Bitcoin (BTC) fell sharply on Feb 2 after being rejected by a descending resistance line. While it has rebounded at a short-term support level, the price action shows the possibility of more short-term downside prior to a reversal.

Bitcoin has been following a descending resistance line since reaching an all-time high price of $69,000 on Nov 10. On Feb 1, it was rejected by this resistance line for the third time (red icons) and fell sharply the next day. While this movement increased the significance of the line, it’s worth noting that resistances get weaker each time they are touched, so an eventual breakout above it would be the most likely scenario.

If a breakout transpires, the first resistance area would be found at $40,800. This target is a horizontal area that previously acted as support. Above that, the next resistance would be found at $46,700, the 0.382 Fib retracement resistance level.

Short-term breakdown

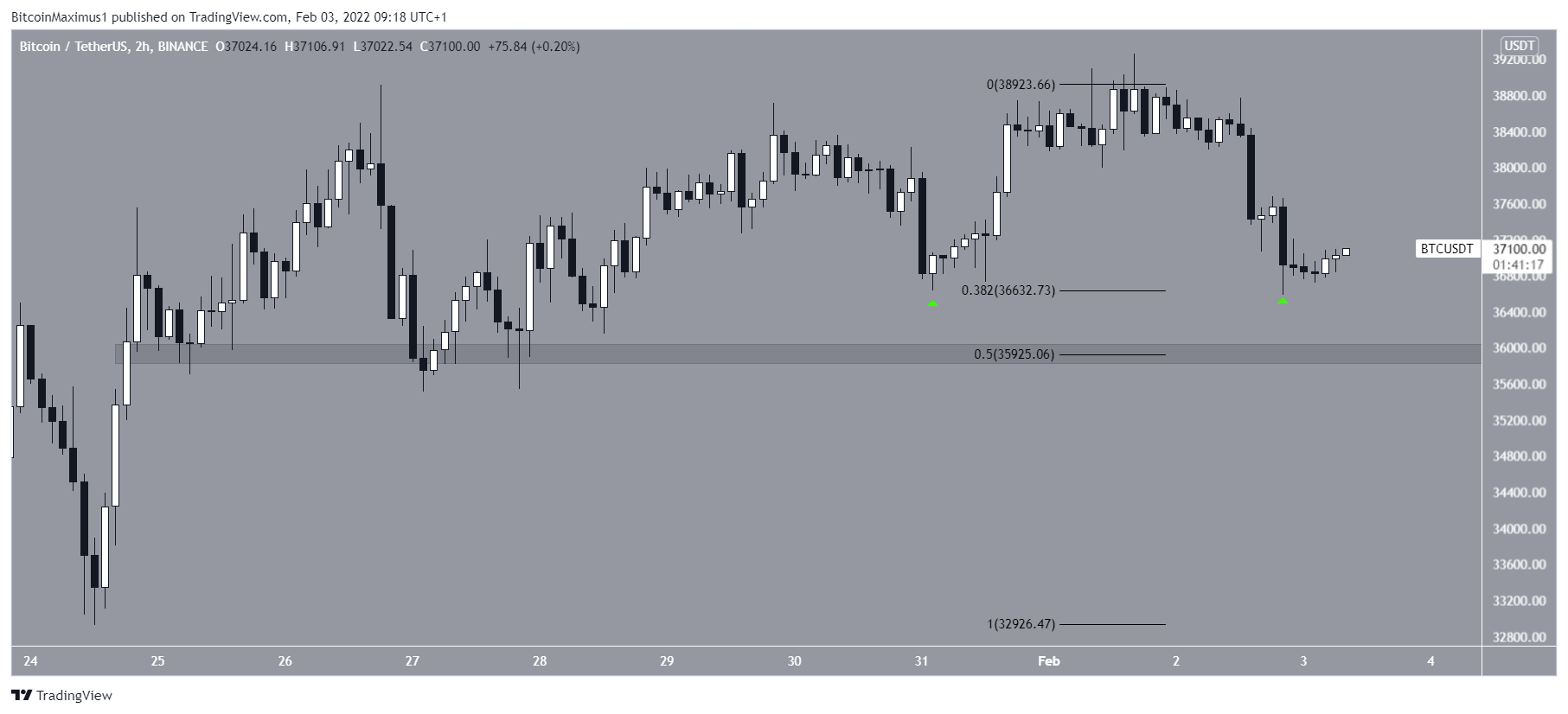

The two-hour chart shows two main developments.

Firstly, BTC deviated above the Jan 26 high (red line) before falling back below it. This is a bearish development that is often followed by a downward move.

