On Oct 19, the Bitcoin (BTC) price initiated an upward move, finally breaking out from its consolidation phase that had lasted for the entirety of the previous week.

At the time of press, BTC was approaching the Sept 3 highs of $11,940.

Bitcoin Breaks Out

Bitcoin had been struggling to move above the 0.786 Fib level of the previous decrease at $11,588 for roughly a week. On Oct 19, the price finally created a bullish engulfing candlestick and proceeded to reach a high of $11,840.

There is no bearish divergence in place nor is the MACD decreasing, so the upward movement is expected to continue. The closest resistance area is found at the Sept 3 highs of $12,067, while the closest support area is found at $11,200.

Short-Term Movement

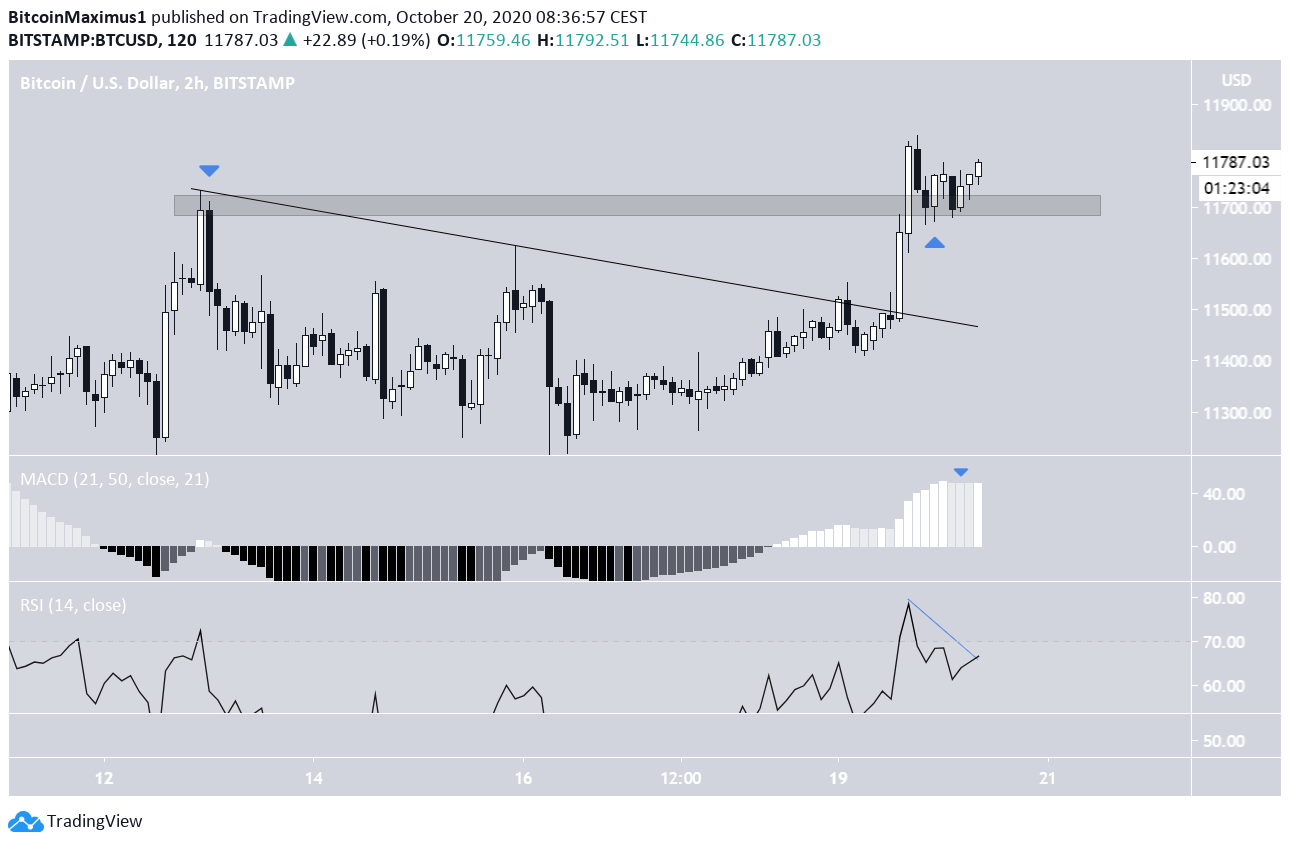

The Bitcoin price has also broken out from a descending resistance line which had been in place since Oct 12. Despite this, the 6-hour chart has begun to show the first signs of weakness in the form of a bearish divergence in both the RSI and the MACD, though the fragility is more pronounced in the latter.

The two-hour chart gives a very similar reading, though the bearish divergence is not confirmed.

Furthermore, there is a small resistance/support flip at $11,700. As long as the price is trading above this level, it is expected to continue moving upwards.

Wave Count

In BeInCrypto’s Bitcoin analysis from Oct 19, we stated that:

“It’s possible that the price has already completed wave 4, and has now begun wave 5, which is expected to end between $11,930-$12,030, a target found by using the Fib lengths of waves 1-3 and wave 1.”

The price has now indeed begun wave 5, which has the same target as before. BTC has possibly completed sub-waves 1-3, (shown in green below), but has yet to complete 4-5. It is not yet clear if wave 5 will be extended.

The longer-term wave count gives a similar target, since a 1:1 ratio for waves A:C (black) gives a top of $11,876.

Alternatively, the bullish count has a series of 1/2 waves, in which BTC is currently in the third.

While the future movement could be very different, a target near $11,900 is also given by this count. The price reaction at this level should be helpful in determining the trend.

To conclude, Bitcoin is expected to continue its upward movement at least until it reaches $11,900 and could possibly move higher depending on its reaction to resistance.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.