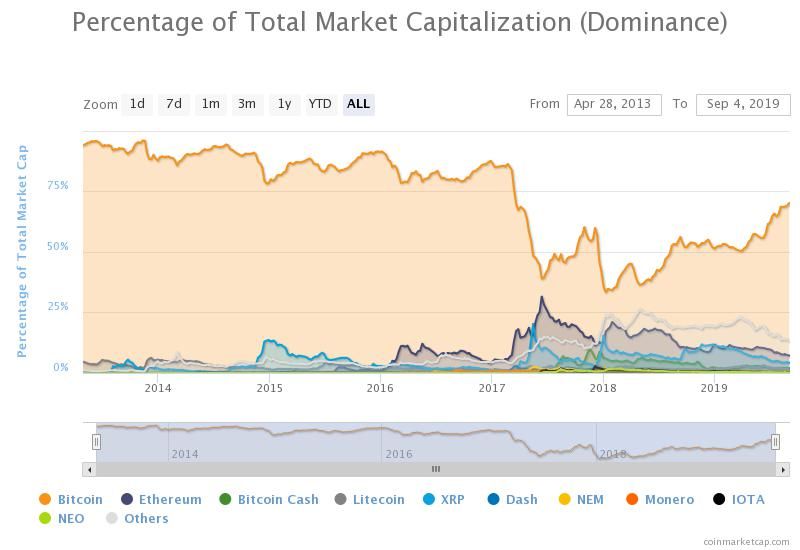

According to Binance Trading, so-called altcoins will rise again relative to Bitcoin. The major over-the-counter cryptocurrency trading desk still believes that Bitcoin’s market capitalization will eventually make up around 50 percent of the entire industry.

The research department at the leading digital currency exchange platform Binance has just released its monthly report for August.

In cooperation with @Binance Trading, here is our latest overview of August's #cryptocurrency markets through an institutional lens.

Amongst them, #Bitcoin dominance reached new highs, and altcoin volumes were near an all-time low. https://t.co/pNHAzYA7tJ

— Binance Research (@BinanceResearch) September 4, 2019

Binance Points Out More Volatility

In the document, Binance Research provides cryptocurrency market statistics for August. Although these metrics are available from other resources, the monthly publication of the Binance Research report highlights just what a rough time altcoins have been having of late. The figures detailing the change in market capitalization of the top ten crypto assets are particularly illuminating.

Since the last report, the price of Bitcoin has dropped just 2.9 percent. Meanwhile, every other asset in the top ten cryptocurrencies has fallen much more dramatically.

Ether, Binance Coin, EOS, Stellar Lumens, and Cardano all saw a market capitalization drop of more than 20 percent in comparison to last month. Litecoin, the worst top ten performer last month, fell by 33.42 percent. Finally, XRP, Monero, and Bitcoin Cash had falls of 19.67, 15.96, and 15.68 percent respectively.

Although much of the document simply recaps developments taking place this month at Binance – for example, new trading pairs and the addition of lending support – the section from the exchange’s over-the-counter trading desk is more interesting.

Return of the Altcoins

In the second section of the report, the Binance OTC trading department mostly speculated about the potential for a renewed “alt season.” The exchange writes:

“Our view is that Bitcoin does not necessarily need the support of altcoins to become digital storage of value, and can continue to succeed acting as a ‘digital gold.'”

Binance Trading continued by stating that the performance of each altcoin should be dependent on how active the project is and that “altcoins must be an integral part of the [cryptocurrency industry’s] maturation process.”

Trade cryptocurrencies at the world’s largest exchange by volume, Binance, and help out BeInCrypto in the process.

The OTC desk also reiterated a prediction it made in its last monthly report. The firm stated it still believes that Bitcoin dominance will return to around 50 to 60 percent. However, it does not guess as to when this will be. The trading desk only offers:

“Short-term wise though, BTC dominance may be sticking around.”

In closing, Binance Trading argues that Bitcoin dominance being at its current levels of close to 70 percent is an anomaly in recent history:

“It has only been in the past three months or so that BTC dominance has shot up so dramatically, and the crypto-world has found its way of making everyone feel like a prisoner of the moment.”

Of course, if you take the entire history of cryptocurrency, instead of a cherry-picked set of dates, Bitcoin dominance being below 70 percent is much more of a historical anomaly.

Interestingly, another analyst claimed similar to Binance today on Twitter.

Are you still hopeful of a renewed altcoin surge or do you think most projects are doomed to obscurity? Let us know below, and don’t forget to check out our guide on the best cryptocurrency exchanges for trading Bitcoins.

Images are courtesy of Shutterstock, CoinMarketCap, Twitter.