BNB saw its price move below $300 for the first time since March 13, 2023. The native coin of the largest crypto exchange in the world, Binance, has seen its price decline by nearly 4% in June alone.

While BNB is still up 22% for the year, the fourth-largest cryptocurrency by market capitalization has finally broken through its $300 price support. The critical support area had been tapped several times before. Proving to be a strong zone of support.

However, current market conditions have seen the price decline 14% since reaching its yearly high of $350 on April 16, 2023.

Additionally, the Securities and Exchange Commission (SEC) also announced it was suing Binance Exchange and Binance CEO Changpeng Zhao. The SEC alleges that Zhao shuffled “billions of dollars” of Binance user’s funds, covertly transferring these funds to a company that was controlled by Zhao, himself.

In light of the recent news, BNB had dropped to $284, a nearly 6% decline at the time of writing.

BNB Long-Term Investors are Offloading their Bags

On Monday, June 5, BNB price dropped 3% after the ecosystem was rocked by a week-long sell-off frenzy among long-term investors.

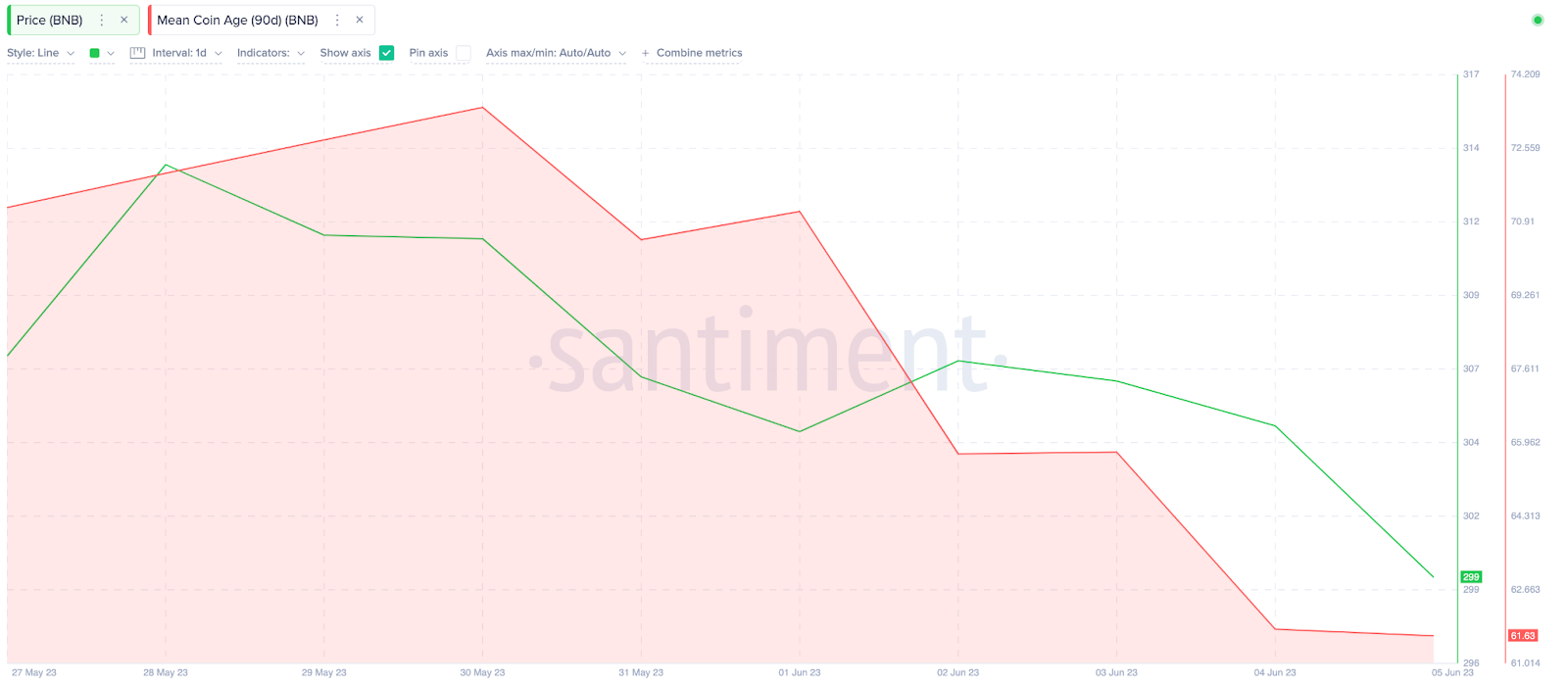

The Santiment chart below shows that long-term holders on the BNB chain began to offload their coins around May 30. Specifically, in the seven trading days between May 30 and June 5, BNB Mean Coin Age dropped 16% from 73.5 to 63.6.

