Bitcoin (BTC) was able to gain back some lost ground on Feb. 24 but has yet to break out above an important resistance level at $56,000.

Bitcoin is expected to eventually break out over this level again to confirm that the trend is bullish.

Bitcoin Holds on Above Support

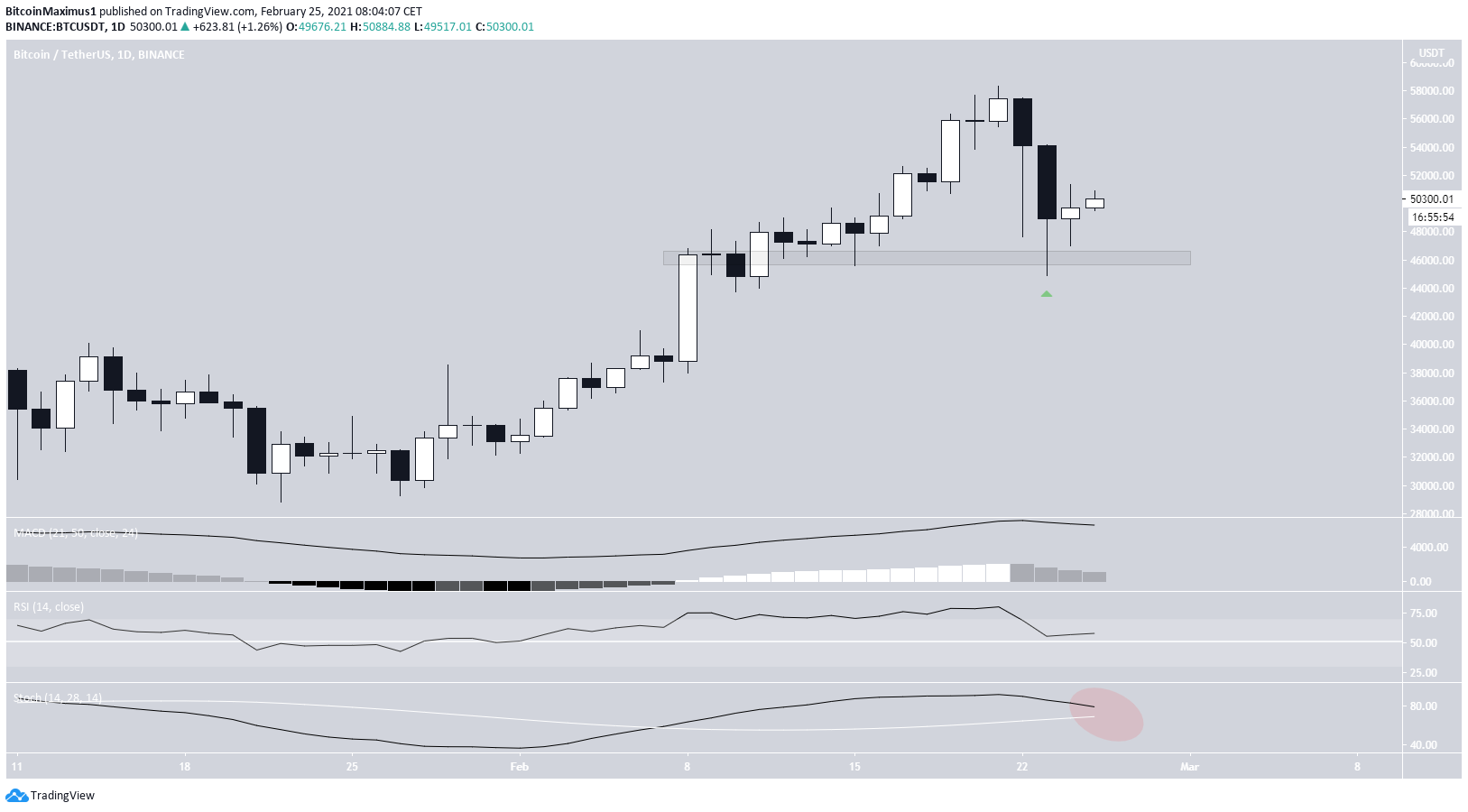

On Feb. 24, Bitcoin continued a modest recovery that started on Feb. 23 by creating a small bullish candlestick.

While BTC is still holding above the $46,100 support area, there are no definite bullish reversal signs.

On the contrary, technical indicators are showing a loss of momentum and are at a critical juncture.

The MACD histogram is close to turning negative, the RSI is just above 50, and the Stochastic oscillator is falling. The latter has nearly made a bearish cross in the process.

How these signals continue to develop will help in determining the direction of the trend.

