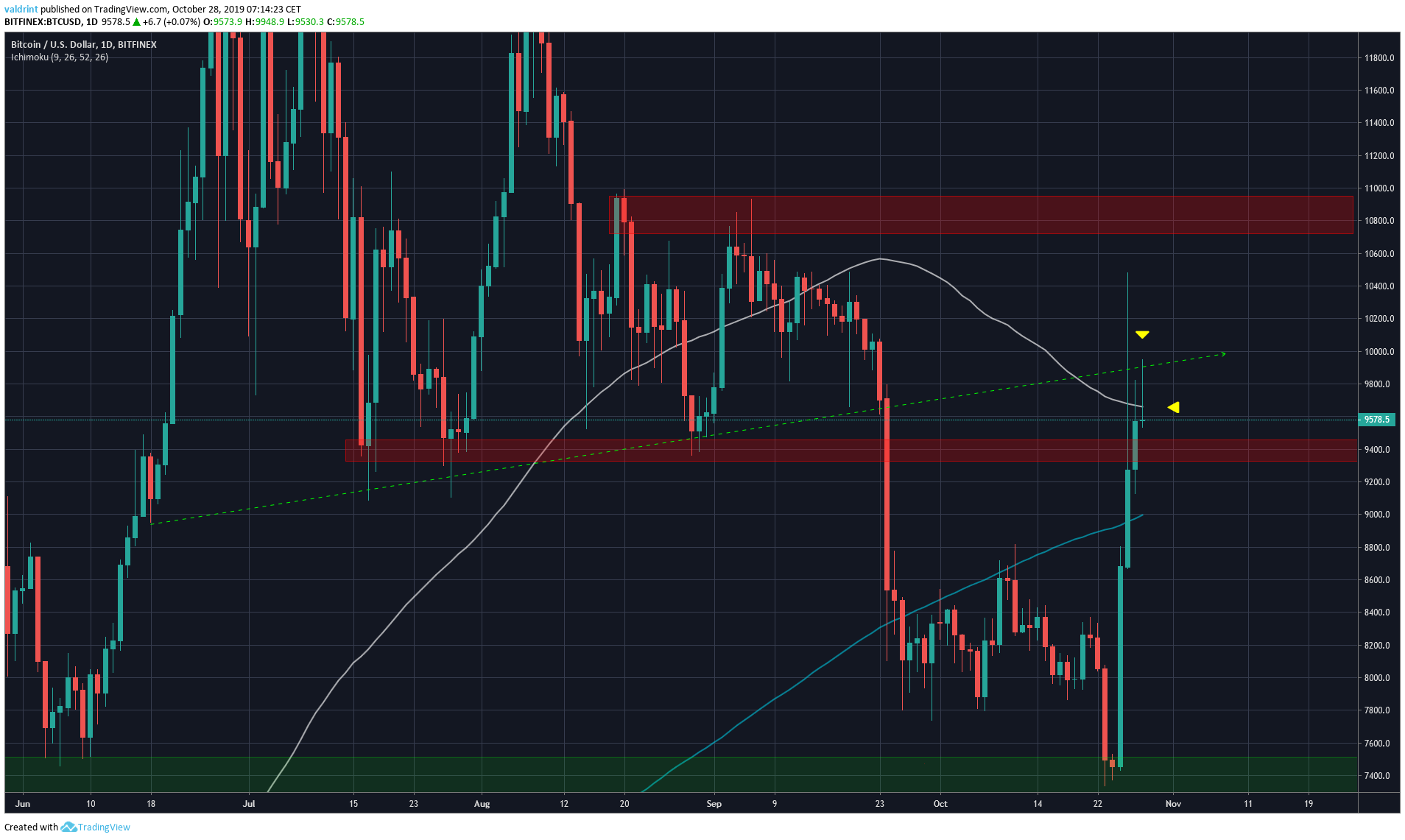

The Bitcoin price broke out from a descending wedge. The breakout was swift and done with significant volume. Currently, it is trading slightly above the previous breakdown level, right at the 100-day moving average (MA). In the short-term, it has created a bearish double top pattern.

Bitcoin Price Highlights

- The Bitcoin price broke out from a descending wedge.

- There is resistance at $9600 and $10,800.

- The 100-day MA is offering resistance.

- The price has made a short-term double top.

- There is bearish divergence in the RSI.

Previous Breakdown Level

The Bitcoin price began a very rapid upward move on October 25, once it reached the $7400 minor support area. Within 16 hours, the price reached a high of $10,480. However, it has been decreasing since. While it reached a close above the $9400 resistance area, it did so only incrementally and has created several long upper wicks. When looking at the moving averages (MAs), the bearish sentiment is evident.

The Bitcoin price has failed to reach a close above the 100-day MA for three days in a row now — creating very long upper wicks each time.

Additionally, the price was trading inside a symmetrical triangle throughout July/September. The current upward move has validated the support line of that triangle.

This is an extremely bearish development since it suggests that BTC will resume its downward movement and the increase was only a response to the prior breakdown.

When looking at the moving averages (MAs), the bearish sentiment is evident.

The Bitcoin price has failed to reach a close above the 100-day MA for three days in a row now — creating very long upper wicks each time.

Additionally, the price was trading inside a symmetrical triangle throughout July/September. The current upward move has validated the support line of that triangle.

This is an extremely bearish development since it suggests that BTC will resume its downward movement and the increase was only a response to the prior breakdown.

Short-Term

In the short-term, the Bitcoin price has just made a double top, which is a bearish pattern. Furthermore, it is combined with a bearish divergence in the RSI. The non-existent volume during the second top makes us believe that a decrease is in store. It would be customary for the price to decrease at least to the 0.5 Fibonacci level of the move — reaching $8700. Good luck and happy trading! For yesterday’s analysis click here.

Good luck and happy trading! For yesterday’s analysis click here.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored

![Bitcoin Analysis for 2019-10-28 [Premium]](https://beincrypto.com/wp-content/uploads/2019/09/bic_bitcoin_btc_drop_.jpg.optimal.jpg)