Bitcoin (BTC), the largest cryptocurrency by market capitalization, has marked a significant milestone by processing its one billionth transaction. This achievement highlights the robust activity and growing adoption of Bitcoin despite the fluctuating market conditions.

The Bitcoin community, particularly on social media platforms like X (Twitter), has been abuzz with celebrations. The excitement highlights this milestone’s significance for investors and enthusiasts.

The Road Ahead: Bitcoin After 1 Billion Transactions

On-chain data confirmed this historic moment for Bitcoin. The dashboard from Clark Moody shows that the all-time transaction count on the Bitcoin network has reached 1,000,193,647. Additionally, data from Swan indicates that the 1 billion transaction milestone was achieved at the block height of 842,241.

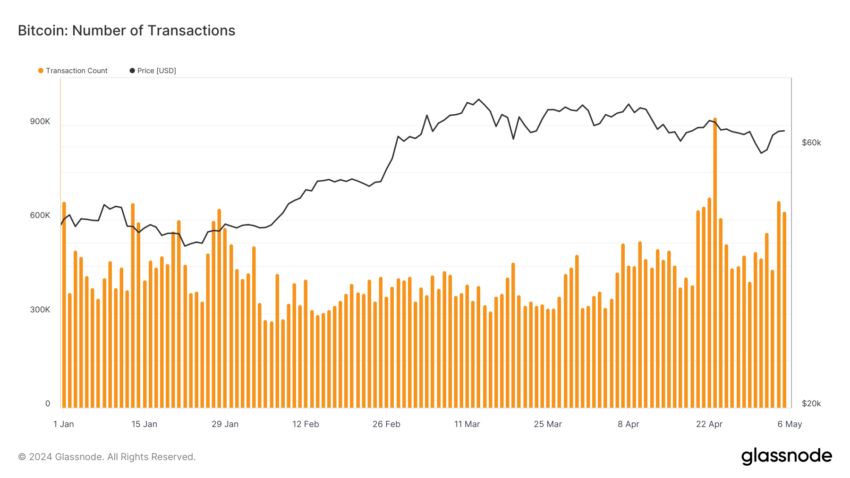

Glassnode’s recent data points to April 23 as the day with the highest number of Bitcoin transactions in 2024 so far. On that date, 926,842 transactions were recorded when Bitcoin was priced at $66,403. However, the transaction count from the previous day was 625,859, with Bitcoin’s price around $64,000.

Read more: A Basic Guide On How Bitcoin Transactions Work

Despite this milestone, Bitcoin’s scalability remains a topic of discussion. Crypto analyst Colin Talks Crypto shared his insights. He sees that the challenges and potential scaling issues still remain as Bitcoin continues to grow.

He predicts that Bitcoin’s price might see “euphoric blow off tops,” leading to massive congestion and a significant increase in transaction fees. Such scenarios could make it unaffordable for many to transact. As fees might exceed the balance in over 90% of Bitcoin addresses, making these balances are essentially unspendable.

“It could also mean weeks or even months of waiting for the backlog of transactions to clear from the mempool. This is when I think things have a chance of changing. […] Only when congestion and fees have gotten bad enough that most people are priced out of using the system, will there be enough outcry to finally increase the block size. In my opinion, it could take things getting worse than the 2015-2017 transaction backlog and high fees to cause the shift,” Colin added.

Colin’s perspective highlights a critical debate within the Bitcoin community between ‘big blockers’ and ‘small blockers.’ The big blockers advocate for increasing the block size to handle more transactions and reduce fees. Conversely, the latter resist such changes, focusing on maintaining decentralization and security.

Furthermore, Colin also critiques the effectiveness of the Lightning Network, a proposed solution for Bitcoin’s scalability issues. He suggests that it fails to address core issues at the base layer.

Experts Weigh In

Kadan Stadelmann, CTO at the open-source technology provider – Komodo, weighs in on the ongoing scalability debate. He emphasizes the importance of secondary layers in Bitcoin’s evolution.

