The bitcoin (BTC) price decreased considerably on March 28, falling below the $57,800 area.

Despite the drop, it does not look like the upward trend has ended. Therefore, another all-time high price for BTC is expected in the coming weeks.

Bitcoin Drops Below Support

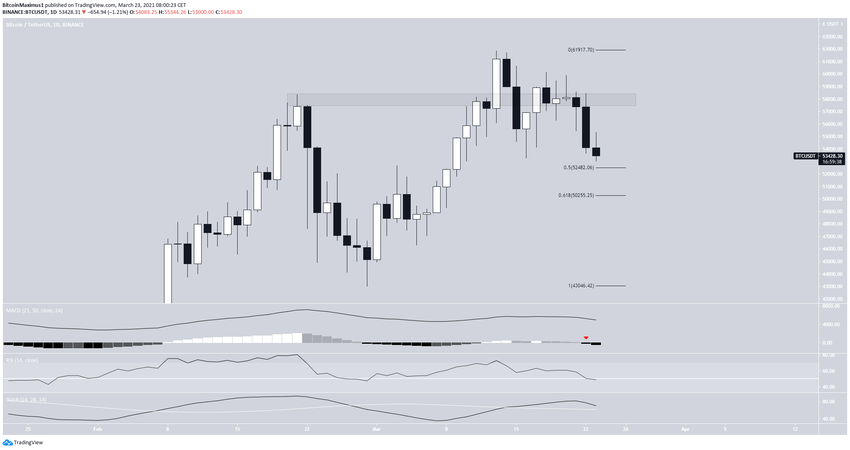

Yesterday, BTC decreased considerably. It failed to reclaim the $57,800 area and validated it as resistance instead.

Currently, it’s trading just above the 0.5 Fib retracement level at $52,500. The 0.618 Fib retracement level is found at $50,250.

Therefore, this entire range is likely to act as support.

Technical indicators are still undecided. While the MACD histogram has turned negative, the Stochastic oscillator is still bullish.

Furthermore, the RSI is just above 50, a potential level for a bounce.

RSI Movement

It’s worth mentioning that the RSI has been above 50 since October 2020 when the price was trading at $10,500.

It has not fallen below 50 since, with the exception of a deviation at the end of January 2021.

The two other times the RSI was at 50 (green arrows), a significant bounce occurred.

Therefore, an RSI drop below 50 and its validation as resistance would indicate that the long-term upward trend has likely ended.

However, a bounce is the most likely scenario.

Wave Count

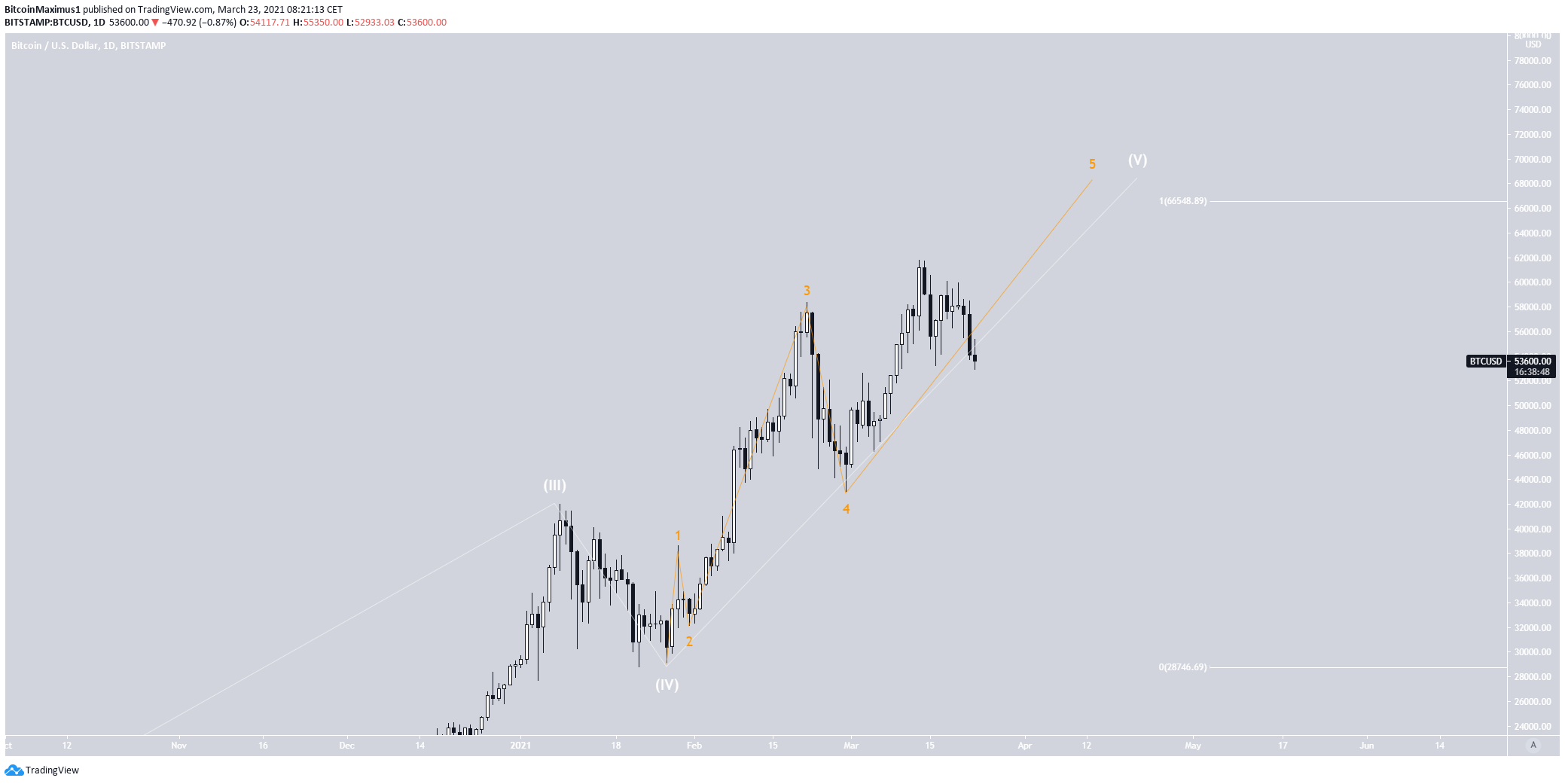

There are a few potential wave counts that are still in play.

The main count suggests that BTC is in minor sub-wave four (black). A final upward movement could take it towards the range of $67,000-$68,000.

However, the wave count is very close to being invalidated. The invalidation level is at the top of minor sub-wave one at $52,652.

The sub-wave count is shown in orange.

The longer-term count is presented below. The sub-waves are shown in orange, while the main waves are shown in white.

It’s likely that the price is in the final portion of its upward movement.

Alternative BTC Count

If the invalidation level from the previous image is reached, there are two potential alternative counts in play. Those are a running flat or a triangle.

The running flat would suggest that BTC is still in sub-wave four (orange).

In this scenario, the price would continue to decrease toward the potential support line of channel near $48,000.

However, it would most likely resume its upward movement after.

The triangle possibility is similar, with the exception that the price would find support near $50,000 before bouncing.

An irregular flat is also possible. In this case, BTC could fall below the March lows of $42,000. However, this does not seem likely at the time.

From the alternative scenarios, the triangle seems to be the most likely.

Therefore, while it is possible that there is another decrease in the short-term, it does not look like the top is in.

Conclusion

Bitcoin is currently attempting to find support near $50,250-$52,500.

While the exact wave count is unclear, the bullish impulse does not look complete just yet.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.