The US labor market sent shockwaves through Wall Street, with Bitcoin (BTC) moving in response.

Data shows that the August jobs report delivered the weakest payroll gains since 2021, raising alarms about the health of the US economy while fueling fresh demand for alternative assets like crypto.

Bitcoin Gains as Investors React to Cracks in the US Employment Picture

The US Bureau of Labor Statistics (BLS) reported that the economy added only 22,000 jobs in August, far below forecasts of 75,000.

Meanwhile, the unemployment rate climbed to 4.3%, its highest since October 2021. This highlights cracks in a labor market that had previously appeared resilient.

Revisions to past reports deepened the gloom, with June and July figures revised down by a combined 285,000 jobs.

“That’s a total of -285,000 jobs in 2 months. What is happening here?” analysts posed.

Heather Long of The Washington Post highlighted the August print as another weak jobs report. However, while wages rose 3.7% year-on-year (YoY), outpacing inflation at 2.7%, the broader slowdown is undeniable.

The deterioration comes with striking detail. Bloomberg reported that American companies announced just 1,494 new jobs in August, the lowest for that month since 2009. Meanwhile, layoffs surged 39% to 85,979.

Even more concerning, for the first time since April 2021, the number of unemployed Americans surpassed available job openings.

July data showed 7.18 million job openings against 7.24 million unemployed people.

Weak Jobs Data Reinforces Bitcoin’s Role as a Macro Hedge

With easy job gains no longer on the table, analysts point to multiple causes. Among them is Trump’s tariffs dampening business confidence.

Others also point to the disruptive role of artificial intelligence (AI) in reshaping the employment market.

Notwithstanding, markets reacted quickly, with Bitcoin climbing toward $113,000, amid an attempted recovery rally. As of this writing, BTC was trading for $112,974, up by over 2% in the last 24 hours.

The surge comes as US labor market data grows as a crucial macro for Bitcoin. The pioneer crypto’s attractiveness as an alternative asset is gaining traction, presenting as a hedge against weakening macroeconomic fundamentals.

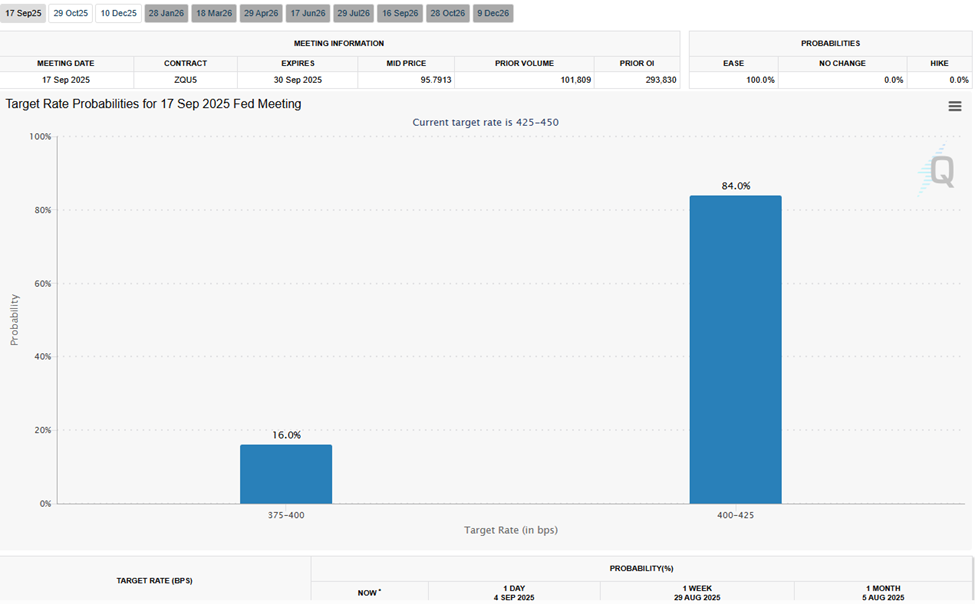

The divergence between jobs and inflation complicates the picture. Wage growth remains steady, but the slowdown in hiring suggests that the Fed faces a difficult balancing act ahead of its September policy meeting.

Rate expectations are shifting fast, yet the underlying theme is that economic momentum is faltering, and investors are searching for safety in places far beyond the jobs market.

Bank of America now projects the Fed to cut interest rates twice this year. This is a significant revision after it predicted no rate cuts in 2025.

With layoffs accelerating, job creation stalling, and unemployment rising, the August jobs report highlights a turning point for the US economy.

However, this is yet another opportunity for Bitcoin as a global barometer of fear, risk, and resilience.