The recent US Department of Justice (DoJ) crackdown on Binance and its former CEO, Changpeng Zhao (CZ), has tarnished crypto’s reputation as a tool for money laundering and sexual abuse. But will its alleged use in nefarious activities cause it to be dumped by investors, delaying the next bull run?

Last week, the DoJ announced an enforcement action against Binance’s ex-CEO, Changpeng Zhao, for allegedly allowing Binance to be used to channel money for sanctioned entities and child abusers. The former crypto boss has pleaded guilty and will pay a $50 million fine and face sentencing in February.

Binance Volume Decline Could Delay Crypto Bull Run

Part of the deal with the DoJ includes heightened monitoring of Binance’s operations over three years. A deal with the US Treasury Department demands monitoring for five years. According to the former head of internet enforcement at the US Securities and Exchange Commission (SEC), John Reed Stark, Binance’s alleged involvement in terrorist financing and child abuse is not trivial.

“These types of violations literally become a matter of life and death for people, they’re not just a matter of theft or grift.”

The fall of CZ saw $650 million in outflows from Binance, while the exchange’s BNB token plummeted by 15%. Yesha Yadav, a professor at Vanderbilt University, said that “Binance 2.0” may not attract the same volumes it once did.

Read more: 7 Best Binance Alternatives in 2023

Its dominant position in crypto markets could cause a downturn in trading activity in the coming months. The charges also raise moral questions about crypto’s utility that may delay any anticipated market turnaround.

SEC Overreach May Discourage Crypto Investors

Investors hoped the so-called crypto winter caused by high-profile enforcement actions would soon give way to the next bull market. Bitcoin has risen to more than double its value at the beginning of the year. Applications by big investment firms to launch crypto spot ETFs have made investors optimistic.

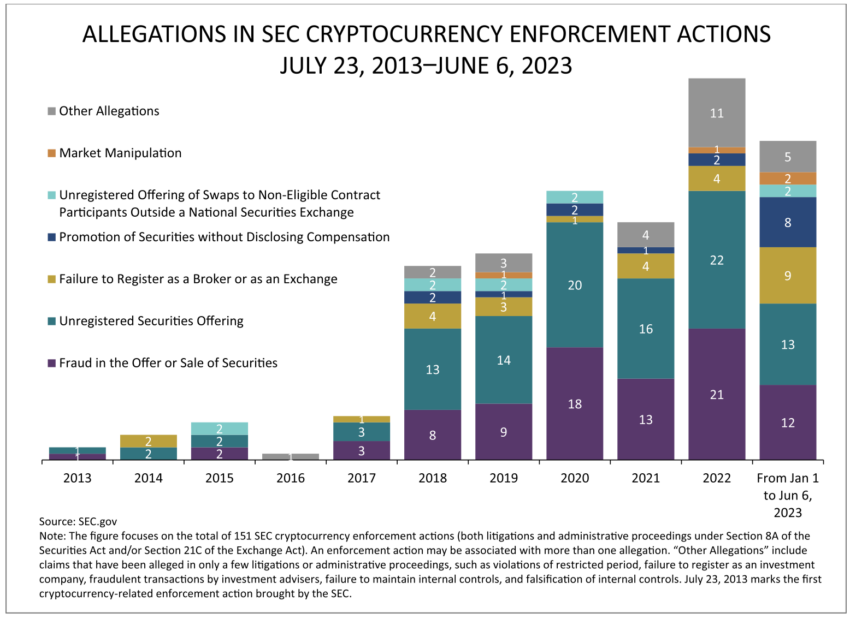

But the conviction of former FTX CEO Sam Bankman-Fried, the DoJ’s crackdowns on Terra Luna co-founder Do Kwon, former Celsius CEO Alex Mashinsky, and the Singapore arrest of Three Arrows Capital executive Su Zhu have seen crypto’s reputation take a beating in the last 18 months. In addition, several other crypto executives face civil charges.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

The SEC has sued TRON’s Justin Sun for offering unregistered securities, while the US Commodity Futures Trading Commission and the US Federal Trade Commission have targeted Voyager Digital CEO Stephen Ehrlich. Barry Silbert, of the Digital Currency Group, was accused by the New York Attorney General of knowingly defrauding investors and hiding over $1 billion in losses.

All of these charges will intensify scrutiny and increase the compliance burden for exchanges serving US customers. Exchanges may pass on costs to customers, who could opt for traditional investment routes with a lower legal risk. Successful enforcement actions could end up regulating crypto out of existence.

Do you have something to say about the effect of the Binance crackdown on the next crypto bull run, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.