A Bit of Relief

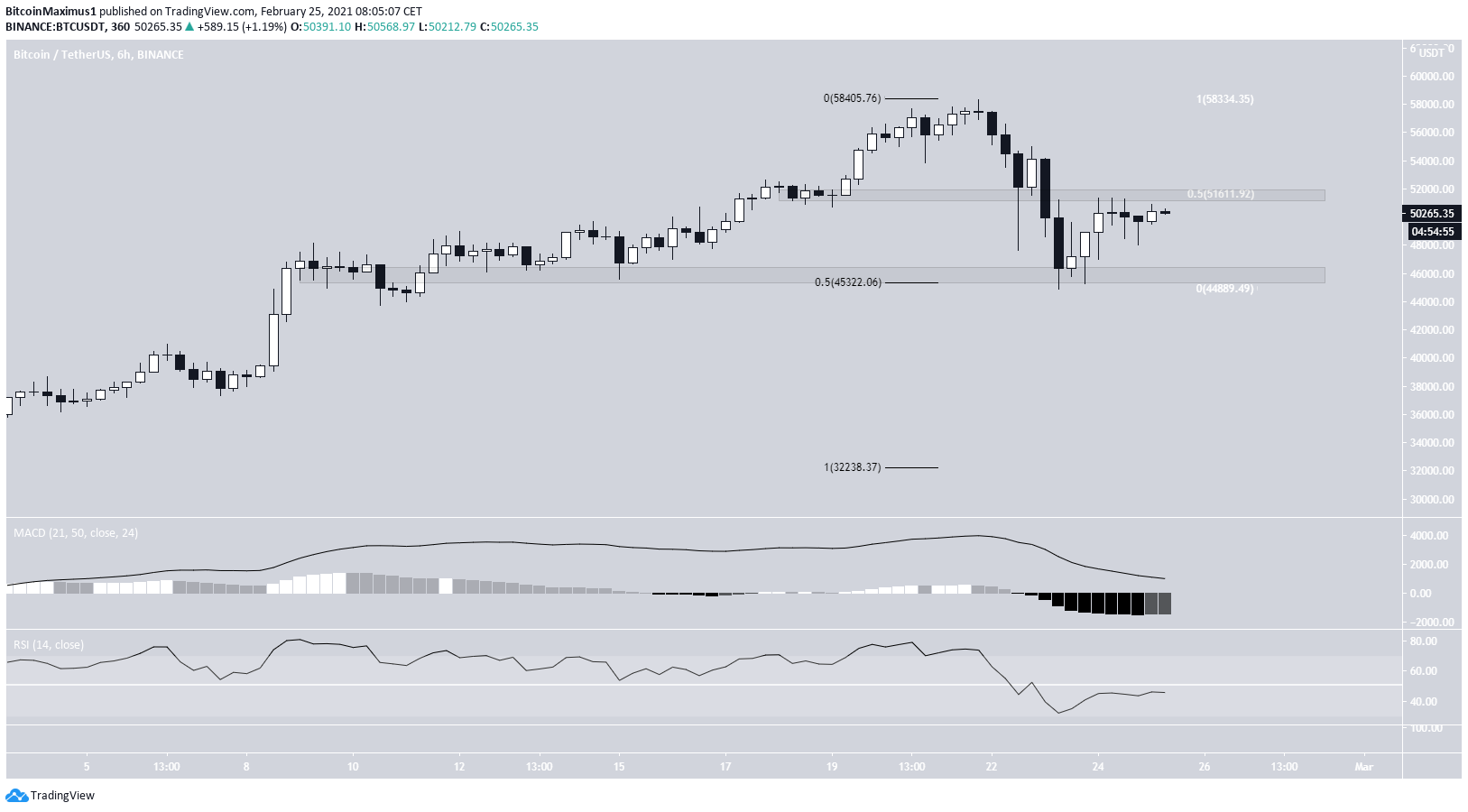

The six-hour chart shows that the bounce occurred right at the 0.5 Fib retracement level at $45,300.

Currently, BTC is trading in a range between the aforementioned support at $45,300 and the 0.5 Fib retracement of the previous decrease at $51,600 (shown in white).

Technical indicators are showing some bullish reversal signs, although they are not sufficient enough to confirm a breakout.

The two-hour chart shows that BTC has already broken out from a descending resistance line.

The MACD is nearly positive and the RSI is at the 50-line. A movement above the $56,000 resistance area would likely confirm that the trend is bullish.

BTC Wave Count

The wave count shows that BTC is in wave four of a bullish impulse that began on Jan. 30.

The Feb. 23 low was likely the end of the first portion of the correction, and BTC is now in the B sub-wave (black).

At the current time, we cannot determine where the bottom of the C wave will be. This is because the pattern could potentially be a regular, irregular or running flat correction. The possibility of a triangle also remains.

A decrease below the wave one high at $38,620 would invalidate this particular wave count.

Conclusion

While the short-term trend for Bitcoin seems bullish, a breakout above $56,000 would be required in order to confirm that the price is heading higher.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.