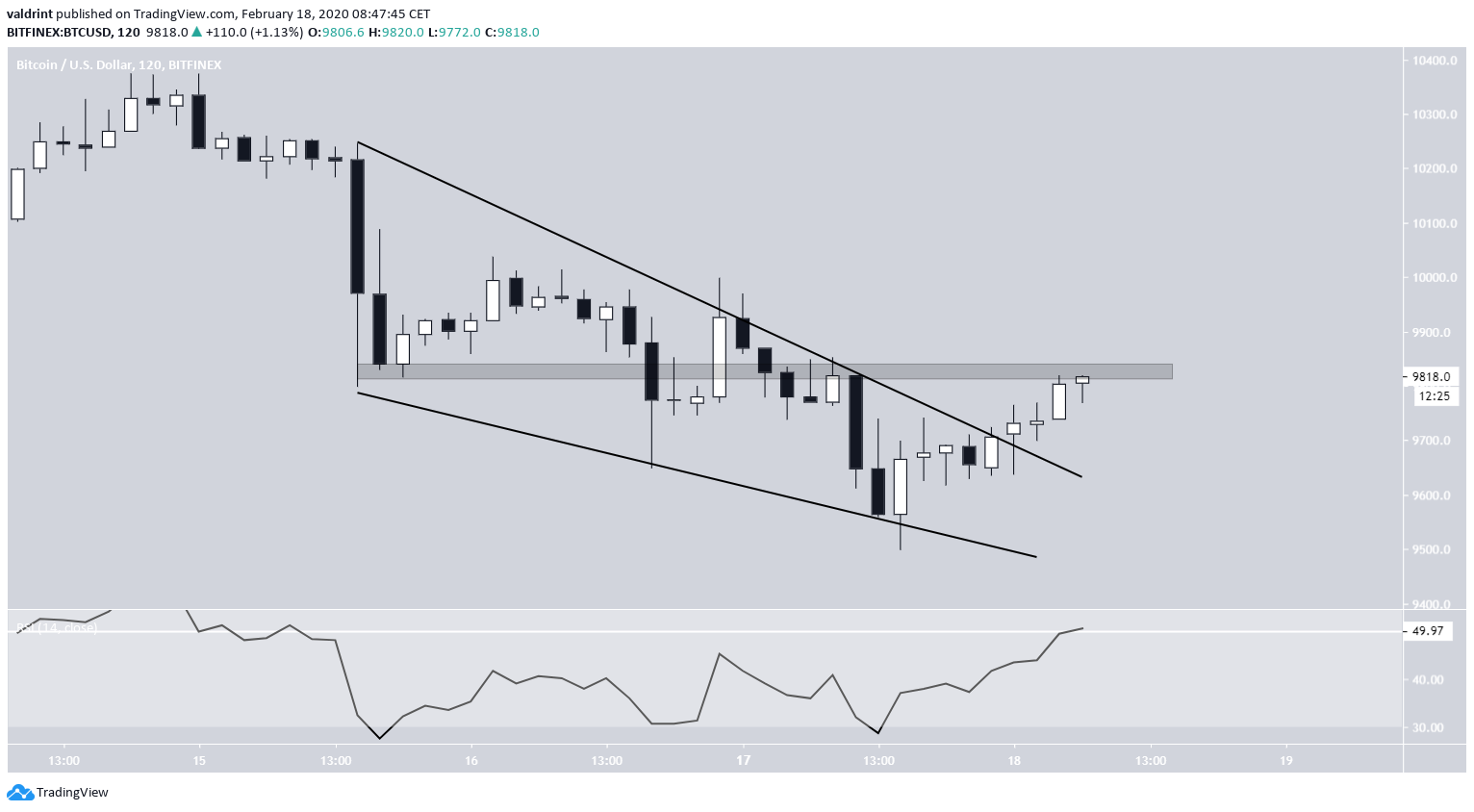

On February 18, the Bitcoin price broke out from a short-term descending wedge — marking an end to the decrease that began on February 15.

Bitcoin Price Highlights

- The Bitcoin price broke out from a short-term descending wedge.

