Bitcoin (BTC) rebounded considerably on Jan 24 after falling to a long-term support level. Technical indicators are now showing signs that it might have completed its correction.

Bitcoin has been falling since reaching an all-time high on Nov 10, 2021. The downward move eventually caused a breakdown below the $40,800 horizontal support area, which is now expected to act as resistance.

The decrease continued until Jan 25, when BTC reached a local low of $32,917. It bounced immediately after (green icon) and created a bullish candlestick with a very long lower wick. This is considered a sign of buying pressure.

In addition to this, the bounce validated an ascending parallel channel which has been in place since April 2021.

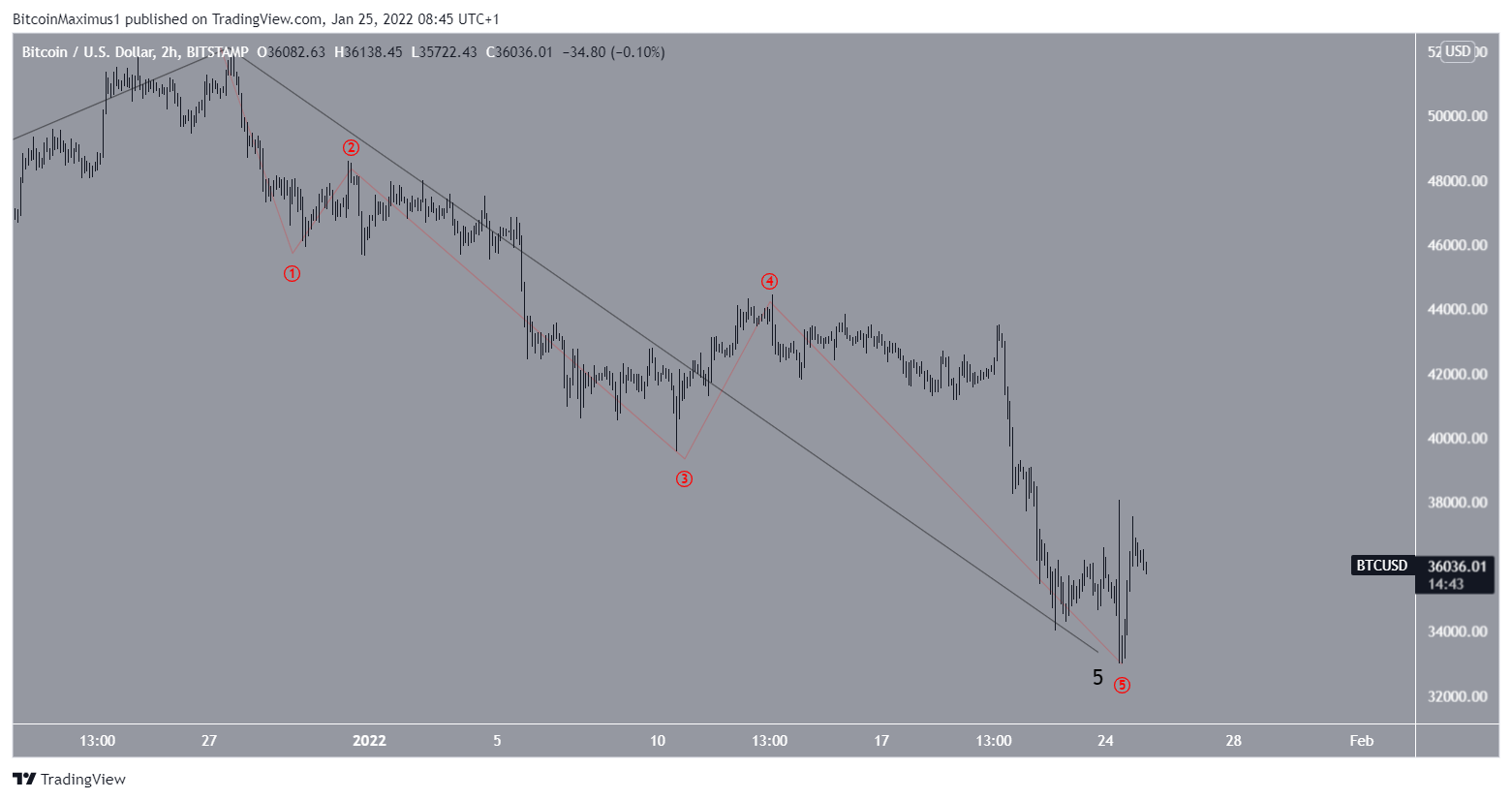

Short-term movement

The two-hour chart shows that the recent upward move was preceded by bullish divergences in both the RSI and the MACD. This is a development that often leads to bullish trend reversals.

After the bounce, BTC managed to reach a high of $37,550 before decreasing again.

Currently, it’s trading just above the 0.382 Fib retracement support level at $35,800. The next closest support levels are found at $35,260 and $34,700. These targets are the 0.5 and 0.618 Fib retracement support levels, respectively.

One of these levels is expected to give BTC another boost to the upside.

Bitcoin wave count

The wave count suggests that BTC has completed an A-B-C corrective structure that has been developing since April 2021. If correct, yesterday’s bounce was the final bottom, giving waves A:C a 1:1 ratio. The sub-wave count is shown in black.

A closer look at sub-wave five reveals another completed five waves down (red), further supporting this scenario.

While an alternate count suggests that another slight drop could eventually follow, it still predicts a rebound to test higher resistances.