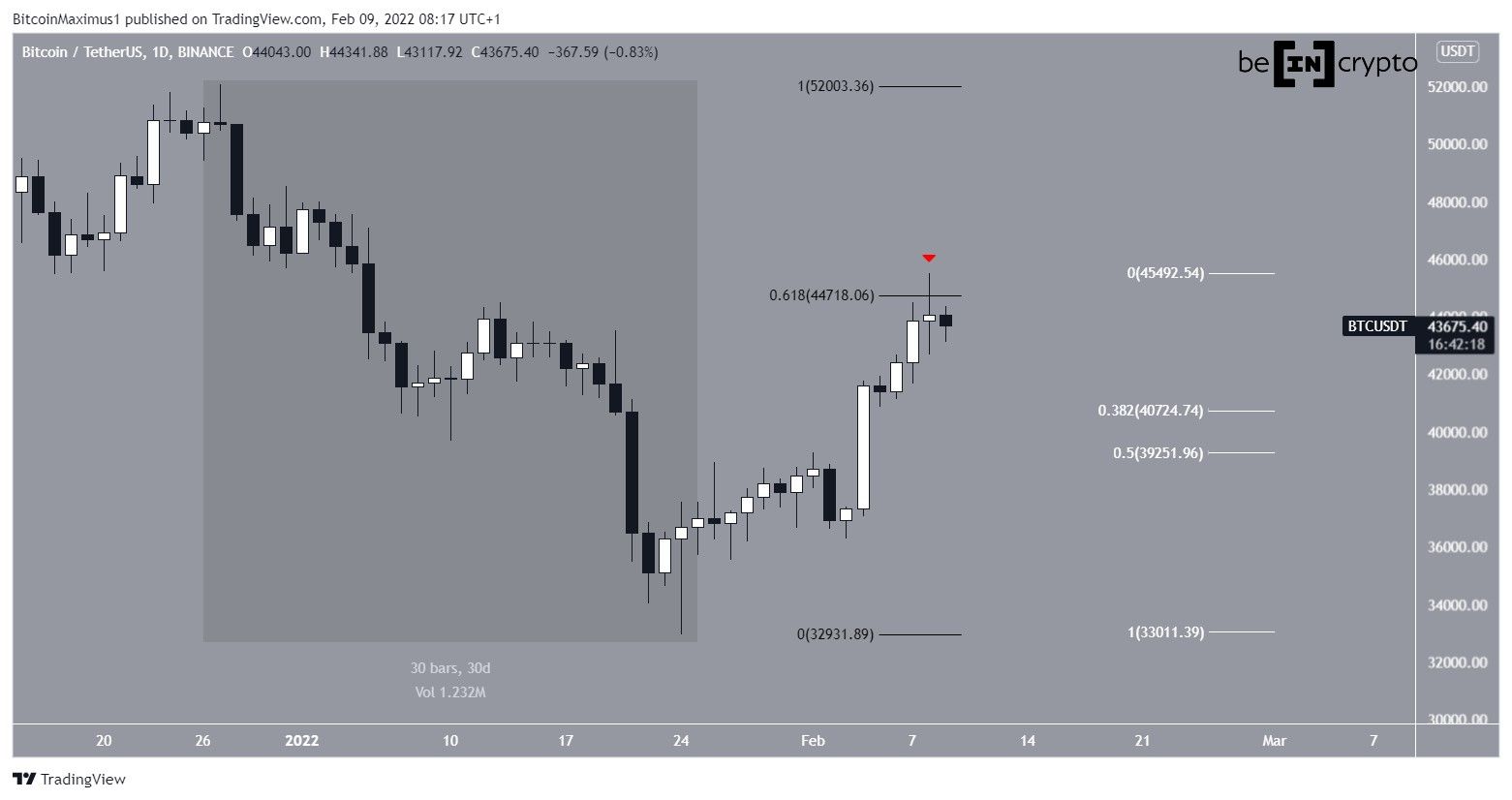

Bitcoin (BTC) broke out from its short-term pattern on Feb 7 but was rejected by the closest Fib resistance the next day. It’s currently attempting to find support.

Bitcoin reached a local high of $45,492 on Feb 9 before decreasing. The decrease occurred after a rejection from the 0.618 Fib retracement resistance level when measuring only the most recent portion of the downward movement (highlighted) at $44,720. It then created a Doji candlestick (red icon), which is often considered a sign of indecision due to its long upper and lower wicks.

The closest support levels are found at $40,725 and $39,250. These are the 0.382 and 0.5 Fib retracement support levels (white).

Ongoing breakout

The two-hour chart shows that BTC has broken out from an ascending parallel channel that had previously been in place since Jan 24.

Currently, it’s in the process of validating the channel’s resistance line as support (green icon). If successful, this would likely lead to the continuation of the upward movement towards new local highs.

Bitcoin wave count analysis

Due to the shape of the current upward move, the most likely BTC long-term wave count suggests that the bottom is already in.

As for the short-term count, it seems that BTC is in the process of completing a fourth wave pullback. This would indicate a decrease towards the middle of the previous parallel channel and between the 0.382-0.5 Fib retracement support levels at $41,920 and $40,800 respectively.

Following this, the upward movement is expected to continue.

The alternative count would suggest the creation of a fourth wave triangle. In this possibility, BTC would not break down inside the channel, and instead would continue validating its resistance line and consolidate before breaking out.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here