The Bitcoin (BTC) price gained a bit of bullish momentum over the weekend, recording close to 2% gains as bulls seemed in control — but only momentarily.

On a short-term basis, the Bitcoin price gained considerable momentum on Oct. 23, appreciating by almost 2.8% in a matter of a few hours. Nonetheless, the fresh gains saw a quick reversal, with bears pulling back the BTC price to the lower $19,300 level.

Bitcoin price still under bear control

On Oct. 23, the BTC price spiked to a high of $19,695 before pulling back to the $19,300 mark. The $19,600 level has acted as a crucial resistance on Bitcoin’s short-term chart.

At the time of press, Bitcoin was trading at $19,332, gaining 0.75% on the daily chart. The $19,130 mark is acting as the next key support.

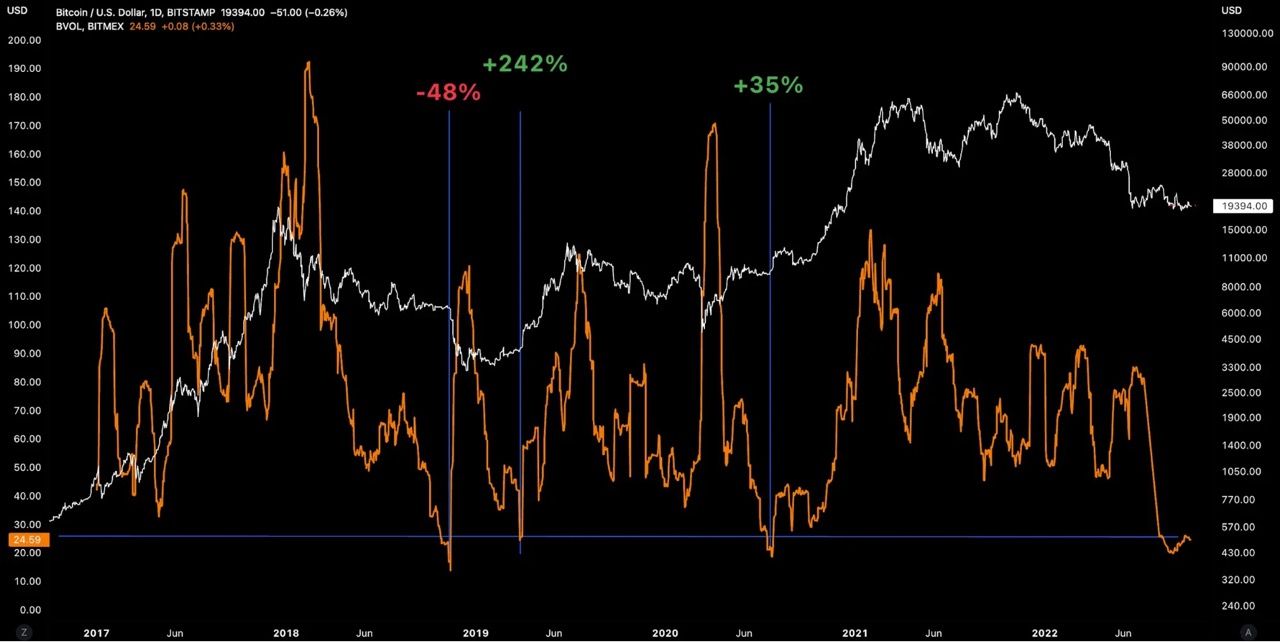

Messari data showed that while the current Bitcoin price action is anomalous, it isn’t unique. BVOL gauges the rate of fluctuations in the BTC price over time. Interestingly, BVOL was making some drastic moves, and the last three BVOL closes below 25 have resulted in large moves.

Two of the moves were bullish, and one BVOL dip below 25 resulted in bearish overturns.

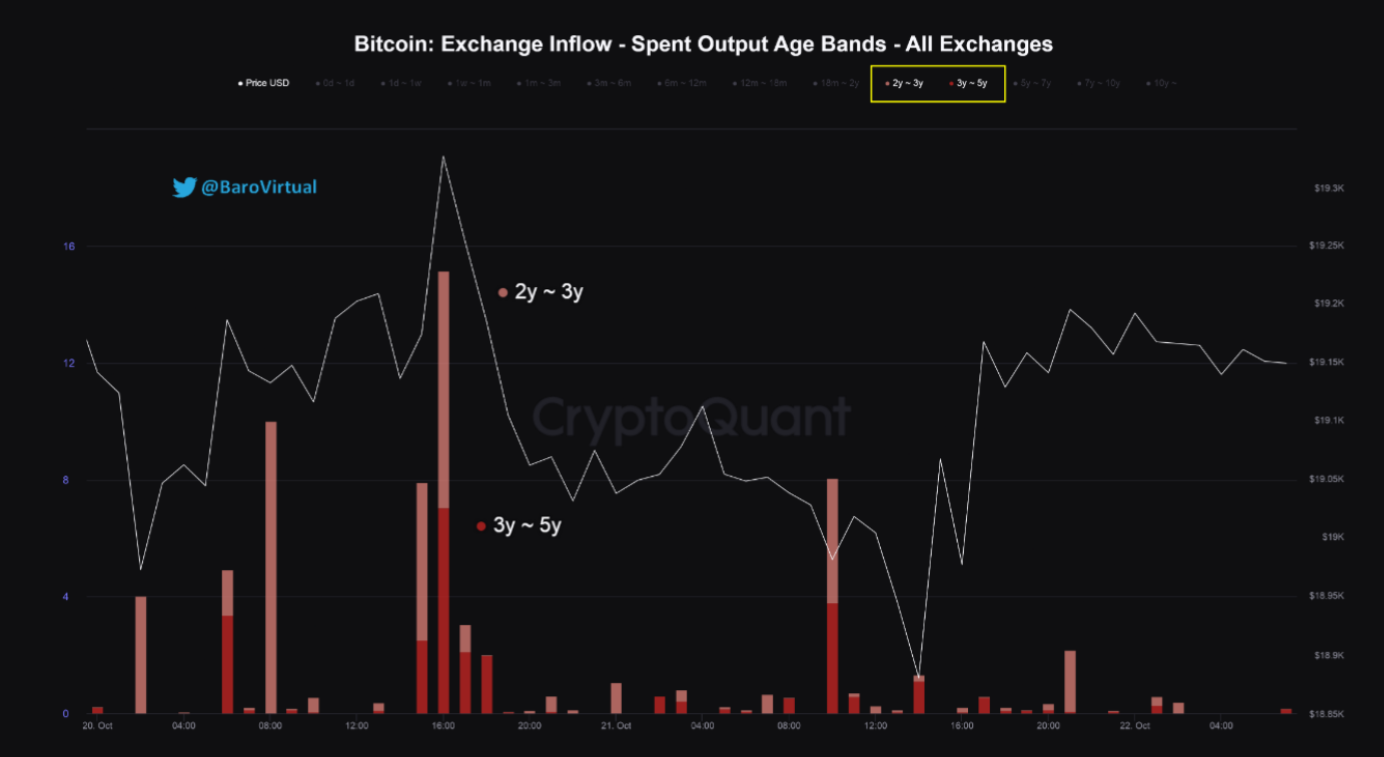

Old Bitcoins moving

The last few days saw old Bitcoins being deposited on cryptocurrency exchanges—specifically coins from the age categories of 2-3 years and 3-5 years. Such a movement generally results in negative short-term price action.

The Bitcoin price trajectory now seems largely dependent on the S&P 500’s behavior. Bitcoin investors from the aforementioned age group expect a further drop in the S&P 500.

According to fractal analysis, the stock market could expect two more big sell-offs on Nov. 22, 2022, and Dec. 23, 2022, as per CryptoQuant analyst.

Sentiment analysis from CryptoQuant highlighted that anxiousness was visible on dominance by volume. Notably, after a period of one month where Bitcoin was the most traded coin on exchanges, altcoins started to dominate.

On Oct. 23, 50% of the trading volume on exchanges came from altcoins.

Interestingly, in the time periods that altcoins traded heavily on exchanges, the following scenarios took place:

- November 2021 – January 2022: BTC price dropped from $67,000 to $36,000

- April 2021 – June 2022: Bitcoin price dropped from $47,000 to $20,000

Whether another drop in price follows is something that is yet to be seen. For now, the next Bitcoin price resistance is found at the $19,600 mark. The $19,000 level is acting as the next key support.