Binance has converted the remainder of its $1 billion in industry recovery funds to other assets. The converted assets include Bitcoin, Binance Coin, and Ethereum.

Binance CEO Changpeng Zhao has announced that Binance will convert the remainder of its $1 billion Industry Recovery Initiative funds from BUSD to native cryptocurrencies, including Bitcoin, Binance Coin, and Ethereum.

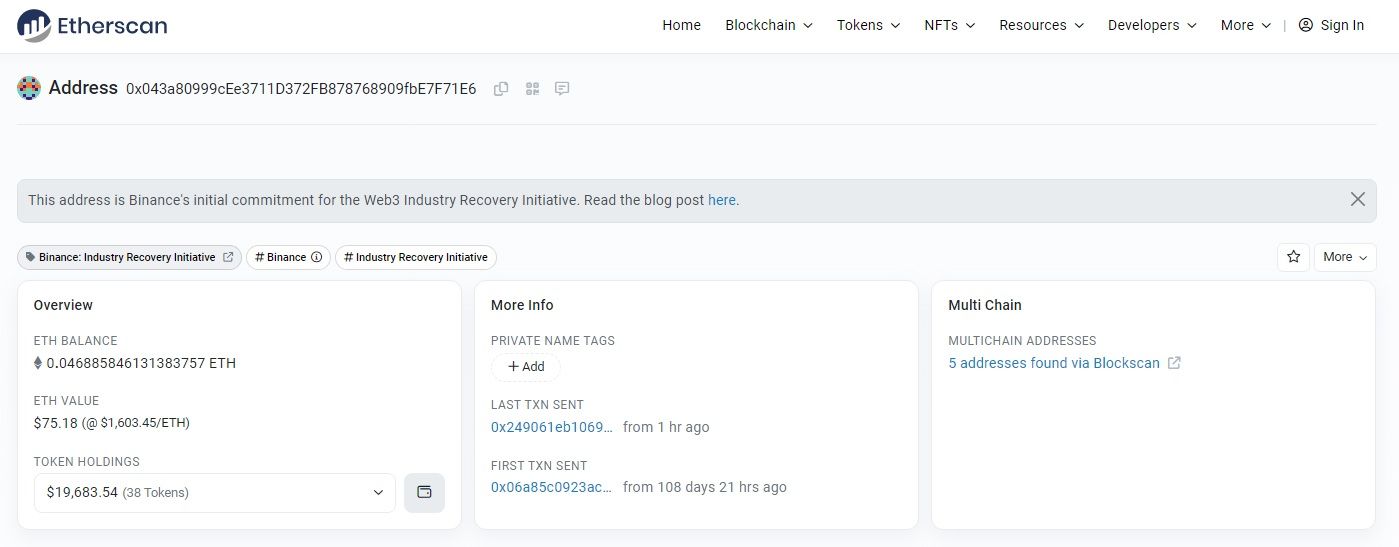

SponsoredHe also tweeted the address to ensure some transparency:

The reasoning offered by Zhao was the heavy changes that the stablecoin market and banks have faced in recent weeks. He later responded to other tweets that it was a way to keep the funds in a safe asset.

Most of the crypto community supported the move, though some questioned why more assets weren’t considered. However, there’s no conclusive evidence that the market will hold its current value after tumbling upon news of the Silvergate closure and broader market turmoil.

