The bitcoin (BTC) price has been increasing since bouncing on March 25. It’s currently reapproaching the $60,000 level.

While bitcoin is expected to reach a new all-time high, a short-term retracement is likely prior to the final breakout.

BTC Nearing All-Time High

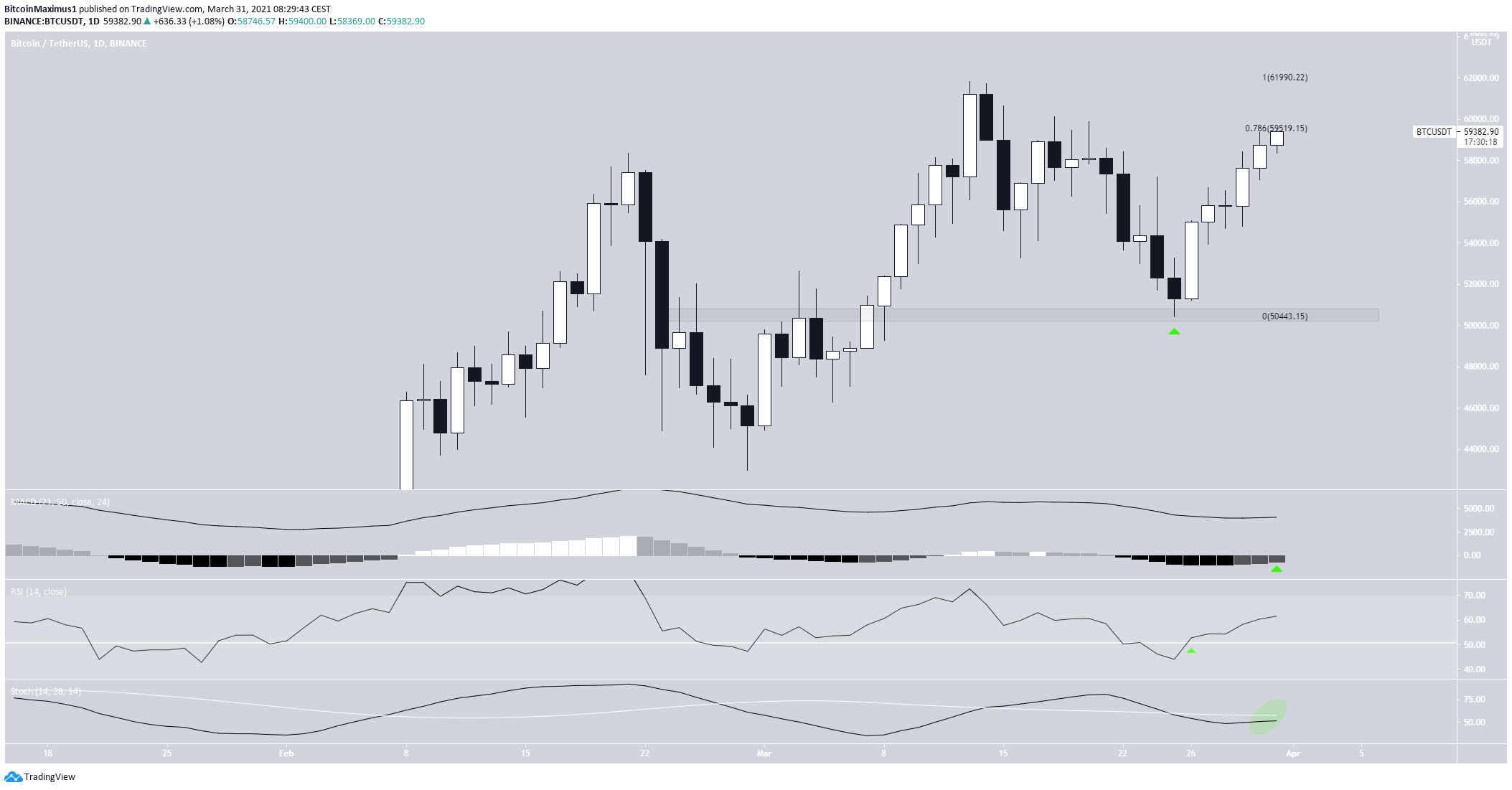

BTC has been increasing since bouncing on March 25. Since then, it’s reached a high of $59,800 on March 31.

Currently, the price is trading inside the $59,500 resistance area. This is the 0.786 Fib retracement level of the previous drop.

Technical indicators have turned bullish. The MACD has given a bullish reversal signal and the RSI has crossed above 50.

While the stochastic oscillator has yet to make a bullish cross, it’s very close to doing so.

Will It Break Out?

The six-hour chart shows that the $59,500 area is also a horizontal resistance level.

Both the MACD and RSI are bullish. Therefore, an eventual breakout from this area is expected.

The closest horizontal support level is found at $57,000.

The two-hour chart shows the first signs of weakness.

The MACD has generated a triple bearish divergence. In addition, the RSI has generated some bearish divergence, though it’s still unconfirmed.

A retracement could depend on the exact value of the top. However, if the local top is reached near $60,000, the first Fib support level would be found at $56,500.

Wave Count

A short-term wave count (highly speculative) suggests that BTC is nearing the top of a bullish impulse.

While this is likely still a longer-term minor sub-wave one, BTC would be expected to correct soon.

A potential target for the top of this move is found between $60,000-$61,000.

Conclusion

Bitcoin is expected to soon reach a new all-time high price. However, a short-term retracement could be likely prior to the final upward move.

For BeInCrypto’s previous bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.