Bitcoin (BTC) has had a remarkable run over the past weekend, surging to its highest level since April 2022. As of Dec.r 4, Bitcoin sits around $41,500, up 5% in the last 24 hours. Analysts are split, however, on whether this move will lead to a further surge past $50k or a potential sell-off.

According to crypto influencer Crypto Caesar, who boasts 61,000 followers: “The longer Bitcoin continues to climb towards 50k without an ETF approval the more I think this could be a sell the news event. Not trolling.”

He seems to believe that much of Bitcoin’s current momentum is driven by speculation around a potential Bitcoin ETF approval between Jan. 5-10, 2024. If that approval doesn’t come or is already priced in, we could see prices fall back.

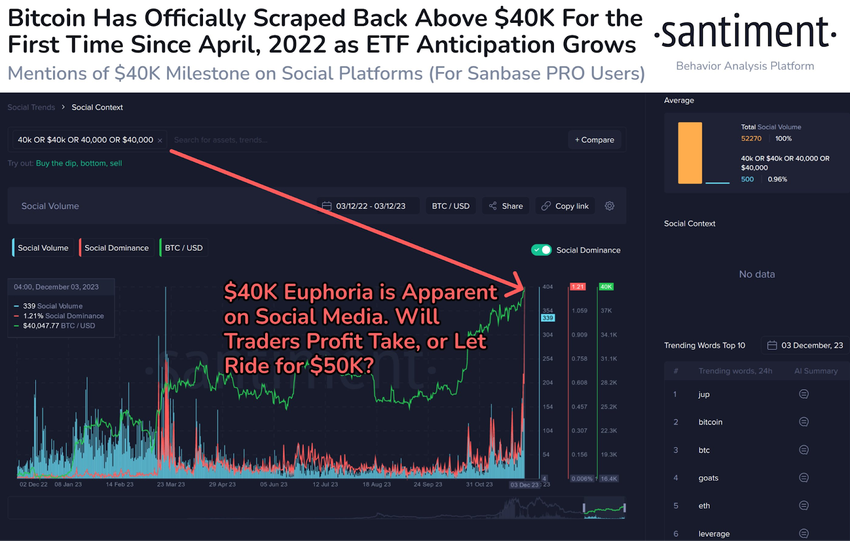

On the other hand, analytics provider Santiment sees room for further upside, noting: “Bitcoin has risen back above $40K for the first time since April 28, 2022, as the weekend is coming to a close in celebratory fashion. #FUD & #FOMO toward the ongoing #ETF confirmation dates will dictate whether $50K arrives sooner rather than later.”

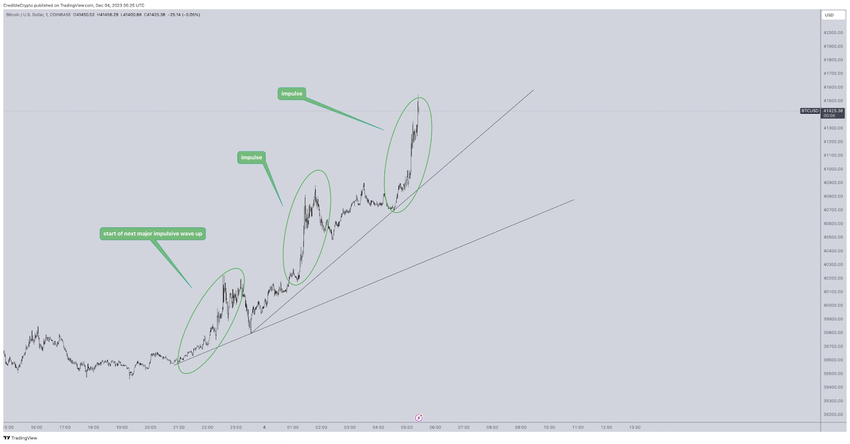

Influential analyst CrediBULL also sees Bitcoin’s recent price action as bullish, telling his 355k followers: “This is the part where the trend lines just keep getting steeper. As mentioned in my latest video update a few hours ago, that lower time frame choppy move up signaled the start of the next major move up, and we are now seeing repeated lower timeframe impulses to confirm. Hold on tight, this will escalate quickly.”

This means that in the recent past, Bitcoin’s price on shorter time frame charts (e.g. 1 hour, 4 hours) was moving higher, but in a choppy way without clear direction. According to this analyst, that recent choppy price action was actually a signal that a bigger, more significant price surge was about to start.

Essentially the calm before the storm. Following that choppy lead-in, the analyst is now seeing sharp, impulsive upward price moves on those shorter charts. This is confirming their view that a major surge is underway.

Finally, analyst Bluntz struck an optimistic tone as well, noting to his 200,000 followers: “We just had a very nice and healthy month long vertical accumulation on #BTC, these sideways corrections build steam for the next leg up which I believe will take us up to $46k+ minimum. Enjoy the Santa rally, ho ho ho.”

So while analysts disagree on exactly how much room Bitcoin has left to run before its next correction, the overall momentum remains decisively bullish. Bitcoin appears poised to test $50,000 if it can break past recent highs around $46,000. With excitement building ahead of the SEC’s potential Bitcoin ETF decision early next year, volatility also looks set to increase.

Bitcoin Minetrix Leverages Staking for Cloud Bitcoin Mining

Bitcoin Minetrix is an emerging project currently undergoing its presale ahead of its full launch. It has innovated a “stake-to-mine” concept that allows everyday crypto users to get involved in Bitcoin mining without expensive equipment. The project has already raised $4.7 million in its early funding rounds.

The core utility powering Bitcoin Minetrix is its BTCMTX token. The token price currently sits at $0.012 and increases by 10% after each presale stage, with the next price boost just three days away. Bitcoin Minetrix aims to provide a more decentralized, transparent alternative to existing cloud mining solutions which have exhibited questionable practices like long-term lockups and unreliable payout schedules.

At its core, Bitcoin Minetrix allows people to leverage cloud computing infrastructure to mine Bitcoin without setting up their own hardware. This improves accessibility dramatically, as specialty ASICs can cost thousands to purchase and configure. It also enables anyone to earn additional Bitcoin mining rewards by staking their BTCMTX tokens, giving the asset true utility.

By tackling issues around transparency and reliability in cloud mining, Bitcoin Minetrix has built significant trust with users. The ecosystem uses Ethereum-compatible wallets like MetaMask for simplified onboarding. Users can easily buy tokens, select staking options, and immediately begin collecting Bitcoin profits.

Additional advantages include low barriers to entry, a user-friendly interface, and heat/noise reduction compared to physical miners. The seamless experience allows users to stake tokens and watch their Bitcoin earnings stack up.

With crypto adoption continuing to accelerate, Bitcoin Minetrix offers an easy way for everyday investors to get exposure to Bitcoin price increases while mining their own coins. Leveraging staking and cloud computing, the platform makes Bitcoin mining simple. As the project gains traction ahead of its full-scale launch, BTCMTX presents an intriguing speculative and utility asset to watch.