The Bitcoin (BTC) has been increasing since Sept. 8 and has finally reached the first notable Fib resistance level.

It’s possible that the BTC price has completed its upward bounce or is very close to doing so, and will likely soon resume its downward movement.

Bitcoin Shows Weakness

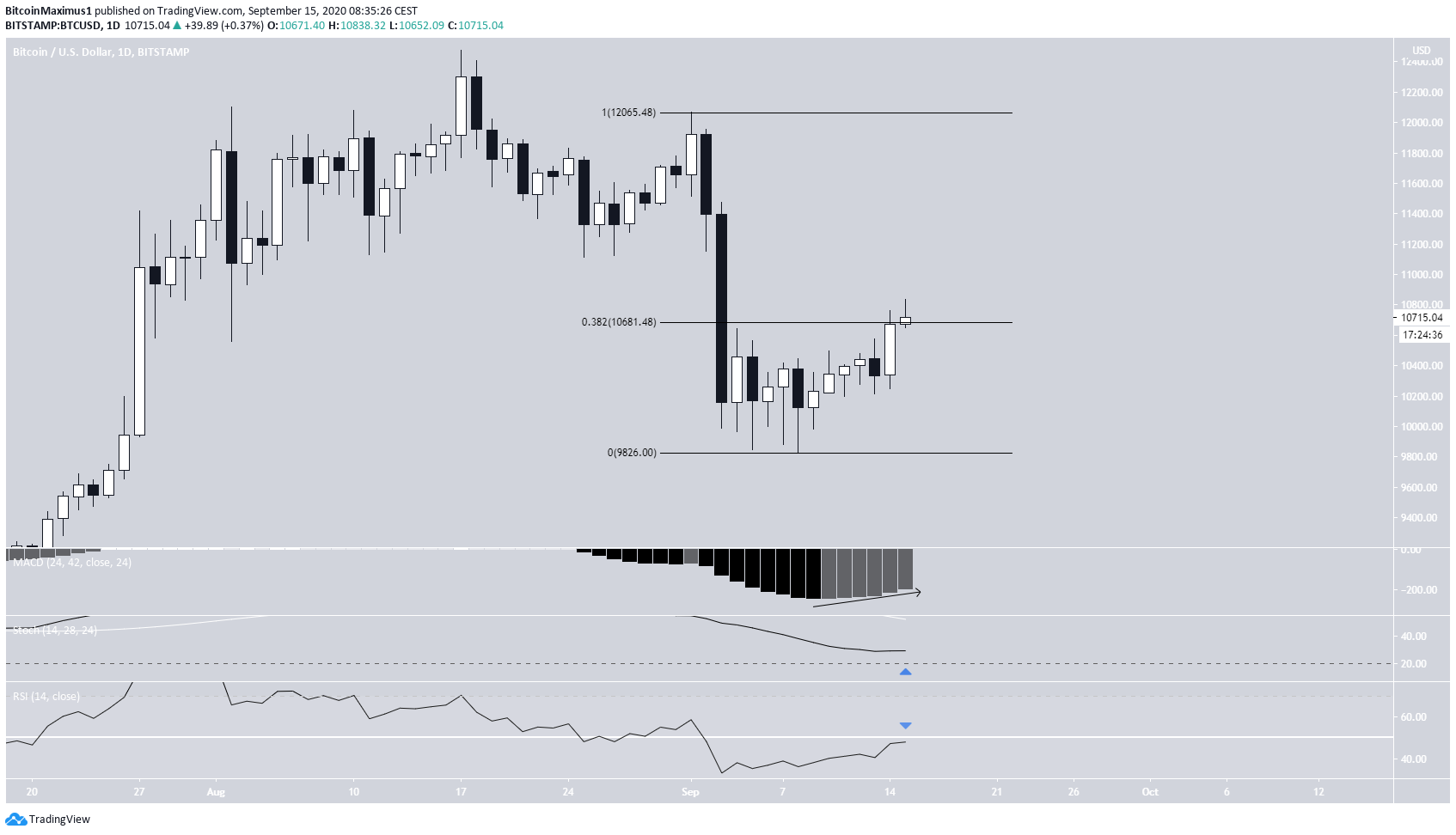

The Bitcoin price has been moving upwards since it reached a local low on Sept 8. The increase has been gradual but accelerated on Sept 14 when the price created a bullish engulfing candlestick. Since the drop from early September, BTC has only managed to reach a local high of $10,839.

The price has reached the 0.382 Fib level of the entire decrease at $10,681. The next notable Fib level is 0.5 which can be found at $10,945.

Technical indicators are undecided. The MACD is increasing, as is the slope of the Stochastic oscillator, even if it has not yet made a bullish cross.

However, the RSI has been rejected by the 50-line and could possibly begin to move downwards.