“There is Bitcoin the protocol as well as Bitcoins the transaction medium and asset. It’s very plausible that the overall Bitcoin protocol, especially with a robust layer two, could power the global financial system. The Block Size Debate, in which various camps argued the virtues of increasing Bitcoin’s block size, has been resolved as the community moves towards building on layer two, of which the Lightning Network is best known, which is a sound approach, considering few, if any, technologies scale completely on layer one,” he told BeInCrypto.

Additionally, Nischal Shetty, co-founder & CEO of Shardeum, highlighted the broader implications of this milestone.

“This celebration of technology helps us further the Web3 ecosystem. While Bitcoin focuses on asset value and has limited transaction capacity. […] One billion transactions per day is a possibility when we will have scalable blockchains and consumer dapps. Let’s keep building to achieve scalability and low fees for the future of Web3,” Shetty explained to BeInCrypto.

Avinash Shekhar, CEO and co-founder of crypto trading platform – Pi42, also provided his perspective on Bitcoin’s current market dynamics.

“With over 15 million transactions in just the last month, Bitcoin’s momentum has received a notable boost from the halving day. The ongoing upward trend suggests a promising outlook for investors, however investors must not give into FOMO and use the dollar cost averaging strategy when it comes to investing in crypto. Bitcoin at the moment is undergoing robust transactional capabilities despite challenges from competitors like Ethereum thus it is crucial to carefully evaluate the overall market conditions, and their own risk appetite before making any decisions,” Shekhar said.

As Bitcoin navigates these challenges, the community remains divided on the best path forward. While some argue for significant protocol changes to enhance scalability, others believe the current infrastructure, including secondary layers like the Lightning Network, will evolve to meet demand. Expected to occur without compromising the foundational principles of Bitcoin, this evolution will maintain the core values of the system.

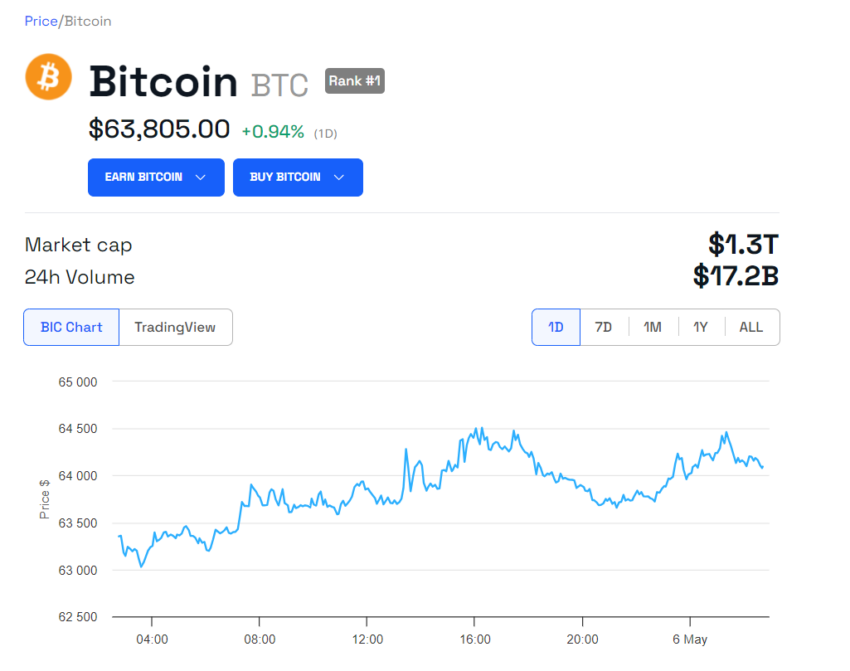

Amidst the new milestone, Bitcoin’s market performance continues to capture attention. At the time of writing, Bitcoin is trading at $63,805, marking a 0.94% increase over the last 24 hours. This recent uptick follows a climb from below the $60,000 threshold, catalyzed by a favorable US labor report the previous Friday.

Read more: Bitcoin Price Prediction 2024/2025/2030

However, a new report from Bitfinex suggests a possible period of price stabilization for Bitcoin, which could last up to two months. This forecasted stability might provide a respite for the market, allowing users and developers alike to focus on long-term solutions for scalability and usability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.