The number of Bitcoin addresses holding a non-zero amount of BTC continues to increase, recently hitting yet another all-time high.

Bitcoiners don’t seem to be fazed by American regulators’ efforts to quash the crypto industry. The number of addresses with at least some BTC has continued to rise.

Bitcoin Addresses Signal Network Growth

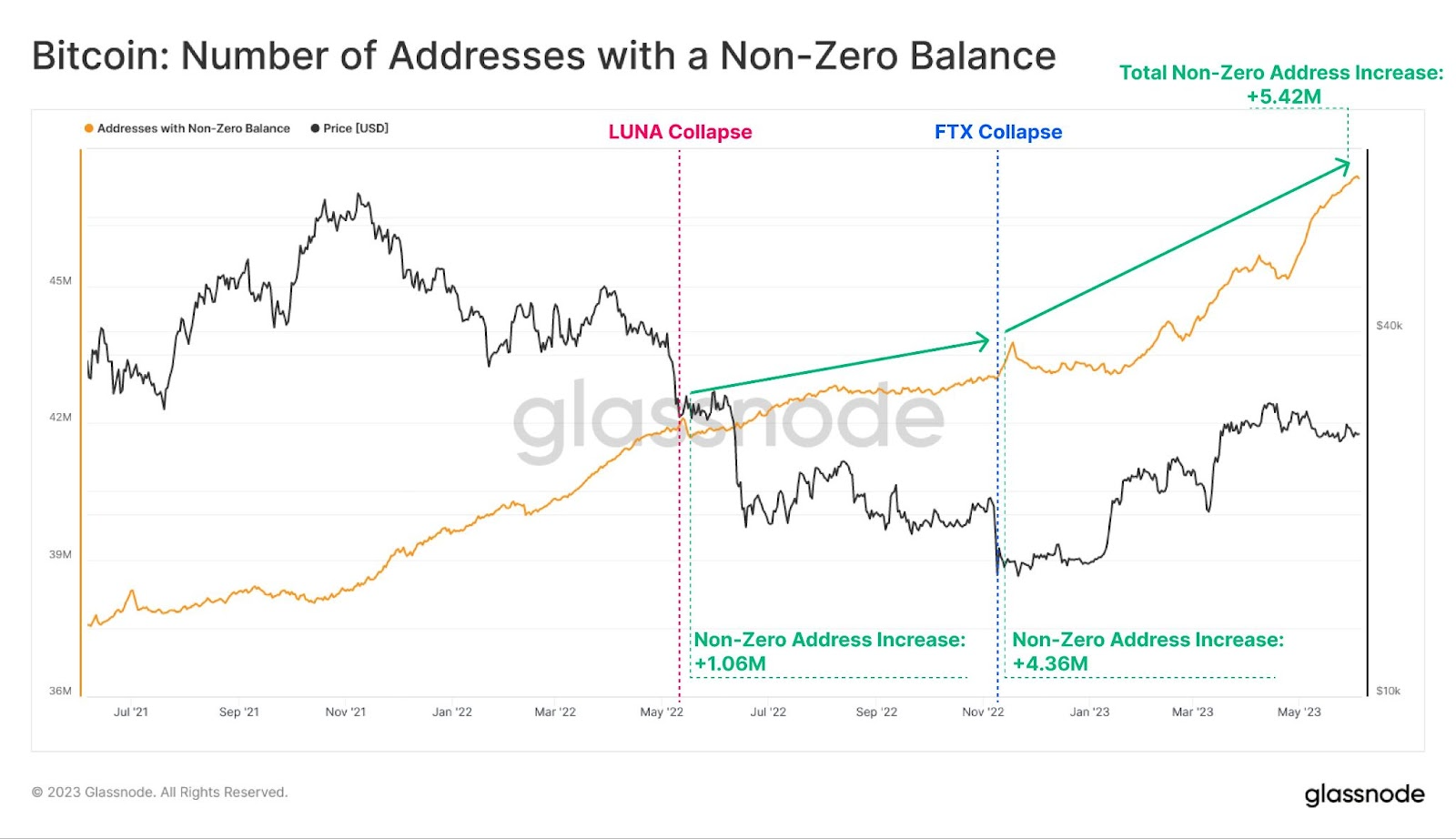

According to the on-chain analytics platform Glassnode, the total number of non-zero BTC addresses has increased by 5.42 million over the past year or so.

Glassnode has measured the growth since the two catastrophic collapses in 2022. More than a million addresses were added between the collapse of the Terra/Luna ecosystem and the fall of FTX.

Furthermore, an additional 4.36 million non-zero Bitcoin addresses have been added since FTX collapsed in November 2022.

The growth in addresses suggests that “network adoption remains resolute,” it stated.

However, the active addresses metric has remained relatively flat since the crypto market peak in November 2021. Lookintobitcoin currently reports that there are 923,025 active BTC addresses as of June 4. There was a notable dip on May 13, but things appear to have recovered.

Bitcoin addresses are certainly expanding, but is anyone spending their BTC? If you want to read the fascinating story of someone who bought two pizzas for 10,000 BTC, click here!

Furthermore, there has been a lot of FUD regarding Binance and the SEC. The regulator has largely gone after Binance.US as the global exchange is beyond its jurisdiction.

As a result, there has been very little BTC outflow from Binance since the enforcement action. On June 7, analyst and chart guru Willy Woo said:

“Binance customers don’t care. Not seeing much BTC leaving, not yet at least.”

On June 6, BeInCrypto reported that Binance reserves had declined by around 10,000 BTC. This equates to just 1.5% of its total and is insignificant when looking at the bigger picture.

BTC Price Bounces Back

Another signal that market participants have shaken off U.S. regulatory wrath is BTC price action today.

Remarkably, the asset is up 4.4% over the past 24 hours to trade at $26,908 at the time of writing.

This week’s twin SEC lawsuits against Binance and Coinbase resulted in a dip to $25,587 on June 6. This was still within the range-bound channel, and BTC has now recovered all of those losses.

BTC has proved to be remarkably resilient in the face of adversarial regulators that believe there is only one currency—the greenback.