Binance has introduced a crypto tax calculator feature for easy tax filings. But, not every user can take advantage of the facility.

The crypto industry is gradually moving away from an unregulated territory to be identified as a well-defined regulated asset class. With regulations incoming, there will be certainty on rules related to taxes.

However, manually tracking trades and calculating profits and losses for tax filing is tedious for traders. Binance has launched a new feature – Binance Tax, to help traders calculate taxes precisely.

Binance Tax Limited to Canada and France.

Binance Tax will support reporting up to 100,000 transactions to calculate taxes. The users can report spot trades, crypto donations and blockchain fork rewards. But, the algorithm does not allow users to report some transactions type, such as Futures and Options trades.

Initially, the feature will only be available in Canada and France. The team replied that they were working hard to bring the facility to more regions when the community questioned when Binance Tax would be available in their country.

French regulatory bodies are pushing to make crypto licensing mandatory for service providers.

Exchanges Complying With Crypto Taxes

As taxation becomes better-defined, exchanges must comply with a particular country’s tax policies. Italy started imposing a 26% tax on crypto gains on profits greater than €2,000 in 2023. Several crypto exchanges such as Gemini, Nexo, Binance, Coinbase and Crypto.com have obtained operating licenses in Italy.

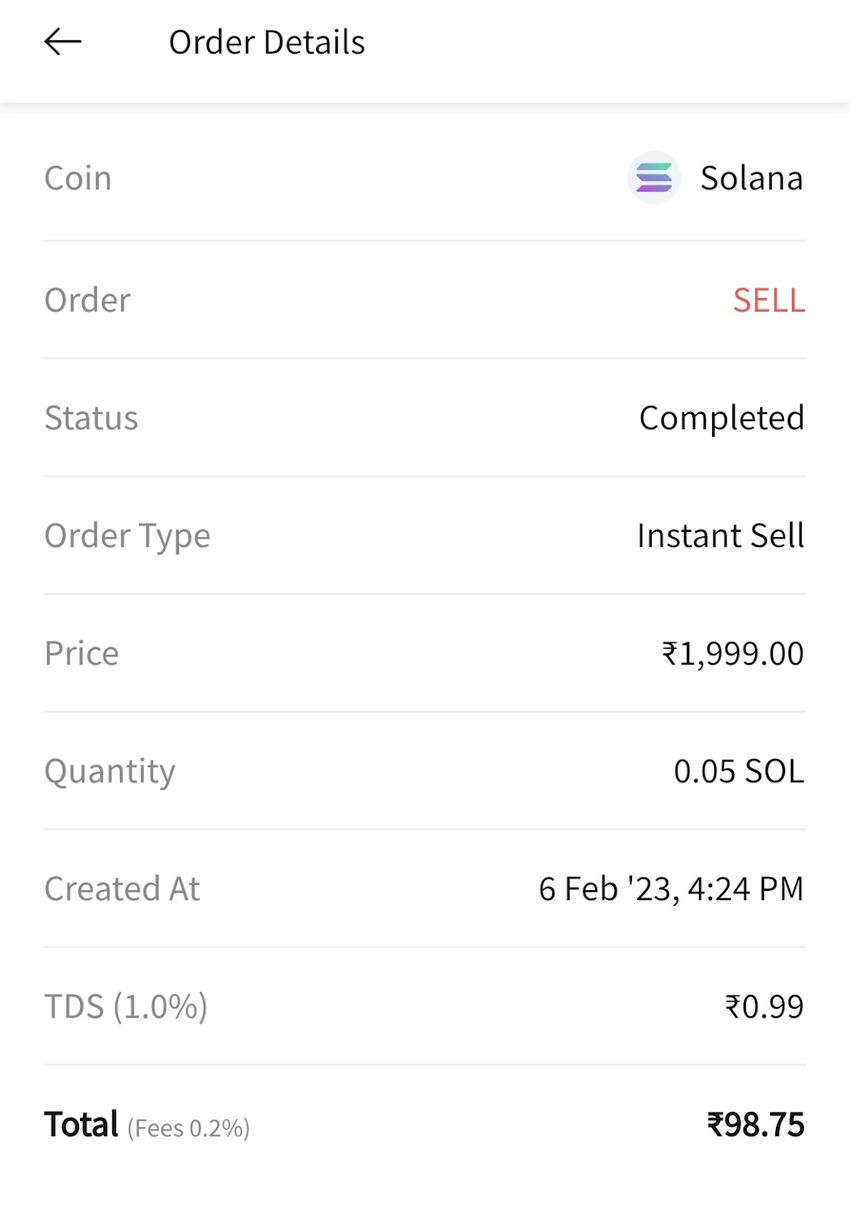

India has a flat 30% tax on crypto gains and a 1% Tax Deduction at Source (TDS). For every sell transaction, the Indian exchanges deduct 1% of the total amount and pay it to the Income Tax Department. For example, if a user sells crypto worth 100 INR, they would only get 98.75 INR after deducting TDS and exchange fees, as shown in the screenshot below.

According to recent announcements, citizens my face jail time of up to six months for failing to pay TDS.

Got something to say about Binance Tax or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here