Since April 30, the Bitcoin price has been trading in a range between $10,050 and $8,500. The price movement inside this area is akin to the distribution phase of a Wyckoff distribution, meaning a breakdown from the range would be expected.

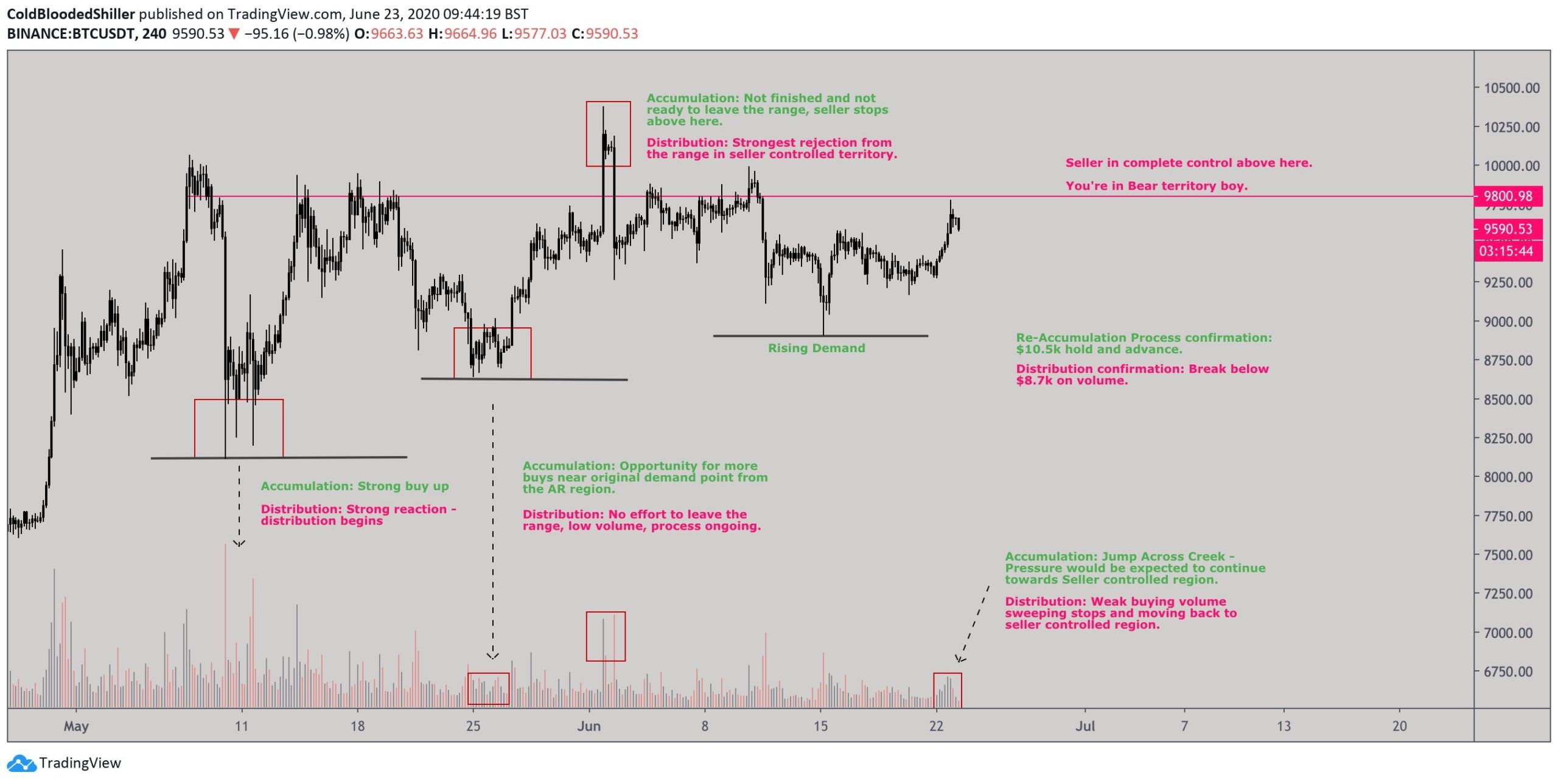

Well-known cryptocurrency trader @ColdBloodShill stated that Bitcoin is probably trading inside a Wyckoff distribution, but noted that distribution and re-accumulation phases are very hard to decipher, meaning a breakout or breakdown above/below the trading range would be required for confirmation,

Re-accumulation and Distribution ranges are the hardest to decipher between. Usually confirmation only comes at the end of the range. Clear seller control above $9.8k. Clear rising demand below.

