Bitcoin (BTC) has been trading inside a corrective pattern since June 18 and a breakdown from this channel could lead to new local lows.

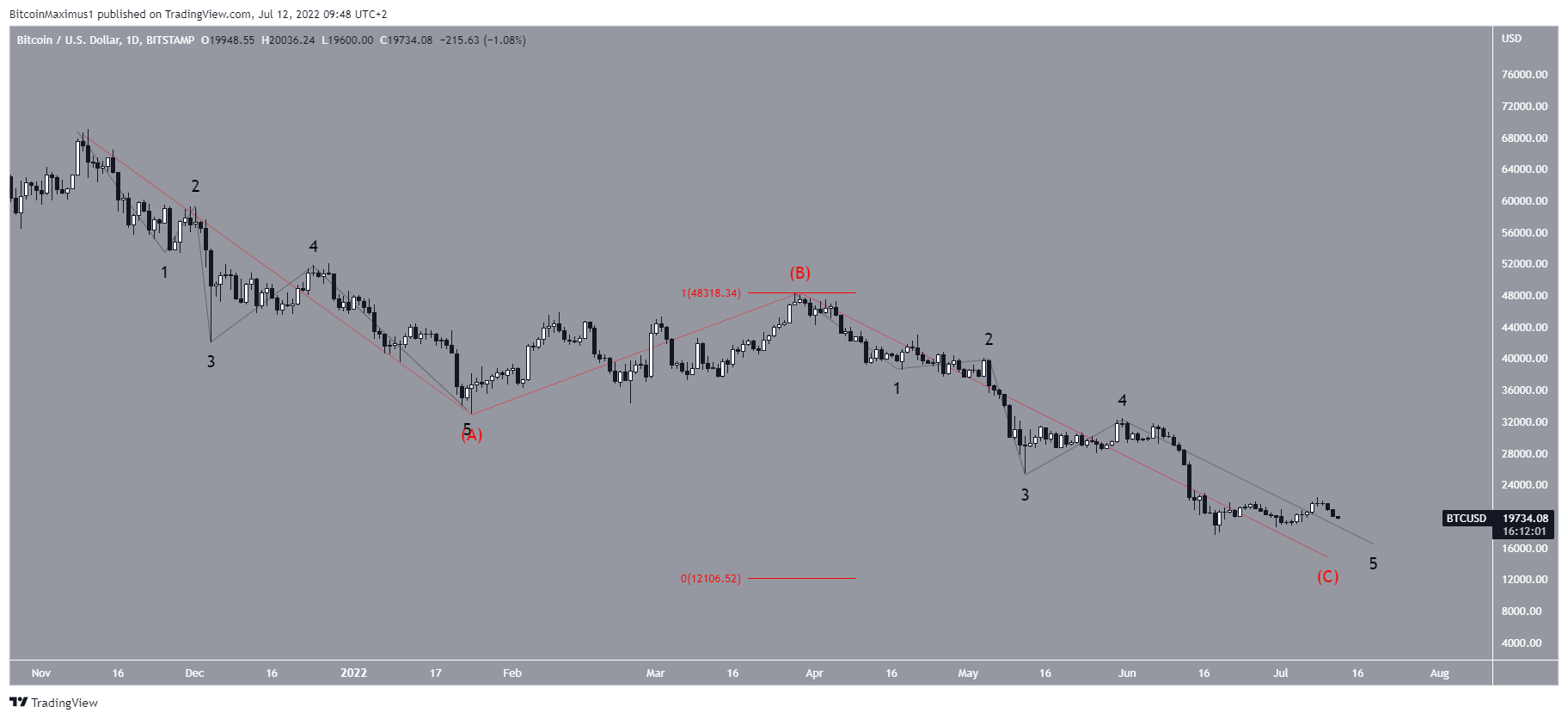

Bitcoin has been decreasing underneath a descending resistance line since the end of March. The last time the resistance line caused a rejection was on June 7. This led to a long-term low of $17,622 on June 18.

While the price increased slightly after this, it was rejected by the $21,700 horizontal resistance area and failed to reach the aforementioned descending resistance line.

Furthermore, while the daily RSI initially broke out from its own descending resistance line, it has failed to validate it as support and is still below 50. As a result, there are no bullish reversal signs in place.

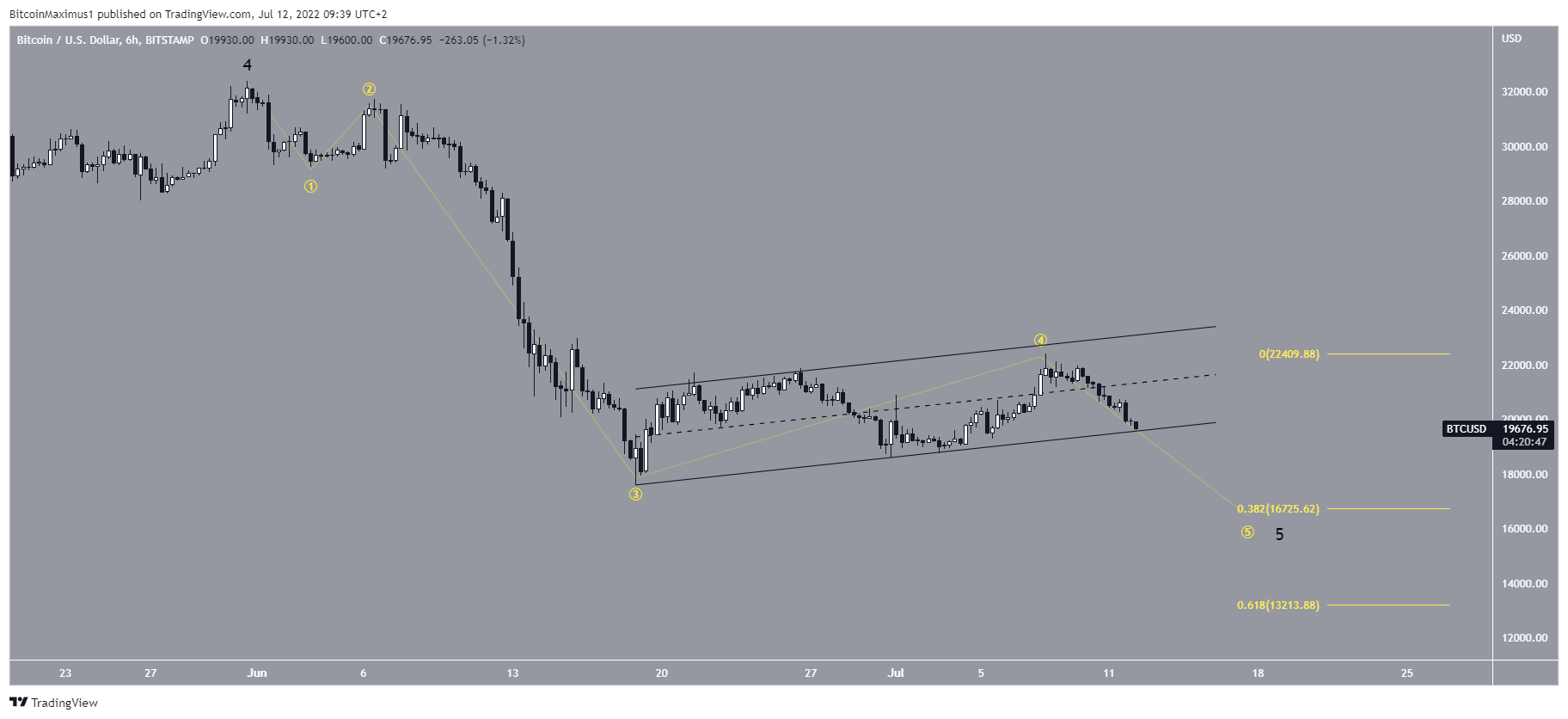

Ascending parallel channel

The six-hour chart shows that BTC has been trading inside an ascending parallel channel since June 19. Such channels usually contain corrective movements and likely means that the underlying trend is bearish.

Additionally, the six-hour RSI has already broken down from its ascending support trendline, indicating that the price could soon do the same. A breakdown from the channel would be expected to lead to further lows.

BTC wave count

The wave count suggests that the price is in the fifth and final wave of a downward move (yellow). The presence of the corrective channel makes it likely that it is a part of the last wave.

Using the 0.382 length of waves 1-3, a breakdown could lead to a low near $16,725.

The long-term wave count suggests that BTC has been completing an A-B-C corrective structure (red) since reaching an all-time high of $69,000.

Giving waves A and C a 1:1 ratio would lead to a low of $12,100. So, the potential for continued downside movement is still immense.

For Be[in]Crypto’s previous bitcoin (BTC) analysis, click here.