BeInCrypto takes a look at various Bitcoin on-chain indicators that deal with the derivatives market, such as the funding rate and open interest.

Bitcoin futures market

In the futures market, traders get liquidated whenever they take a position and the price moves against them for more than a certain threshold.

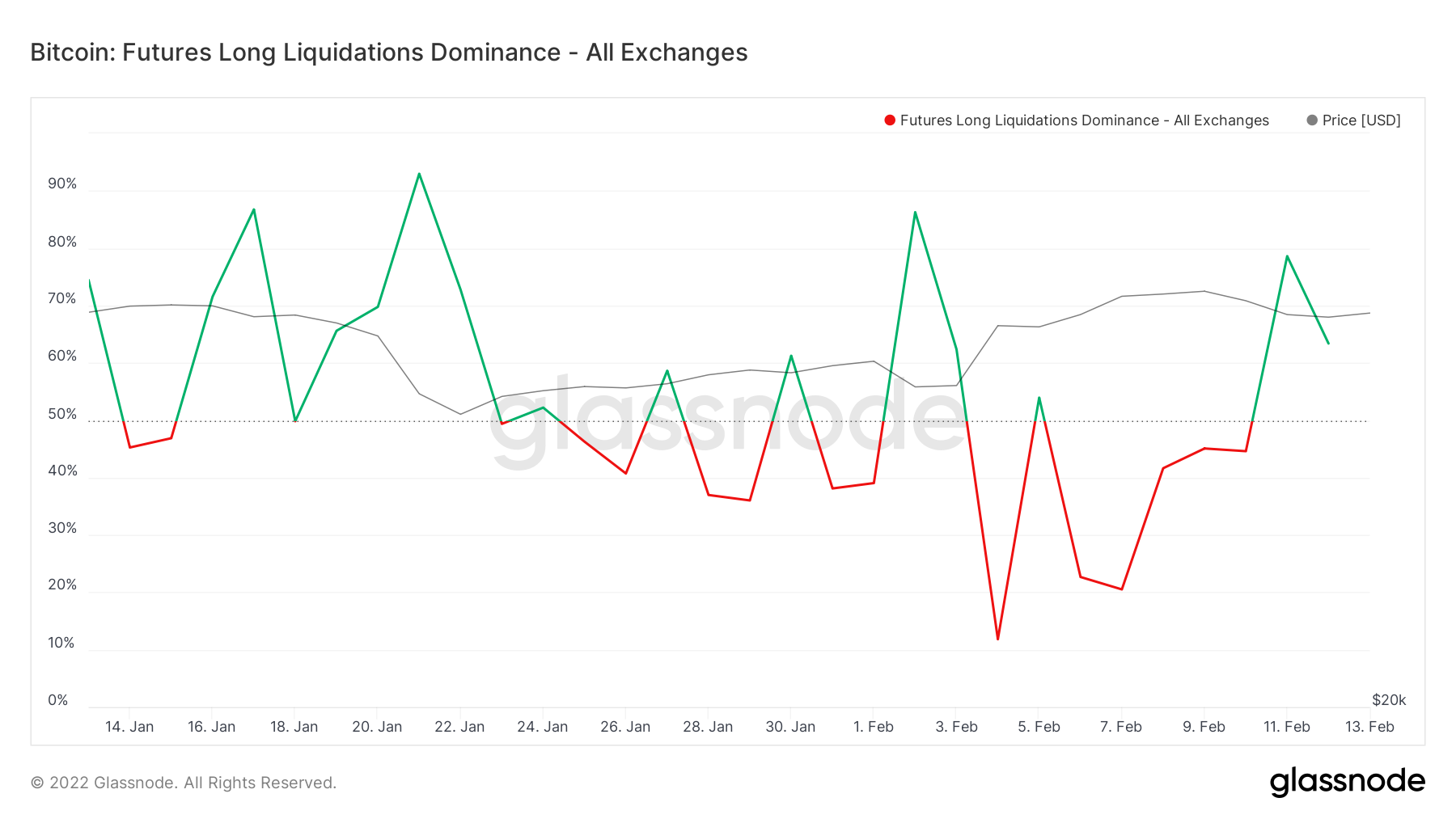

The futures long liquidations dominance measures the percentage of liquidations that are on the “long” side.

On Feb 4, the ratio of long liquidations was only 11%. This means that 89% of all liquidations were on the “short” side instead. This likely occurred as a result of the short-squeeze that occurred one day prior when the price increased from $37,000 to $41,000. High values in one or the other direction usually occurs when a significant number of traders are caught offside in a sharp price move.

On Feb 13, the long liquidations dominance rate was at 61%, a relatively balanced value.

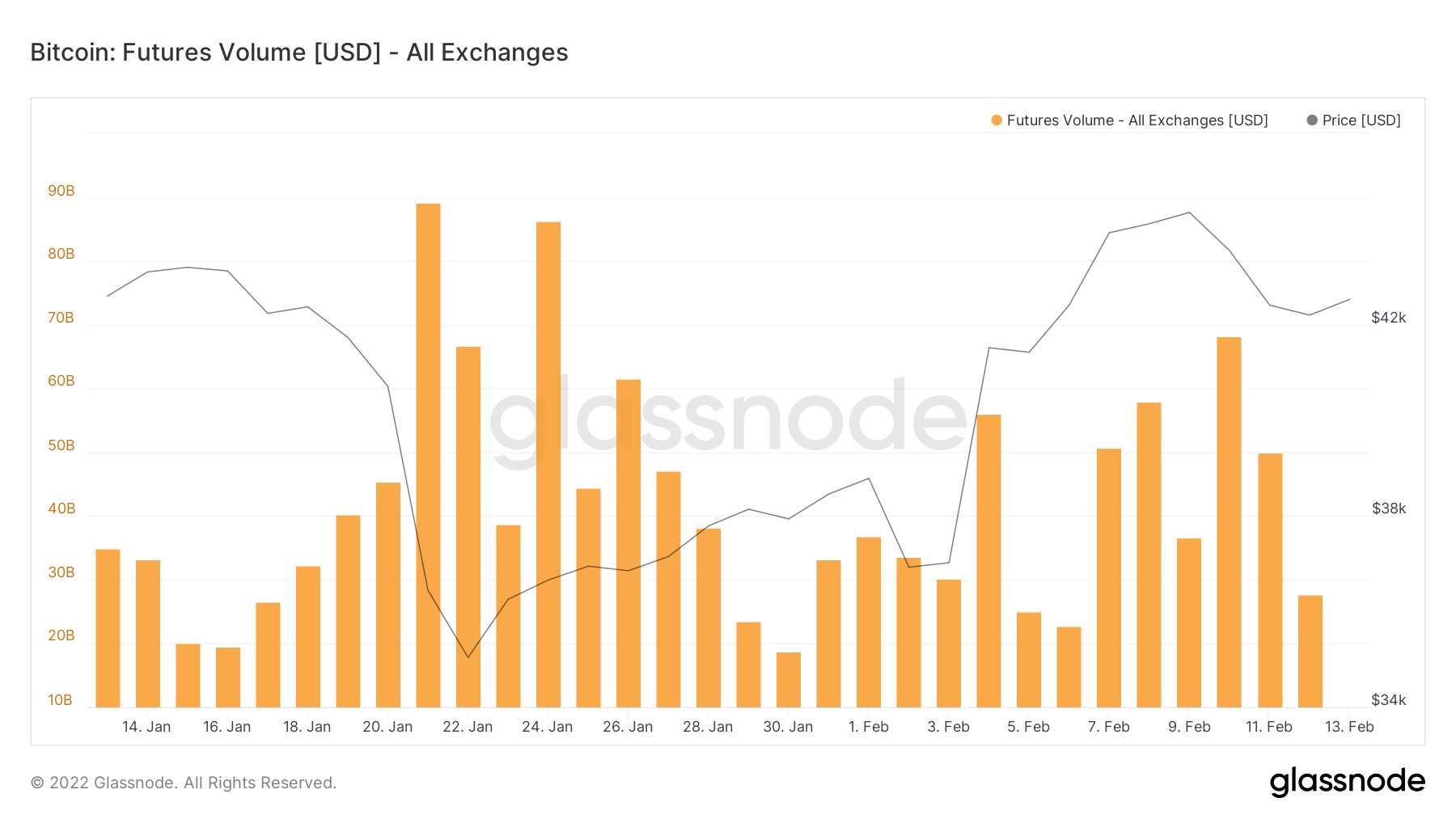

However, futures volume is quite small compared to that over the past month. Therefore, even if a considerable number of traders are caught offside, this would not be expected to cause a significant price movement.

