After hitting its 2019 high at close to $9,000, Bitcoin (BTC) has been largely locked in a $600 range for the past week — fluctuating between $7,600 and $8,200. Similarly, such stale price action was observed between December 2018 and April 2019, right before the Bitcoin price began a drastic recovery.

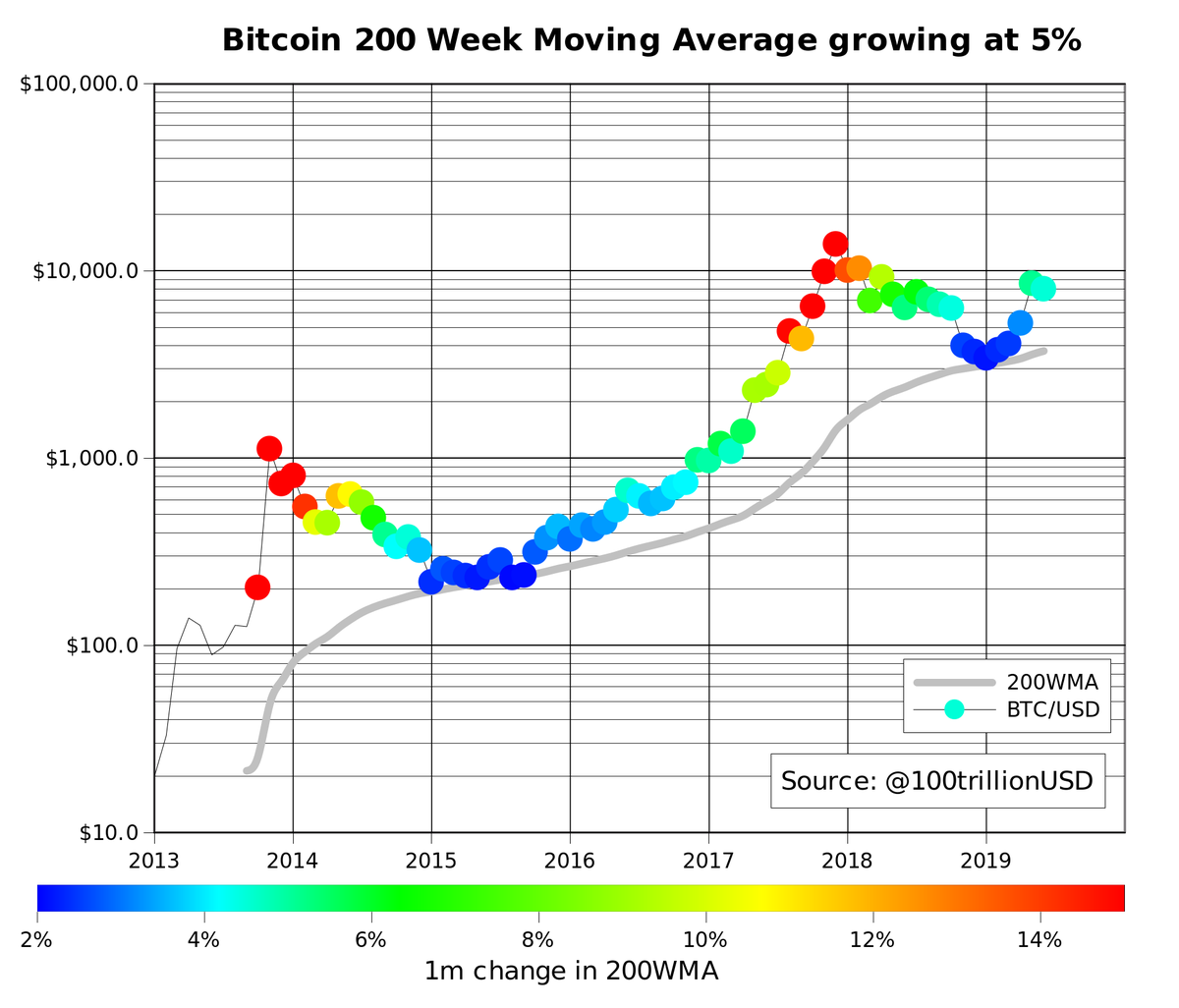

To break down the current price trend, a 200-week Simple Moving Average trend analysis can be plotted. This indicator filters out the short-term price fluctuations from the price action and gives a much clearer picture of the prevailing trend.

Although this is a lagging indicator and can’t predict any future swings, it can be very useful when it comes to comparing current price action to historical trends. With +2.1 percent being the lowest 200-week SMA for Bitcoin, it is currently back at a five percent per month growth rate.

This can be considered a stable trend, since this rate was also observed during late 2016 and early 2017 months — in the months leading up to the last bull run.

However, we should also observe the historical falling channels created in the immediate weeks after a bull run gassed out. At these points in time, the 200-week SMA also demonstrated a solid five percent monthly growth.

This can be considered a stable trend, since this rate was also observed during late 2016 and early 2017 months — in the months leading up to the last bull run.

However, we should also observe the historical falling channels created in the immediate weeks after a bull run gassed out. At these points in time, the 200-week SMA also demonstrated a solid five percent monthly growth.

Bitcoin’s Clock is Ticking

With the Bitcoin’s 2019 bullish trend apparently running out of steam just before it could decisively cross the $9,000 mark, and a range lock occurring with somewhat bearish trends, it has now become all the more critical for a price breakout soon. Otherwise, bearish trends may again start to form, potentially seeing BTC fall back to the next strong support zone.

Tether Candle?

In the past, Bitcoin’s price breakouts have controversially been linked to the minting of new Tether (USDT) — a stable coin intimately linked with Bitfinex. Recently, news of another batch of newly minted Tether amounting to $150 million has started making the rounds on social media, catching the attention of speculators everywhere. Previously, it was suggested that the Bitcoin’s price moves in 2019 are somehow linked to the minting of 300 million Tether back in April. Now, on the back of 150 million USDT minted just days ago, speculators are expecting a similar price breakout to occur — potentially seeing BTC top $10,000 in the coming weeks. How do you think the current Bitcoin 200-day SMA and newly-minted Tether will influence the price action for BTC? Let us know your thoughts in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored