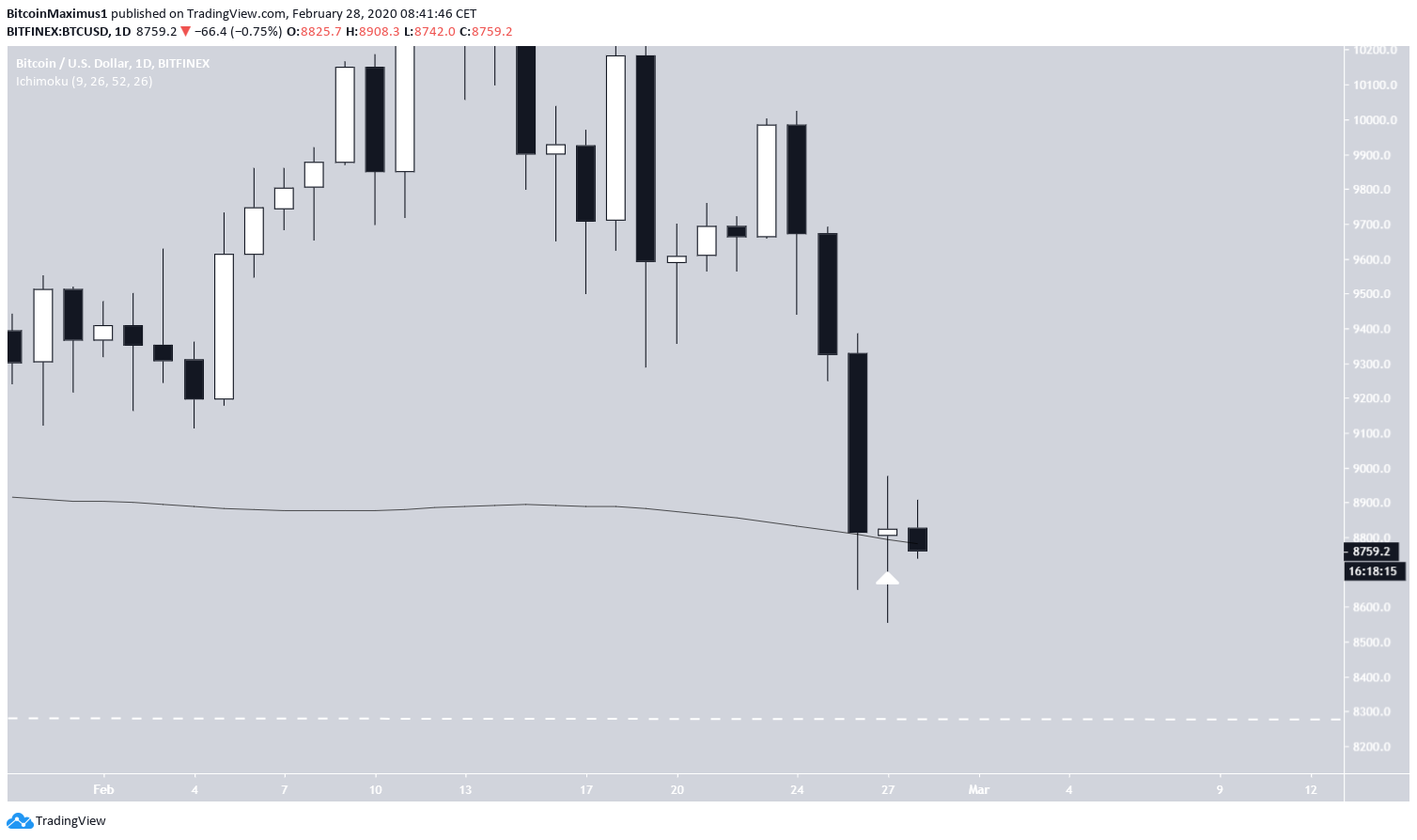

On Feb 27, the Bitcoin price bounced at the 200-day moving average (MA) and created a Doji candlestick.

Bitcoin (BTC) Price Highlights

- The Bitcoin price has created a Doji candlestick.

- It bounced at the 200-day MA.

- There is support at $8,700 and $8,350.

- There is resistance at $8,925 and $9,500.

- The short-term RSI has generated bullish divergence.

Price Struggles

The Bitcoin price decreased for three successive days on Feb 24-26, with the bulk of it occurring during the final day. On Feb 26, the price created a bearish engulfing candlestick, closing 5.5% below the opening price.

On Feb 27, the price moved considerably in both directions, from a low of $8,555 to a high of $8,975, but the closing price was very close to the opening price. This created a Doji candlestick, a sign of indecision in the market since neither the bulls nor the bears could push the price in either direction.

The price is holding on to the 200-day MA support, currently being right slightly above it. The next support area is found at $8,350.

Short-Term Movement

In the short-term, we can see a minor support area at $8,700. The price has approached this level several times and created long lower-wicks, which means that there is considerable buying pressure around this area and that the price might want to move upwards.

Furthermore, there is bullish divergence developing in the RSI, another sign that the price wants to move upwards. If it does so, the first resistance area is found at $8,925.

Relief Rally

If the price is successful in moving above $8,920, which looks likely, the main resistance area is found at $9,500, the 0.5 Fib level of the previous decrease. Minor resistance areas can also be found at $9,120 and $9,370.

To conclude, the BTC price decreased significantly on Feb 26 but bounced at the 200-day MA. The short-term movement suggests that the price will move upwards towards the resistance areas outlined above.

For those interested in BeInCrypto’s previous Bitcoin analysis, click here.

![Bitcoin Analysis for 2020-02-28 [Premium Analysis]](/_mfes/post/_next/image/?url=https%3A%2F%2Fassets.beincrypto.com%2Fimg%2F0Fzo-OdpVr3R9QGYlmwcfbEsGD4%3D%2Fsmart%2F9676ac43b35f488682dfa5d4455def46&w=1920&q=75)