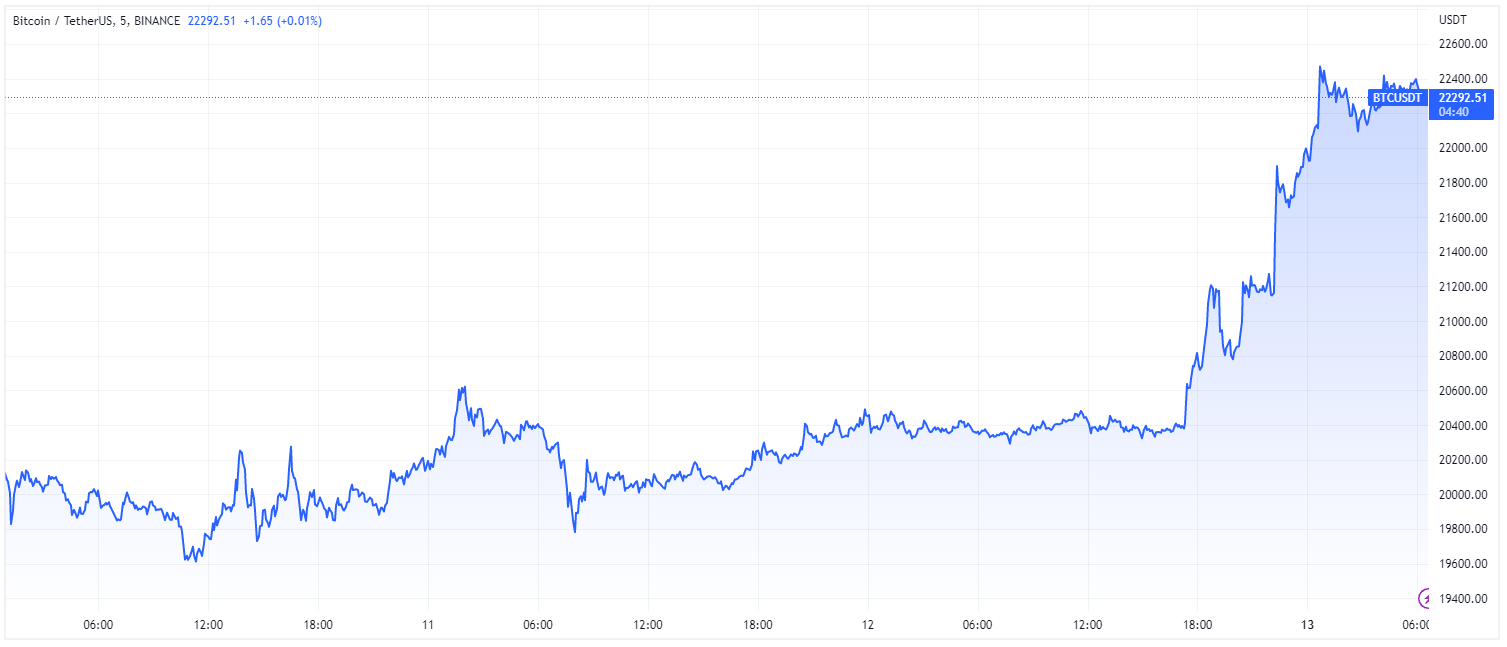

Since those developments, the market has managed to move back upwards, with the past 24 hours seeing bitcoin rise by over 9%. Still, it’s uncertain times for the crypto market, with no signs as to whether it can break resistance levels, though it does seem to hold well above $20,000.

SponsoredBinance Has Total Assets of Over $70 Billion

Binance has been doing well amidst all of this turmoil. The exchange has over $74 billion in total assets, with most of the assets on Ethereum and BSC.

The asset the exchange holds the most is BNB, which accounts for 29.55% of all its assets. This is followed by USDT and BTC, at 21.51% and 15.21%. It also added 11 tokens to its proof-of-reserves (PoR) system, including Dogecoin (DOGE), Curve DAO token (CRV), and 1inch (1INCH).

Bank Runs a Possibility As Firms Go Down

Zhao has chimed in on recent events over Twitter. He reassured investors and market enthusiasts by saying that Binance had no exposure to Silicon Valley Bank. Crypto-focused banks, like Silvergate and Signature Bank, have also gone down, adding anxiety to the market.

There are concerns about bank runs taking place; crypto enthusiasts suggest moving funds onto centralized exchanges. Of course, this comes with its own issues. Zhao has even suggested that Binance may buy a bank.