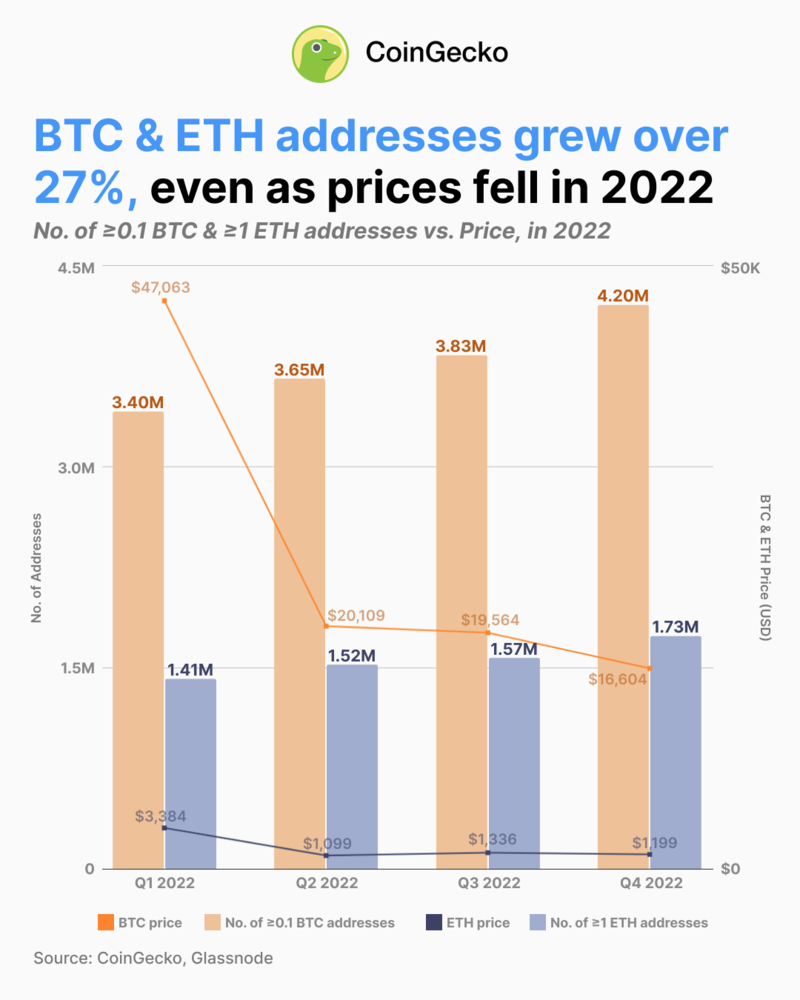

Bitcoin and Ethereum’s adoption over the past year grew despite the bear market condition and the collapse of several crypto firms, according to a Coingecko report.

Despite Bitcoin and Ethereum’s value dropping by over 60% in 2022, crypto investors still made significant investments in the flagship digital currencies. According to the report, the number of addresses holding at least $1000 of either crypto asset increased by 27% in 2022.

During this period, addresses holding 0.1 BTC (roughly $1000) increased to 4.20 million as of December 31 from the 3.40 million recorded on January 1. On the other hand, addresses holding 1 ETH (minimal value of $1000) rose from 1.41 million to 1.73 million over the same time.

BTC and ETH Adoption Enjoyed More Growth in 2022’s Q4

Coingecko noted that the adoption rate of the top two digital assets grew to its highest level in the fourth quarter of the year, coinciding with when Sam Bankman-Fried’s crypto empire collapsed.

According to the firm, while addresses holding 0.1 BTC grew by an average of 7.3% each quarter, the adoption rate during FTX’s collapse jumped to 9.7%. At the same time, addresses holding 1 ETH rose by an average of 7% each quarter and surged by 10.4% during this period.

Ethereum’s higher adoption rate was tied to the completion of its migration to a proof-of-stake consensus mechanism in September.

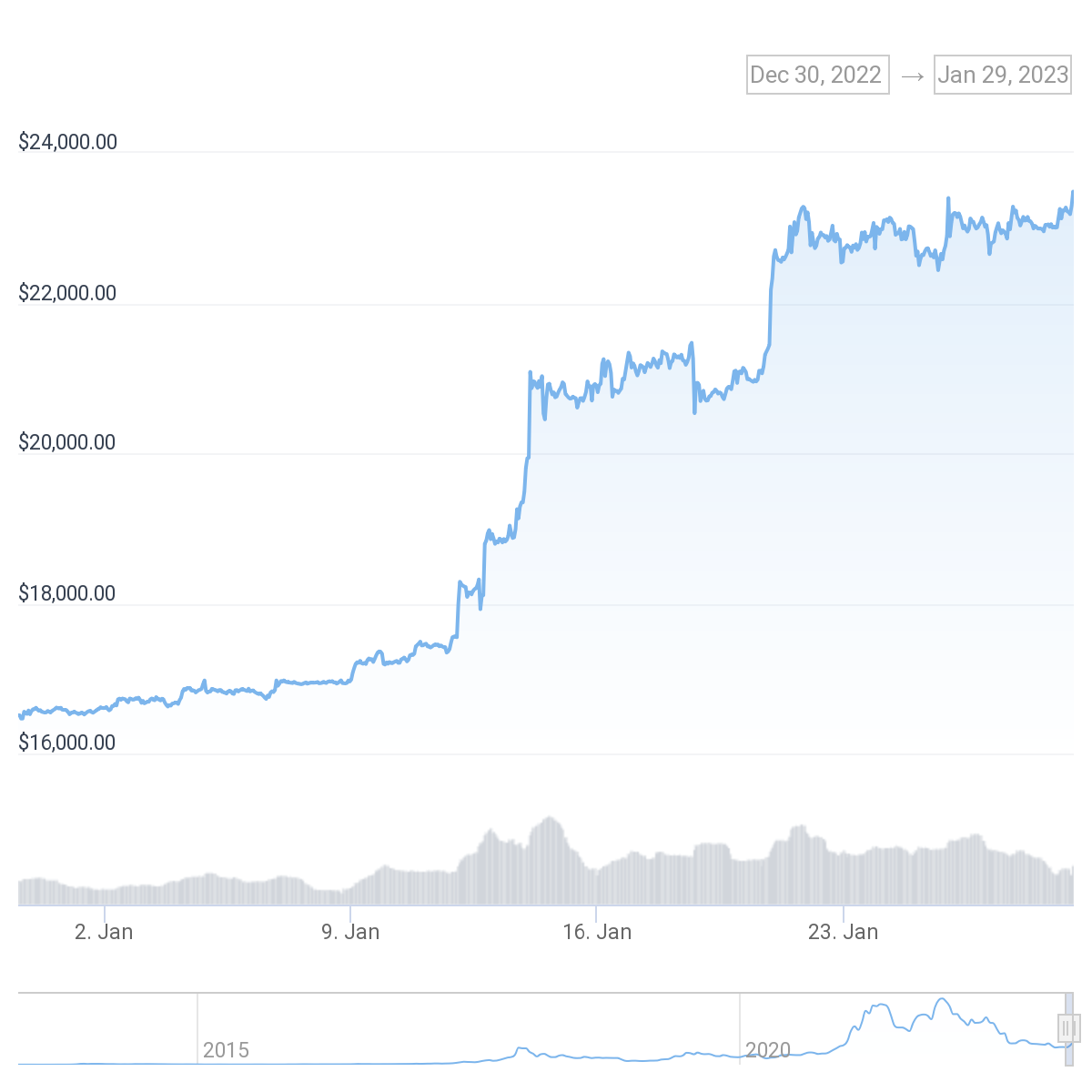

Crypto Sees Bull Start to 2023

Meanwhile, BTC and ETH appear to have shaken off 2022’s poor performance, rising by over 30% over the past month.

In the last 30 days, the two flagship digital assets’ price performance saw them return to their pre-FTX collapse levels. Bitcoin traded above $23,000, while Ethereum rose above $1,600 for the first time since September 2022.

However, the run also spread to other digital assets like Aptos’ APT token, which surged to a new all-time high. Solana’s SOL and FTX’s native token, FTT, were also major beneficiaries of the price bump. Besides that, the total crypto market cap for the industry reclaimed the $1 trillion mark amidst the bull run.

As of press time, BTC sold for $23,468, while ETH exchanged hands for $1613.