Potential Fakeout

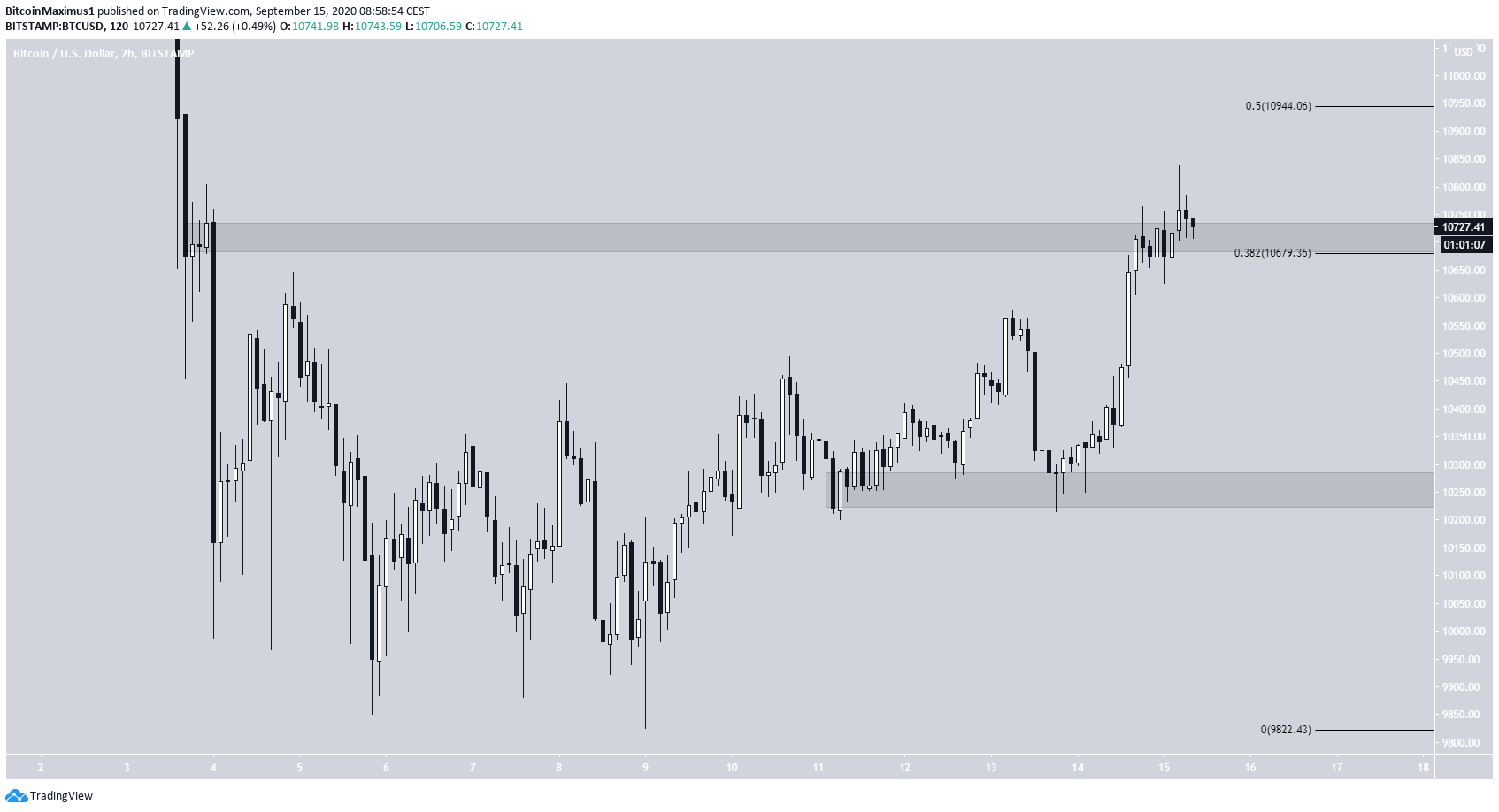

The shorter-term chart is more bearish. While the price has been making higher-highs, there is a bearish divergence in the MACD, Stochastic Oscillator, and the RSI, with the deviation being much more pronounced in the first two.

This is a sign that the price is likely to eventually move downwards.

In addition, BTC has possibly pulled a fakeout above the minor resistance level at $10,700 and is at risk of falling back below it.

If it does, it could drop all the way to the closest minor support level at $10,250.

Wave Counts

In BeInCrypto’s Sept. 11 analysis, we stated that:

The Bitcoin price likely began a bearish impulsive five-wave formation on Sept. 2 and currently is in wave 4, which is transpiring inside a complex corrective structure.

The complex correction has a W-X-Y structure (in red below). At the time of press, the price had reached a high of $10,831, which makes the ratio between the W and Y waves 1:1.61, a common level for such corrections.

In addition, the 0.5 Fib level of wave 3 (orange) is found at $10,951, giving some Fib confluence for the current high.

A closer look at the movement reveals an A-B-C sub-wave (blue) correction inside the Y wave. Within this pattern, the A and C waves have a 1:1 ratio, confirming the previous Fib confluence and making this a likely level for a top.

Based on the length of waves 1-3, the target for the bottom of wave 5 would be at $9,983 (giving a truncated fifth) or $9,473 in the case of a regular wave 5.

A breakdown below $9,450 would put the long-term bullish count at risk.

To conclude, it is possible that BTC has completed its upwards bounce and will decrease towards $9,700 or possibly $9,470.

For BeInCrypto’s previous Bitcoin analysis, click here!