Bitcoin has registered its first weekly gain since August, rising by nearly 3% over the past seven days. This positive momentum interrupts a four-week streak of declines.

The pioneer cryptocurrency experienced a significant downturn in the past month, shedding 11% of its value. This drop was accentuated by a sudden price crash in mid-August, which markedly reduced its overall valuation.

Bitcoin Price Reaches Monthly High

Bitcoin’s recent 3% increase culminated in a monthly high of $26,750. However, it was later adjusted to $26,592 at the time of writing.

This resilience in Bitcoin’s price trajectory is particularly notable given the historical patterns associated with September — a month often referred to as “Rektember” due to Bitcoin’s frequent dips. The stability hints at Bitcoin establishing strong support at its current price, which may help it maintain most of its gains from earlier in the year.

Throughout 2023, Bitcoin’s price movements have been significantly influenced by speculations around the US Securities and Exchange Commission (SEC) possibly approving a Spot Bitcoin ETF. Yet, recent weeks have seen no major updates on this ETF, possibly contributing to Bitcoin’s current stable price behavior.

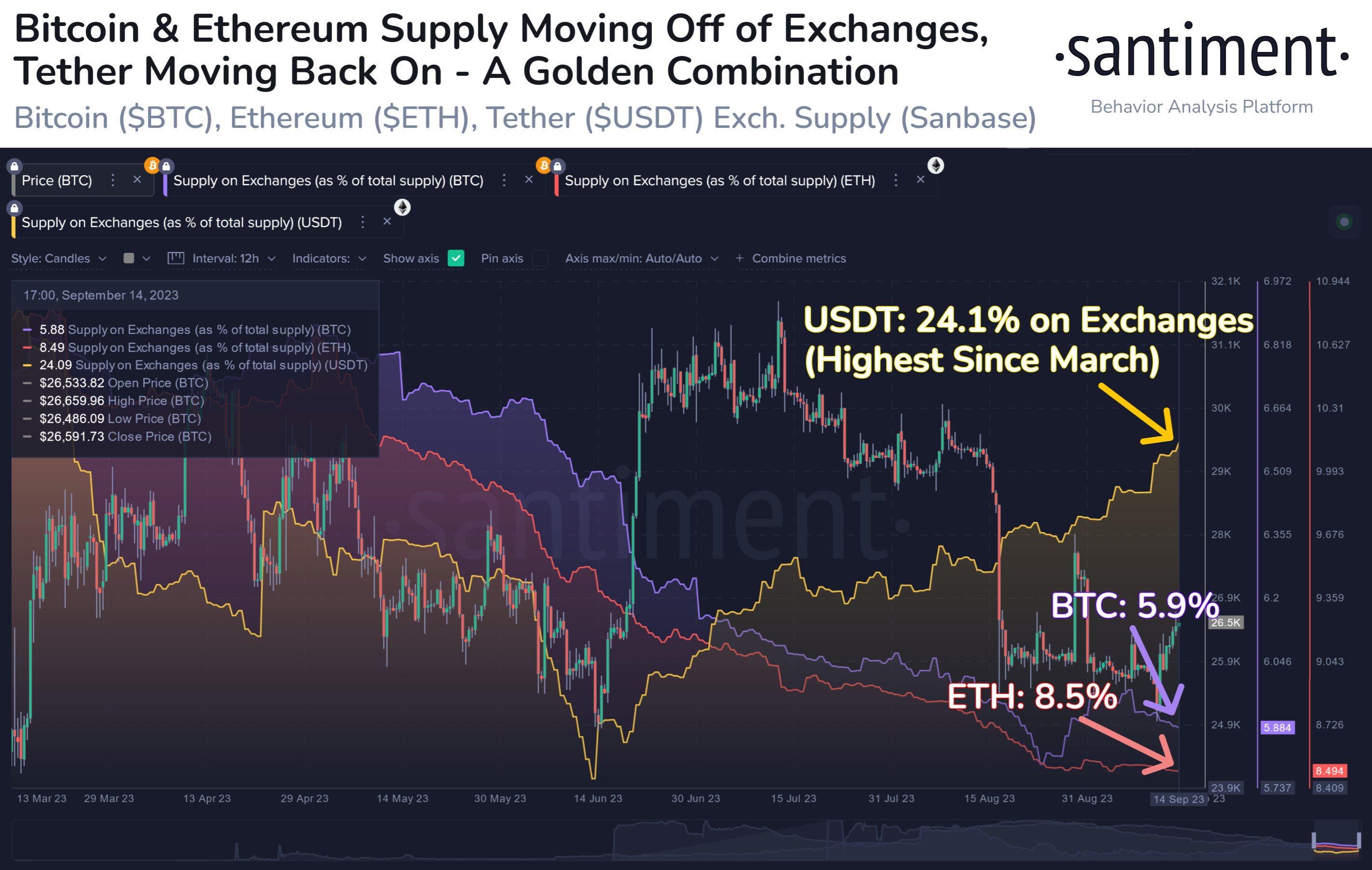

Renowned crypto analytics firm Santiment offers a positive forecast for Bitcoin. It highlighted that the supply of Tether’s USDT on crypto exchanges has soared to its highest since March, reaching 24.1%.

The new trend corresponds with a general decrease in BTC and Ethereum (ETH) holdings on exchanges. This reduction indicates a tendency among investors to retain their assets instead of trading them.

One can foresee a potential uptick in future market buying interest by connecting these two significant trends — the rising USDT supply on exchanges and the shrinking BTC and ETH supplies.

A sign of this emerging trend is Bitcoin’s recent surge in unique addresses, a metric not observed since April. This uptick implies increased engagement within the Bitcoin ecosystem, further supporting Santiment’s optimistic perspective on the foremost cryptocurrency.

On-chain analyst Ali Martinez said that despite the price consolidation Bitcoin has seen over the past few weeks, the growing network activity represents “one of the most bullish divergences from an on-chain perspective.”