Bitcoin has been increasing since March 25, but the rally stalled yesterday once BTC created a Doji candlestick.

While the long-term trend for bitcoin is still bullish, a short-term retracement is expected prior to the continuation of the upward movement.

Bitcoin Rally Stalls

While BTC has been increasing since March 25, the rally stalled yesterday. After reaching a high of $59,800 on March 31, BTC created a doji candlestick — a sign of indecision. This can be seen as a sign of weakness when transpiring in an upward trend.

The candlestick was created at a resistance area near $60,000. This the same place where three upper wicks had been previously created at the beginning of March.

Short-Term Weakness

The six-hour chart shows the first signs of weakness.

BTC has struggled to move above the $59,700 resistance area since it was rejected yesterday.

In addition, the RSI has generated a bearish divergence and the MACD has generated one lower momentum bar. Both of these suggest the rally is losing strength.

The two-hour chart further supports this, with an even more pronounced weakness in both the RSI and MACD.

Therefore, a short-term retracement would be the most likely scenario. This means that bitcoin could decrease towards the 0.382 Fib retracement level at $56,200, before resuming its upward movement.

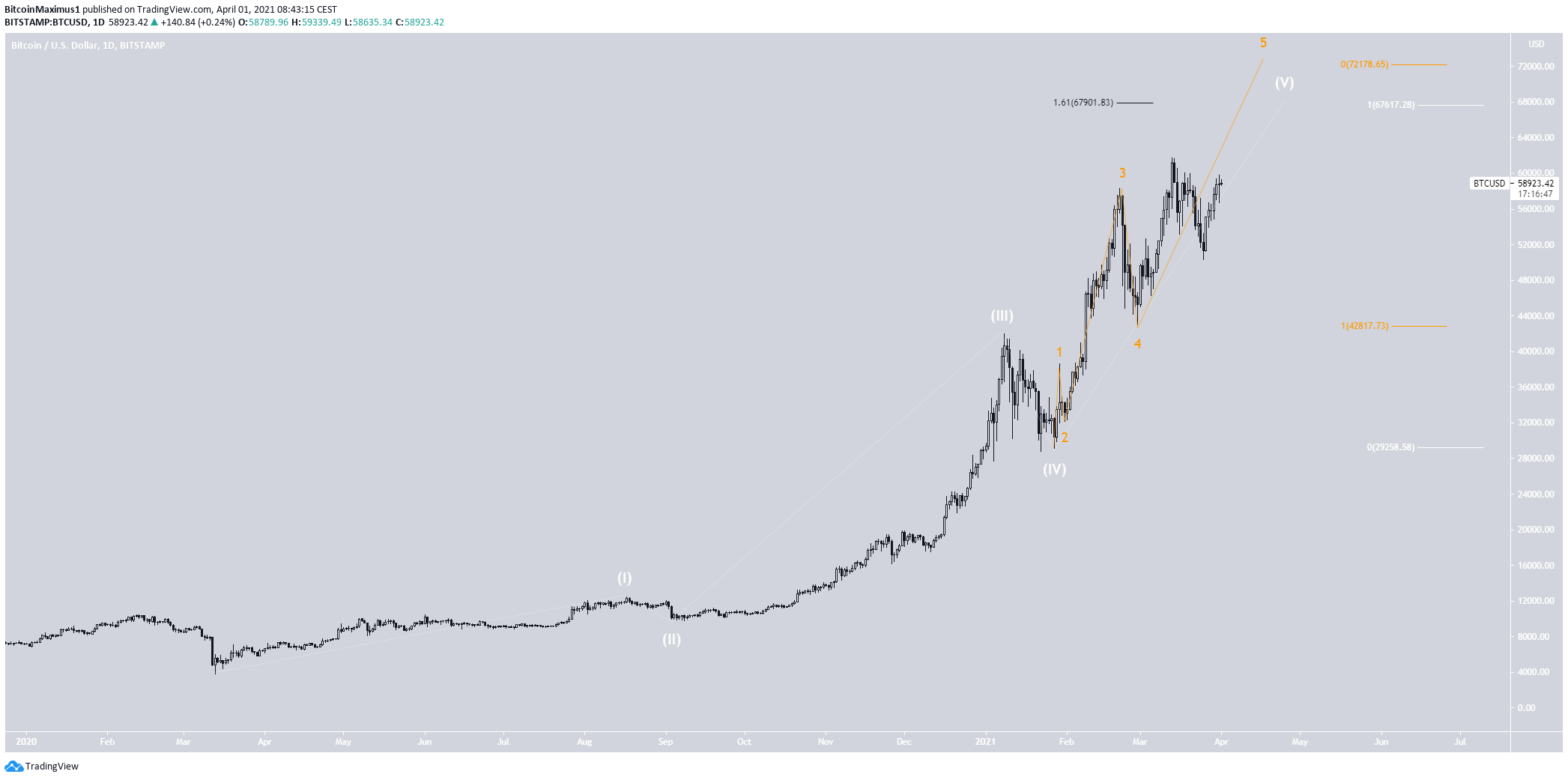

Wave Count For Bitcoin

The wave count still suggests that BTC is expected to reach a new all-time high.

The most likely potential target for the top of the upcoming movement is found between $67,600 – $72,178. This target range is found using a combination of Fib projections and external Fib retracements.

Afterward, BTC is expected to undergo a correction.

Conclusion

BTC is expected to eventually break out above the $59,700 area and reach a new all-time high.

However, a short-term retracement is expected prior to the resumption of the upward movement.

For BeInCrypto’s previous bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.