The Bitcoin (BTC) price saw a strong recovery after bouncing from support on April 26.

However, BTC was rejected by a short-term resistance level just shy of $56,000.

BTC resumes bounce

BTC has resumed the bounce from April 26. The bounce began at a confluence of Fib support levels between $46,900-$47,725. The area is created by the 0.5 long-term Fib (orange) and 0.786 short-term Fib (black).

So far, it has reached a local high of $55,738.

An interesting development is the bullish reversal signal in the MACD.

Despite this, the RSI and Stochastic oscillator are still bearish.

Short-term BTC rejection

The shorter-term chart is showing weakness.

Firstly, the price was rejected as soon as it reached the 0.5 Fib retracement resistance at $55,565 (black).

Furthermore, both the RSI and MACD have generated considerable bearish divergences.

If the price corrects, the three closest support levels are found at $52,381, $51,349, and $50,317. These are created by the 0.382, 0.5, and 0.618 Fib support levels. The 0.5 Fib is also a horizontal support area, making it very likely to act as the bottom.

BTCD Pump

The Bitcoin Dominance Rate (BTCD) is also showing signs of a reversal. Both the MACD and RSI are moving upwards, and the latter has generated a bullish divergence.

A breakout above the current descending resistance line could cause a significant upward movement.

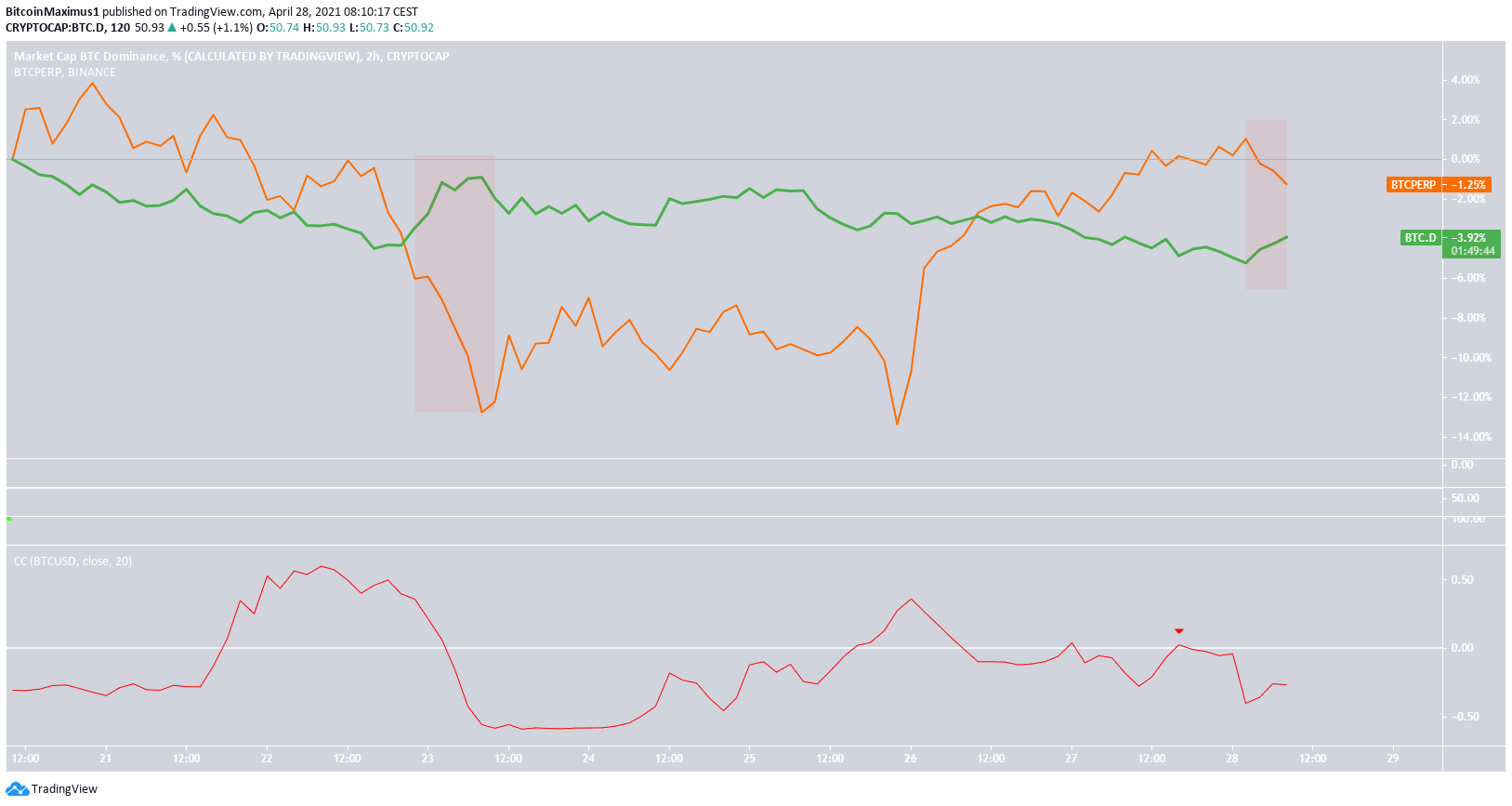

A look at the relationship between BTCD (green) and BTC (orange) does not show a clear relationship. However, sharp BTC price movements have caused a movement in the opposite direction for BTCD (highlighted in red).

This is also evident by the correlation coefficient, which is now negative (red).

Therefore, a retracement could cause the aforementioned increase in BTCD.

Conclusion

BTC is expected to continue retracing towards one of the Fib retracement support levels. This could cause an uptick in the BTCD.

For BeInCrypto’s previous bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.