Options market

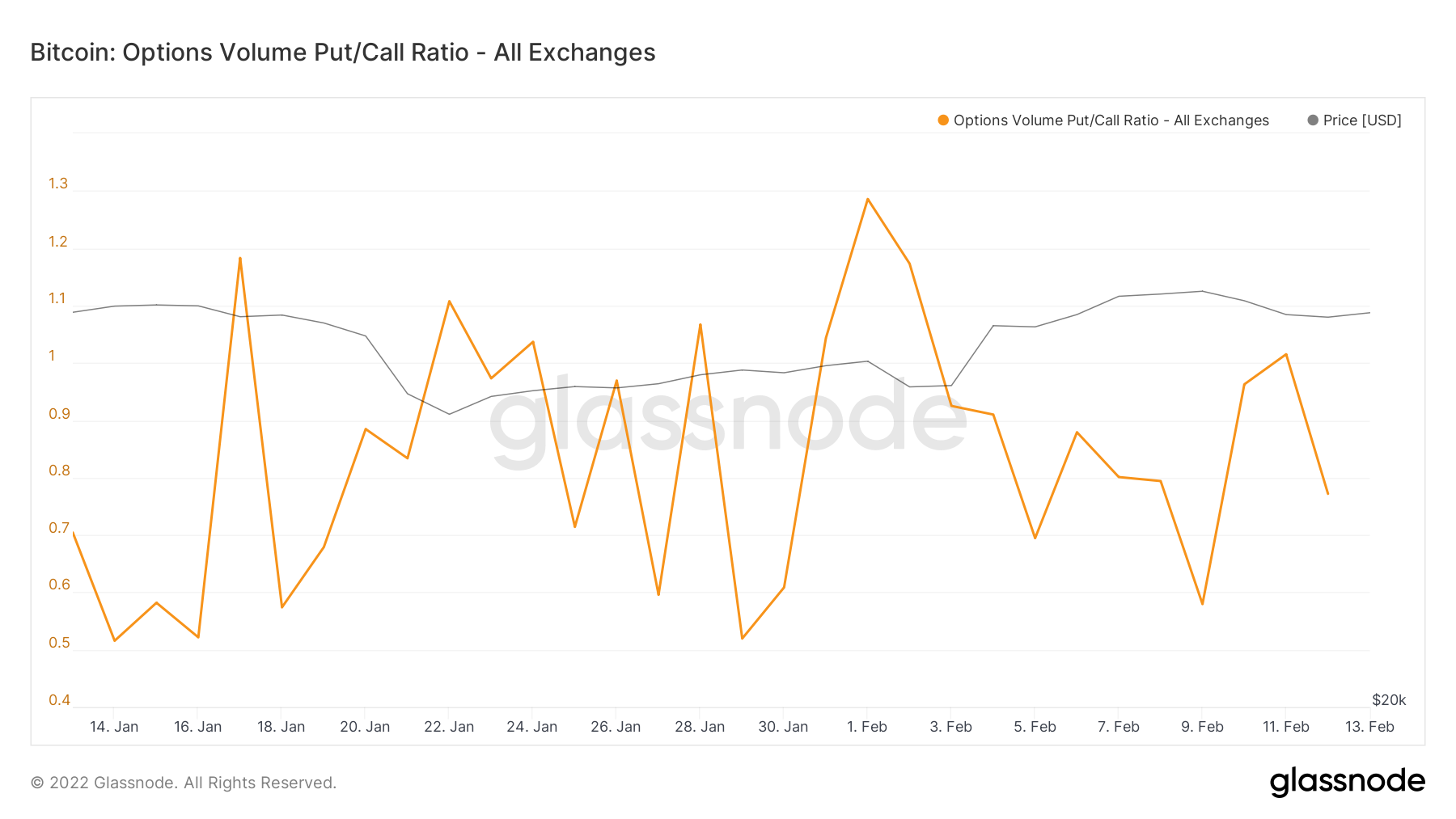

A similar outlook is given by the put/call ratio, which is comparable to the short/long ratio. However it deals with the options market instead of the futures market.

The put/call ratio is currently at 0.77. This means that options traders are favoring bets for the market instead of against it.

An interesting observation is the fact that the put/call ratio peaked at 1.28 on Feb 1. This supports the previous observation that the short squeeze of Feb 3-4 was caused by a considerable number of traders choosing to bet contrary to the market and then the price moving against to them.

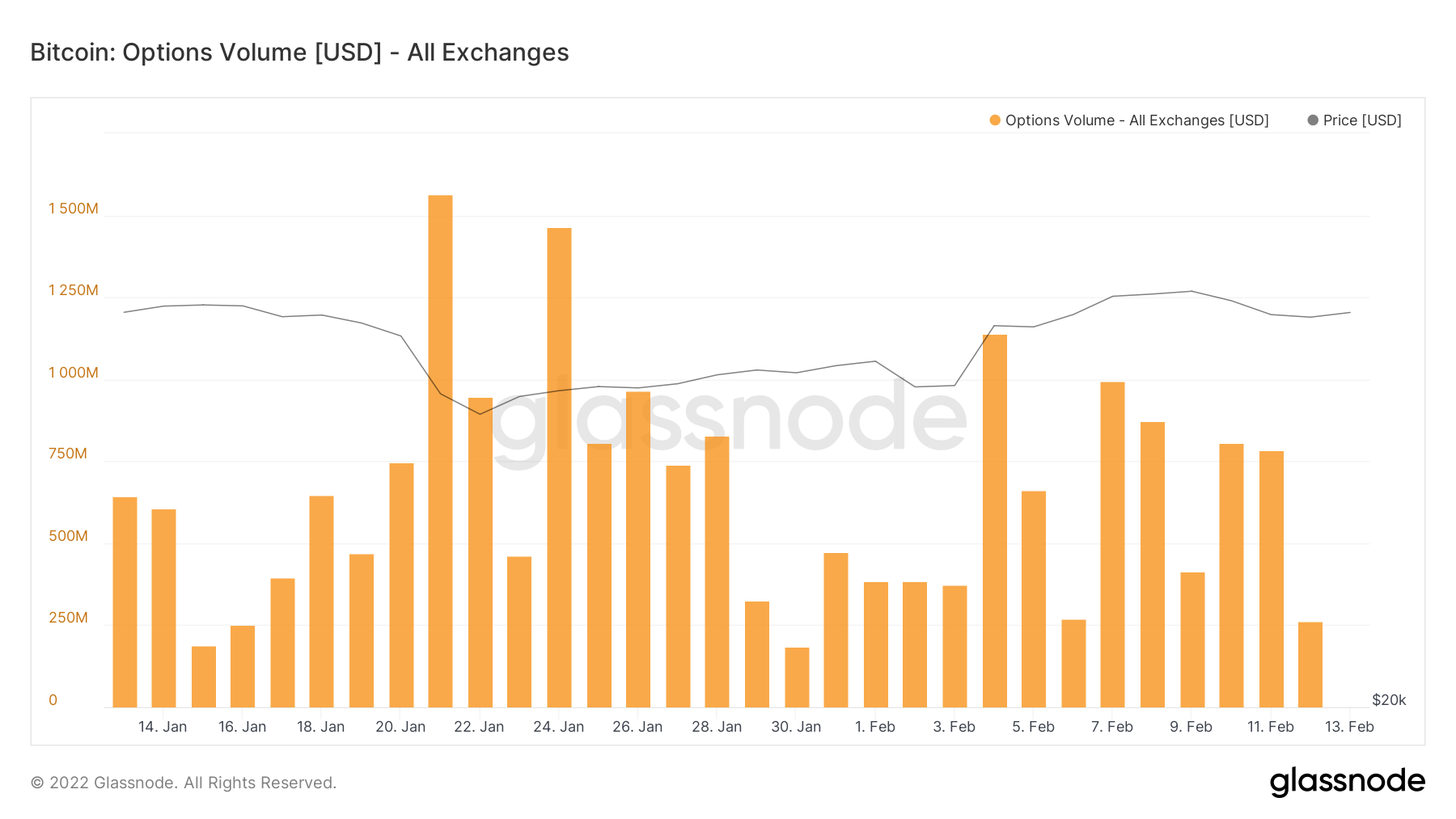

However, similar to the futures market, options contract volume is low. It pales in comparison to that of late January and early February.

Therefore, if a significant price movement were to occur, it would likely not be because of the derivatives market.

BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.