Bitcoin (BTC) has reached a new all-time high against both the Turkish Lira (TRY) and the Argentine Peso (ARS), sparking speculation about whether the US market will be next to see a record-breaking surge.

Given BTC’s latest rally, market watchers are increasingly optimistic that the coin will soon reclaim its dollar ATH as well.

Bitcoin Price Breaks Records in Turkey and Argentina as Inflation Accelerates

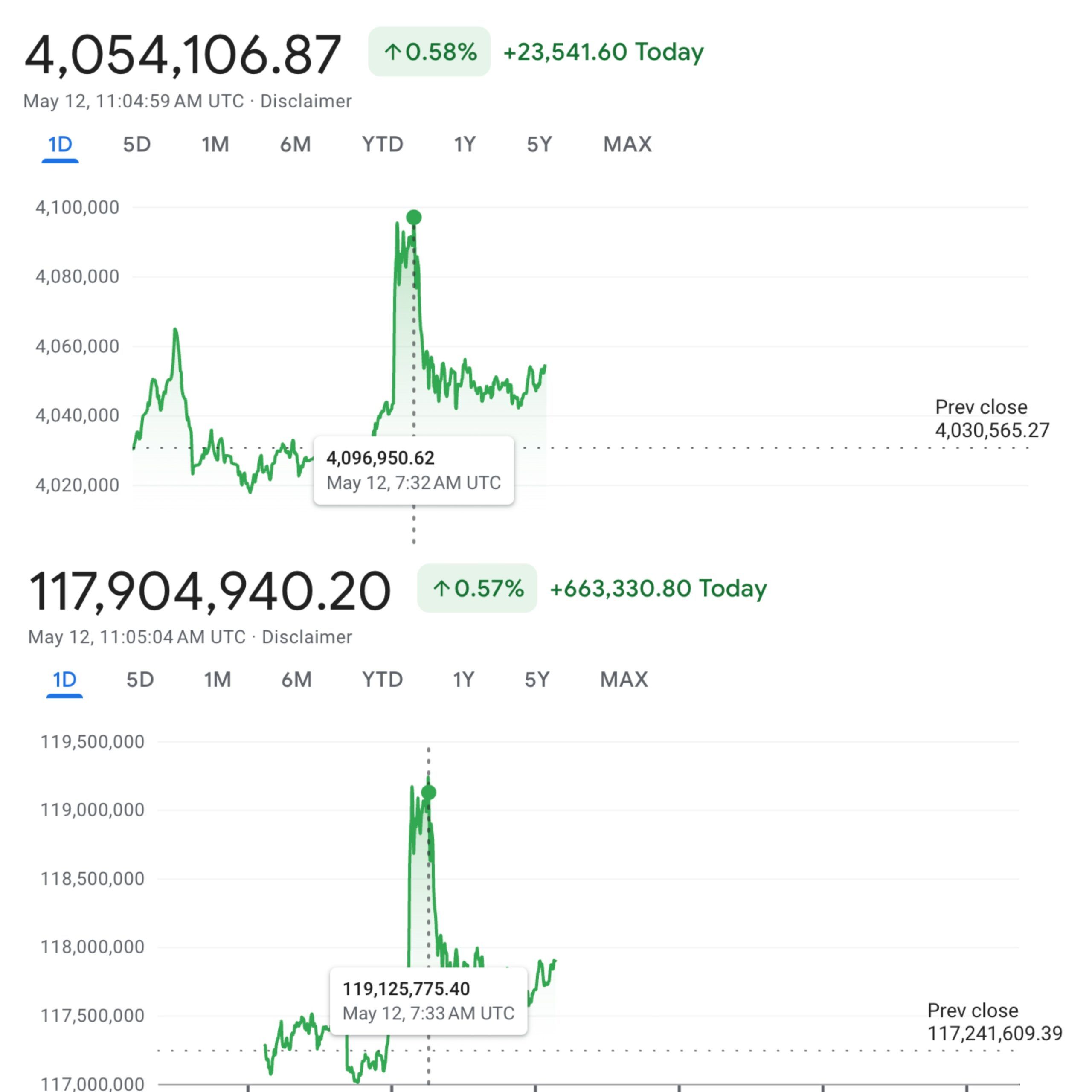

According to the latest data from Google Finance, the BTC/TRY pair peaked at a record high of 4.09 million TRY (approximately $105,000) in early Asian trading hours. Similarly, in Argentina, the BTC/ARS pair reached an all-time high of 119.1 million ARS (approximately $105,600).

Nonetheless, BTC’s varying “all-time highs” reveal more about these fiat currencies than they do about Bitcoin. This surge comes amid the ongoing devaluation of both TRY and ARS. Inflationary pressures have significantly impacted the currencies.

“Turkey seems to always lead. When fiat is dying faster that’s what happens,” an analyst wrote on X.

Data from Trading Economics indicates that Turkey’s inflation rate has remained a significant concern. As of April 2025, the annual inflation rate stood at 37.8%. For Argentina, the situation isn’t any different.

“The country’s inflation rate remains high, with projections indicating a potential 110% by the end of the quarter,” another analyst added.

When inflation is high, the purchasing power of the local currency declines. This, in turn, prompts people to seek assets that can preserve value, such as Bitcoin. This shift can drive up demand for Bitcoin, pushing its price higher in those specific markets.

This trend was also observed in the BTC/USD pair. The rising inflation concerns and the falling US Dollar Index (DXY) pulled the coin from its Liberation Day lows to over the $100,000 mark.

Moreover, after the US-China tariff deal, Bitcoin also reclaimed the $105,000 mark for the first time since January 31.

At the time of writing, BTC’s price adjusted to $104,277, just 4.0% below its ATH of $108,786.

Will Bitcoin Reclaim Its All-Time High? Analysts Predict Possible Surge

Analysts predict that the current rally can continue, eventually pushing BTC to or above its peak. In a recent X post, crypto analyst Edward Gofsky highlighted the correlation between the global M2 money supply and Bitcoin’s price movements.

He suggested that the recent increase in M2 could signal a rise in Bitcoin’s price, potentially pushing it to new all-time highs.

“Final measured technical target of the current move off the $69,000 backtest is between $140,000 and $150,000,” Gofsky predicted.

Another analyst, Lark Davis, pointed out that retail interest remains low despite BTC’s recent highs. This is evidenced by Google Trends data. Search interest in “Bitcoin” has been declining since November 2024.

“That’s how you know the pump is just getting started,” he stated.

Institutional interest is another catalyst that could fuel BTC’s rise. BeInCrypto reported that Metaplanet spent $126.7 million to increase its holdings by 1,241 BTC. Strategy’s CEO, Michael Saylor, has also hinted at more purchases.

“Michael Saylor about to buy billions worth of Bitcoin. New all-time high is coming!!” Ash Crypto remarked.

Last week, Standard Chartered also forecasted that institutional investments and ETF inflows could push BTC to $120,000 in Q2.

The long-term outlook appears even more bullish. Analyst Josh Mandell foresees BTC reaching $444,000 by Q2 2026. According to Thomas Young, Managing Partner at Rumjog Enterprises, this would mark “a monetary regime shift.”

“This isn’t just a bull run. $444,000 Bitcoin means: A broken trust cycle, the start of post-fiat finance, Bitcoin as global neutral collateral,” Young stated.

He cited several driving factors, including savers and investors abandoning fiat currencies, a potential bond market breakdown, a surge in institutional Bitcoin adoption, global South nations like Brazil adopting Bitcoin, and a retail mania fueled by renewed media attention.