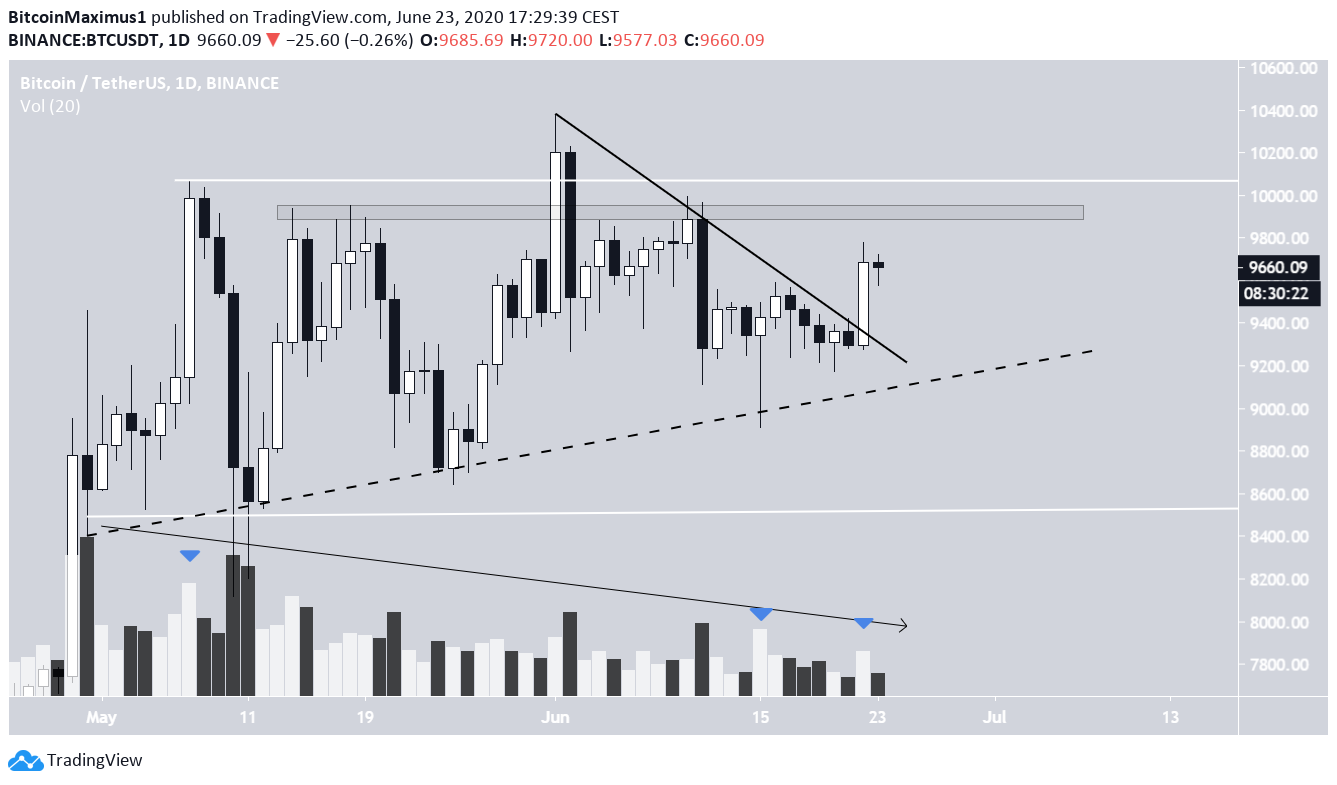

Bitcoin Trading Range

Since April 30, the Bitcoin price has been trading in a range between $8,500 and $10,050, with the exception of a high on June 1, after which the price decreased immediately. This is a bearish sign since the higher prices could not be sustained. The volume pattern is bearish since volume has been consistently decreasing, even though the price is clearly in an uptrend, making higher-lows as evidenced by the ascending support line (dashed) below. Furthermore, yesterday’s breakout occurred with average volume. For the bearish possibility to remain intact, BTC would have to be rejected either at $9,900, the closest resistance area, or $10,050, the range high. While it is possible that BTC makes another high above this range, called the ‘Upthrust after distribution,’ that is less common, and would not fit with the long-term movement, which we will discuss in the next section. A breakdown to $8,500 would confirm the bearish pattern, and could even take the price back below $7,000.

Long-Term Movement

The long-term chart reveals three more reasons why a breakdown from the range is more likely:- The long-term descending resistance line that has been in place since the all-time high of December 2017.

- The $10,300 resistance area that rejected the price in February 2020 and November 2019.

- The ascending support line that had been in place since March 13, from which the price broke down.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored