BeInCrypto takes a look at bitcoin on-chain indicators that relate to BTC lifespan, such as Liveliness and Average Spent Output Lifespan (ASOL). This is done in order to determine if older coins are being sold for profits during this rally or are staying put instead.

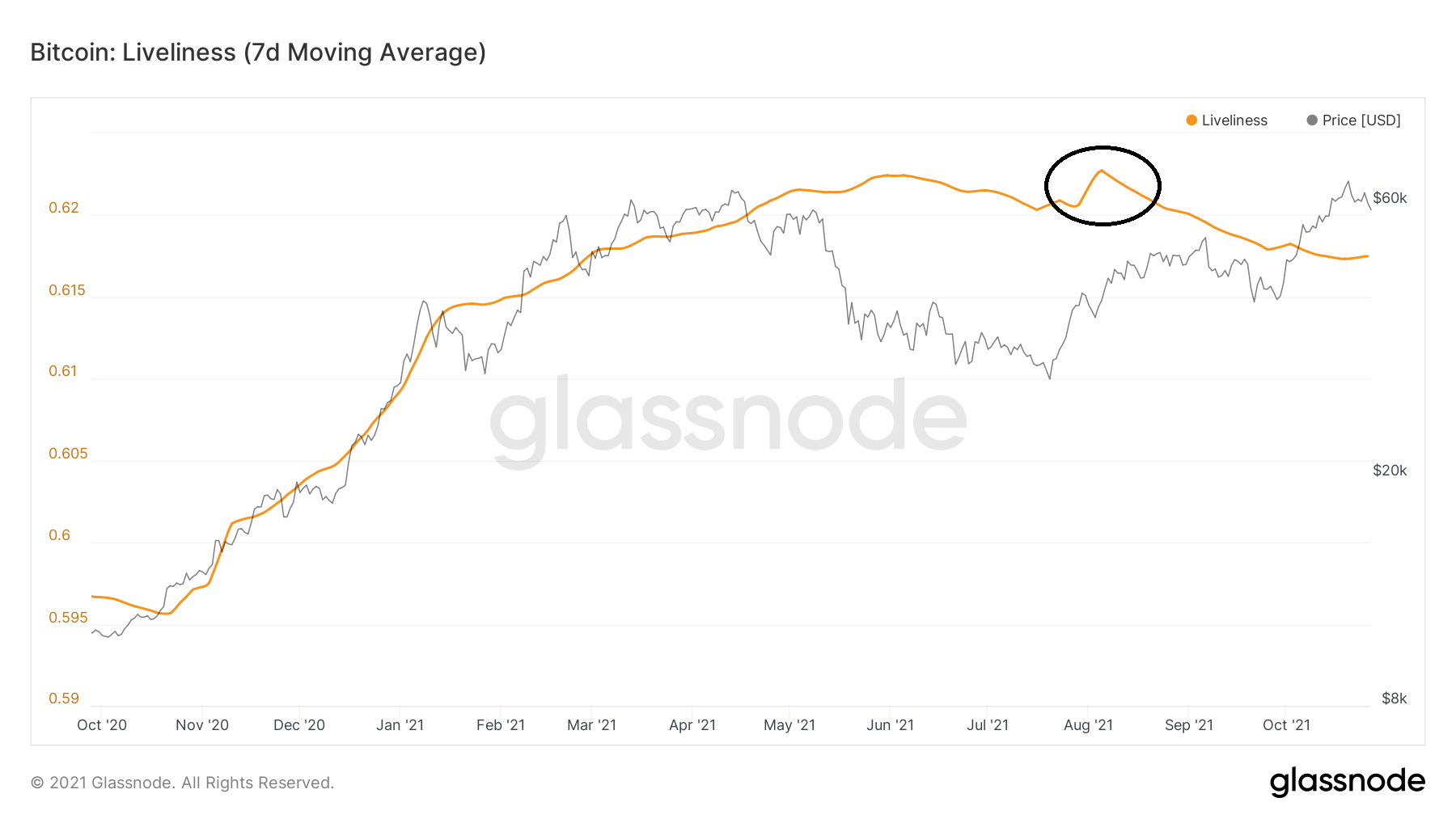

Liveliness is used to determine if old coins are being spent. The metric gives a value between 0 and 1. It’s created by dividing the sum of Coin Days Destroyed with the sum of all coins that have been created. Higher values mean that old coins are on the move, while low values mean that they are staying dormant.

SponsoredThe indicator has often reached a high during the top of bullish cycles.