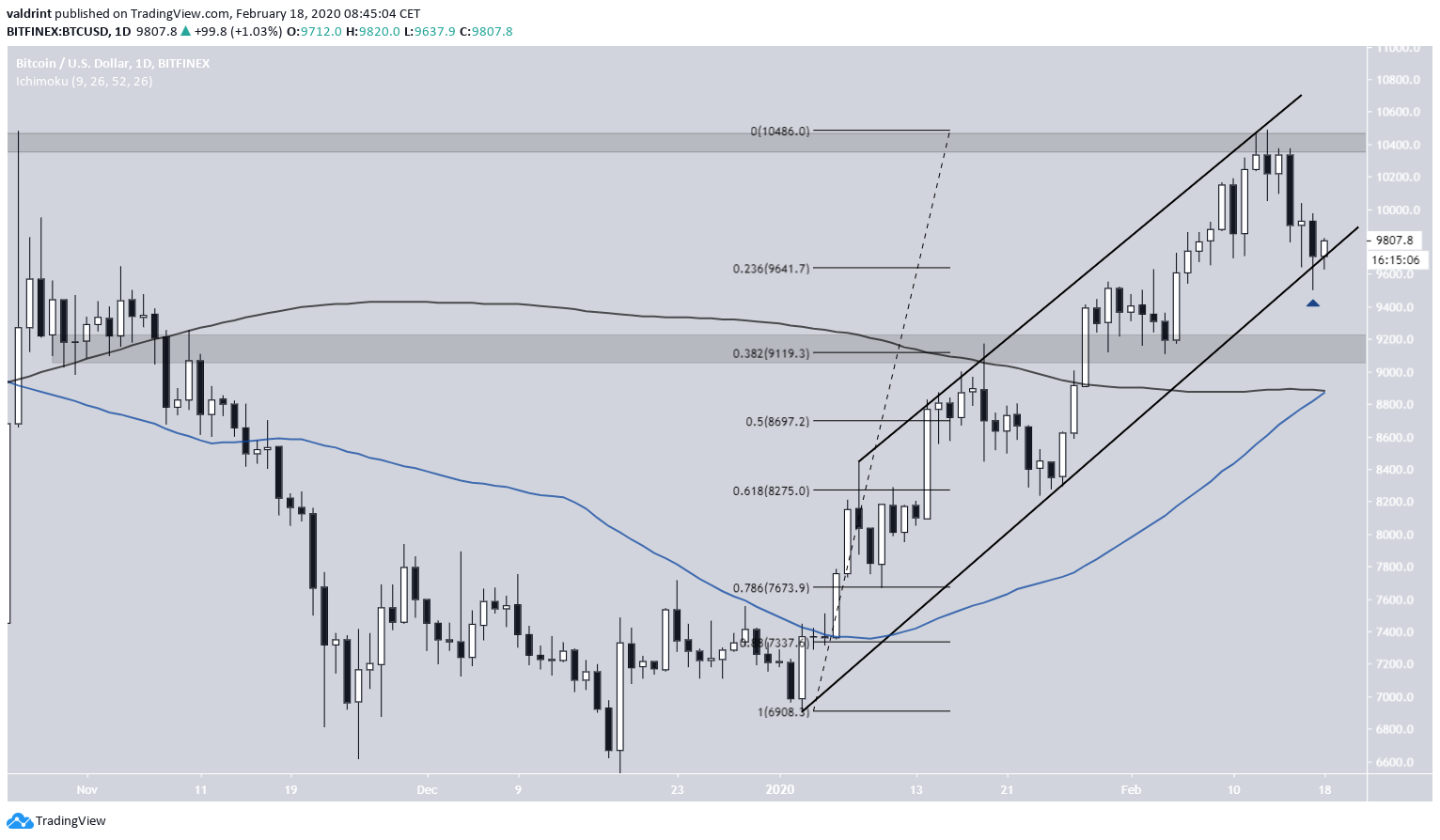

- It is trading inside an ascending channel.

- A golden cross is about to transpire.

- The price is likely in the fifth and final wave of an Elliott formation.

- There is minor support at $9,750 and major support between $9,000-$9,200.

- There is minor resistance at $9850 and major resistance at $10,400.

Wedge Breakout

Since the February 15 breakdown, the Bitcoin price traded inside a descending wedge. Today, the price broke out and has been increasing. It has currently reached the minor resistance area at $8500 and is making an attempt at breaking out. Until it does so, this increase is considered a retracement in response to the prior decrease rather than the beginning of a new upward movement. The RSI also mirrors this statement, since it is right at the 50-line. A price movement above this resistance area would cause the RSI to also move above this line.

Ascending Channel

In the longer-term, the BTC price is trading inside an ascending channel. The breakout caused the price to initiate a small bounce at the support line of this channel. On a bullish note, the 50- and 200-day moving averages (MAs) have just made a bullish cross. The main support area is found at $9000-$9200, the 0.382 Fib level of the entire decrease, and is also supported by the impending bullish cross of the aforementioned MAs.

Bitcoin Wave Count

The Bitcoin price movement has been following an Elliott wave formation since the low of $6477 on December 18, 2019. There are two possible patterns in play:- The first one (blue) indicating that the formation was completed on February 13, with a high of $10,491.

- The second one (green) suggests that this is still a part of the fifth wave that will head towards $11,000.

The 12-hour RSI suggests that the second path has a higher likelihood of being accurate.

In the period from January 8-19, the RSI generated bearish divergence while the Bitcoin price made a higher high right at the resistance line of the channel. What followed was a decrease towards the support line that briefly caused the RSI to drop below the 50-line. Afterward, the RSI bounced along with the price bounce at the ascending support line.

The price and the RSI acted in an exact manner from February 8-13, and the ensuing decrease caused the RSI to fall below the 50-line, where it has currently initiated a bounce. This would be confirmed with an RSI movement above 50 and invalidated with a price decrease below the ascending support line.

The 12-hour RSI suggests that the second path has a higher likelihood of being accurate.

In the period from January 8-19, the RSI generated bearish divergence while the Bitcoin price made a higher high right at the resistance line of the channel. What followed was a decrease towards the support line that briefly caused the RSI to drop below the 50-line. Afterward, the RSI bounced along with the price bounce at the ascending support line.

The price and the RSI acted in an exact manner from February 8-13, and the ensuing decrease caused the RSI to fall below the 50-line, where it has currently initiated a bounce. This would be confirmed with an RSI movement above 50 and invalidated with a price decrease below the ascending support line.

To conclude, the Bitcoin price is trading right at the support line of an ascending channel. We believe that the price will bounce and will make another attempt at breaking out above the current resistance. This movement is likely a part of the fifth and final wave of an Elliott formation.

For those interested in BeInCrypto’s previous Bitcoin analysis, click here.

To conclude, the Bitcoin price is trading right at the support line of an ascending channel. We believe that the price will bounce and will make another attempt at breaking out above the current resistance. This movement is likely a part of the fifth and final wave of an Elliott formation.

For those interested in BeInCrypto’s previous Bitcoin analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored

![Bitcoin Analysis for 2020-02-18 [Premium Analysis]](https://beincrypto.com/wp-content/uploads/2020/01/BIC_btc_long_term.jpg.optimal.jpg)