Secondly, it broke down from an ascending support line that had previously been in place since Jan 27. This further supports the possibility of more short-term decreases.

BTC has been provided some support at the minor $36,630 support area, created by the 0.382 Fib retracement support level. The primary horizontal support is found at $35,925, created by the 0.5 Fib retracement level.

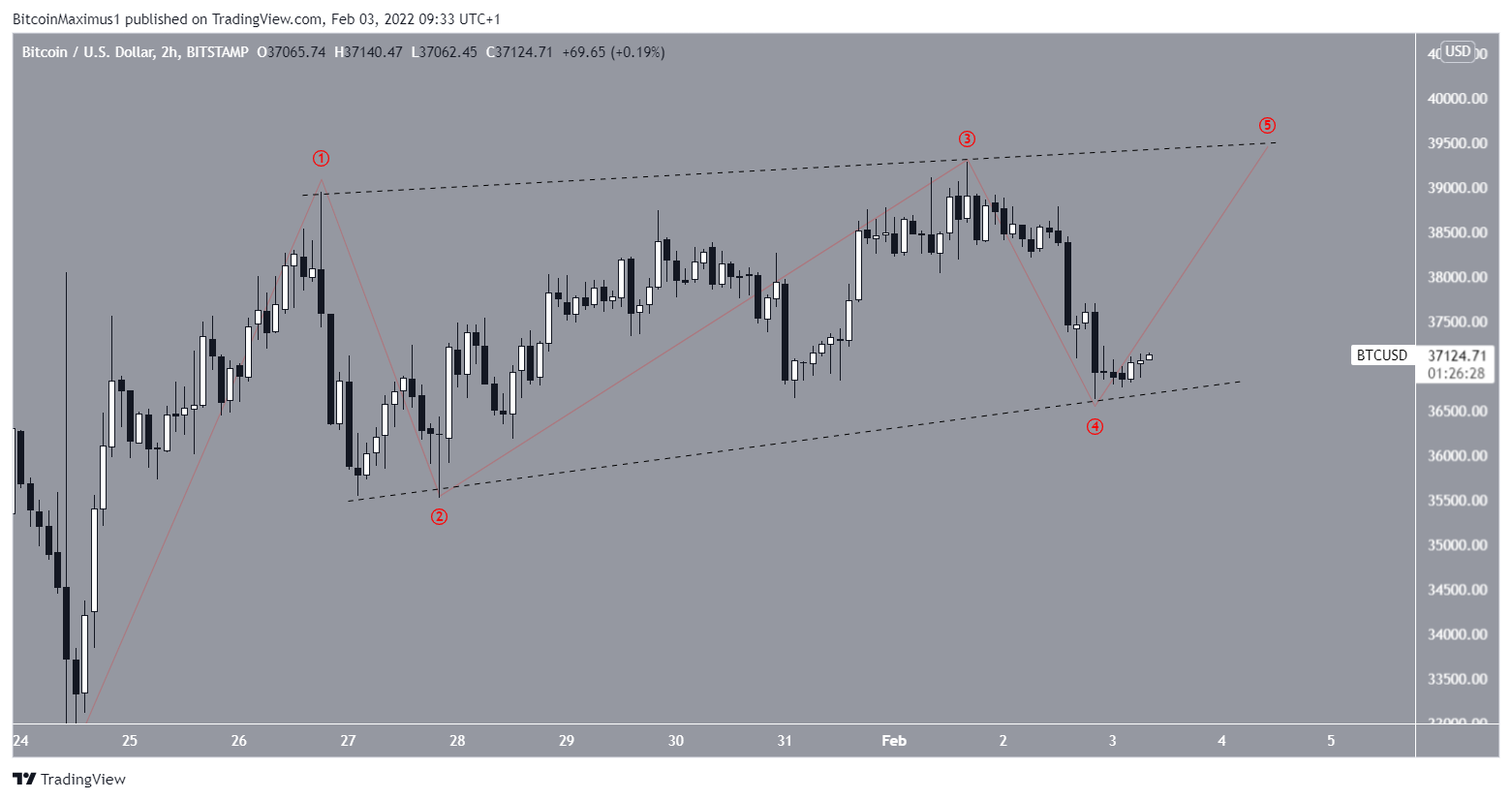

BTC wave count analysis

The most likely long-term count suggests that the bottom is already in. As for the short-term count, it’s possible that BTC is in the process of completing a flat A-B-C correction

Giving sub-waves A and C (black) a 1:1 ratio would lead to a low of $35,871, aligning with the previously outlined support area.

While a leading diagonal is technically still possible, it seems to be much less likely due to the sharp drop on Feb 2.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here