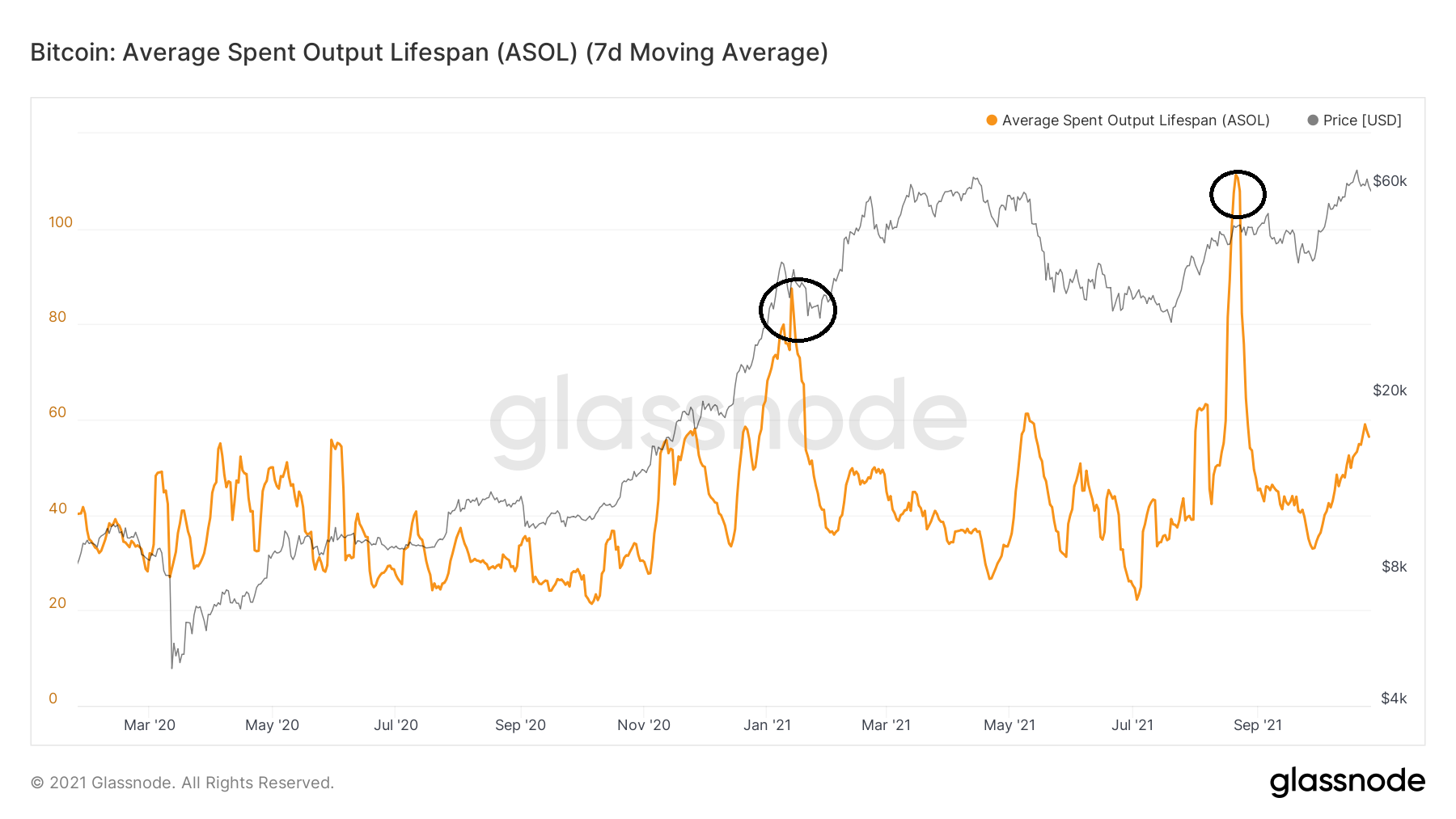

ASOL measures the average age of each transaction output. A high reading means that coins that are currently being transacted haven’t been previously moved for a long period of time.

For an analysis of its historical movement, click here.

Bitcoin liveliness indicator

Liveliness reached an all-time high reading of 0.622 on Aug 5 (black circle). This transpired during the rebound after the July lows near $30,000.

At the time, this looked like a bearish sign, since it meant that old coins were being moved. This usually transpires during relief rallies or top-of-market cycles.

However, liveliness has been decreasing since, and is currently at 0.6175, despite the price recently reaching an all-time high. This is a bullish sign that suggests that older coins are not being spent and supports the possibility that the current upward move is a continuation of the bullish market cycle.

SponsoredAverage spent output lifespan (ASOL)

ASOL reached its initial high of 84.3 on Jan 13. This meant that for each transaction, the BTC had previously not moved for an average of 84.3 days.

The high occurred at the first drop after the then all-time high price of $40,771. This was a result of profit-taking during the bounce after the first retracement. Following this, ASOL decreased considerably.

Similar to liveliness, ASOL spiked considerably on Aug 22, reaching a high of 110. This occurred after the BTC price had bounced from $30,000 to $49,000. At the time, this suggested that the upward move was a relief rally, but ASOL has been decreasing since.

Therefore, both liveliness and ASOL show that there was some profit-taking on the initial bounce to $50,000, but that has subsided in the ongoing upward move, and older coins are now dormant.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.