Bitcoin (BTC) has yet again demonstrated its resilience and potential for significant gains. This is according to ARK Invest’s latest report, “The Bitcoin Monthly,” covering the events of March 2024.

BTC’s price reached a new all-time high (ATH) of $73,737 in March, marking an approximately 18.5% gain from the start of the month. The price level also represents a nearly 75% surge during Q1 2024. However, after achieving this ATH, BTC entered a period of consolidation.

Bitcoin Market Remains Bullish Despite Profit-Taking

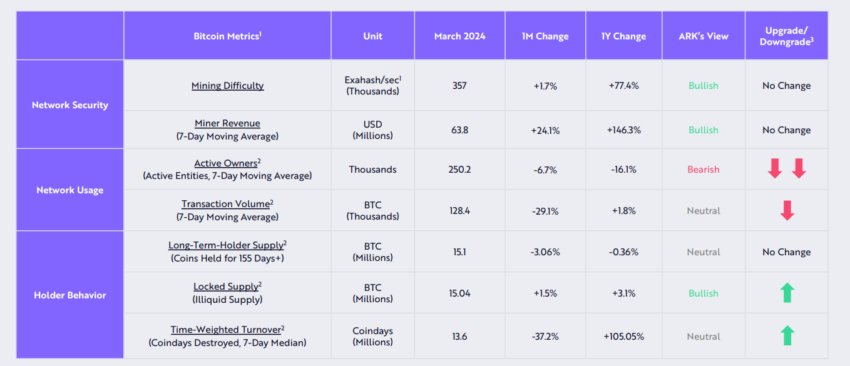

ARK Invest’s analysis highlights that the market sentiment remains robust despite significant profit-taking by long-term holders. This trend is underscored by a steadfast group of investors who have held their positions for five years or more. Their commitment underpins stability in the face of profit-taking.

One of the core indicators, MVRV Z-Score, suggests that Bitcoin has not yet entered the excessively exuberant zone often seen in past cycle peaks.

Read more: Bitcoin Price Prediction 2024/2025/2030

Market Value to Realized Value (MVRV) Z-Score is an indicator that measures the market value against the realized value. While technically overbought according to certain indicators, the MVRV Z-score suggests Bitcoin’s relative valuation remains below the levels indicative of unsustainable market froth.

Regarding technical support levels, Bitcoin’s price exceeds several key metrics, including the short-term holder cost basis and the 200-day moving average. This suggests a resilient market price; however, significant sell-offs can trigger price corrections.

March also saw a notable balance in the inflow and outflow of funds in the US spot Bitcoin ETFs, with assets under management climbing to over $59 billion. This shows continued interest and investment in Bitcoin, reinforcing its appeal to retail and institutional investors.

“In March, US spot Bitcoin ETF inflows and outflows hit records that nearly balanced at $1.6 billion and $1.4 billion, respectively,” ARK Invest wrote.

Further buoying the positive outlook is the improvement in Bitcoin’s risk-adjusted returns. ARK notes that Bitcoin’s four-year annualized returns and the Sharpe ratio have reached three-year highs. This momentum upswing follows a period of lower volatility and less dramatic price action throughout 2022 and 2023.

On the innovation front, Bitcoin’s scaling solutions are seeing rapid advancements. More than 50 independent projects are developing on the Bitcoin base layer, employing technologies such as Roll-ups, State Channels, and Sidechains.

Significant contributions from initiatives like the Lightning Network, Rootstock, and Stacks have collectively locked in nearly $700 million in value since October 2023.

However, it’s important to remember that the outlook presented by ARK Invest here only summarizes Bitcoin’s performance in March 2024.

Read more: Bitcoin Halving Countdown

While it may guide how BTC will perform in the coming months, other factors are equally important to consider. These factors include the upcoming Bitcoin halving event and macroeconomic factors.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.