In simple terms, Mean Coin Age tracks long-term holders’ trading activity by evaluating how long coins in circulation have stayed in their current wallet addresses.

When Mean Coin Age drops drastically within a short period, as seen above, it signals that most long-term holders are moving their coins.

If the trend continues, they could flood the market and inadvertently trigger more BNB price downswings in the coming days.

BNB Been Has Started to Lose Market Share

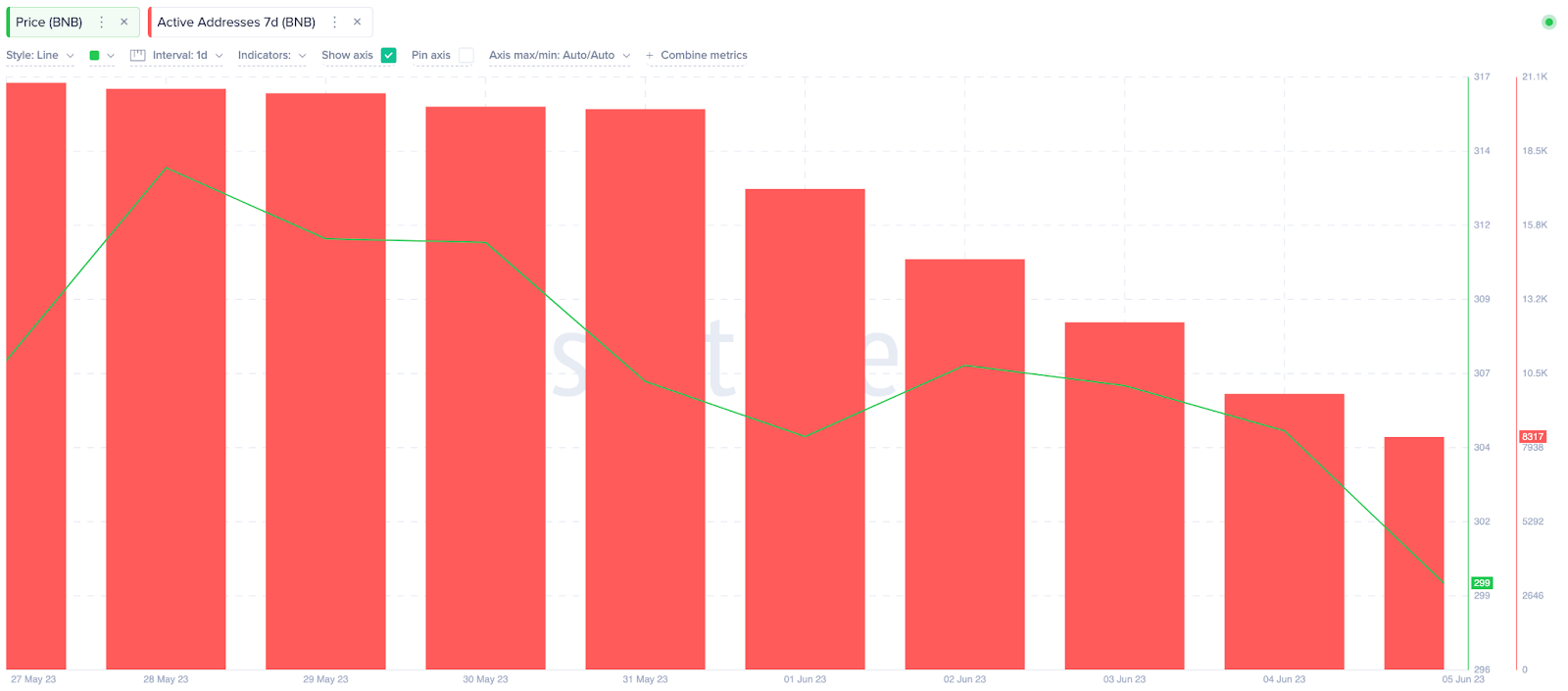

Furthermore, on-chain data reveals that network activity on the BNB chain also began declining on May 30 —around the same time that the long-term holders started selling.

Between May 29 and June 5, BNB Daily Active Addresses (7d) have already declined 250% from 20,591 to 8,317.

The Active Addresses (7D) metric sums up the number of unique wallet addresses interacting on the BNB chain network over a seven-day period. The persistent drop, as seen above, signifies disinterest among the network’s core users.

Unless the trend is reversed quickly, BNB could continue to lose market share to competing networks and ultimately trigger a further price downswing.

In conclusion, if long-term investors continue to sell and network participants continue on this trajectory, BNB could drop much lower than $300.

BNB Price Prediction: Bears Could Push For $280

In line with the prevailing on-chain signals outlined above, the bears might force a BNB price pullback toward $280 in the coming days.

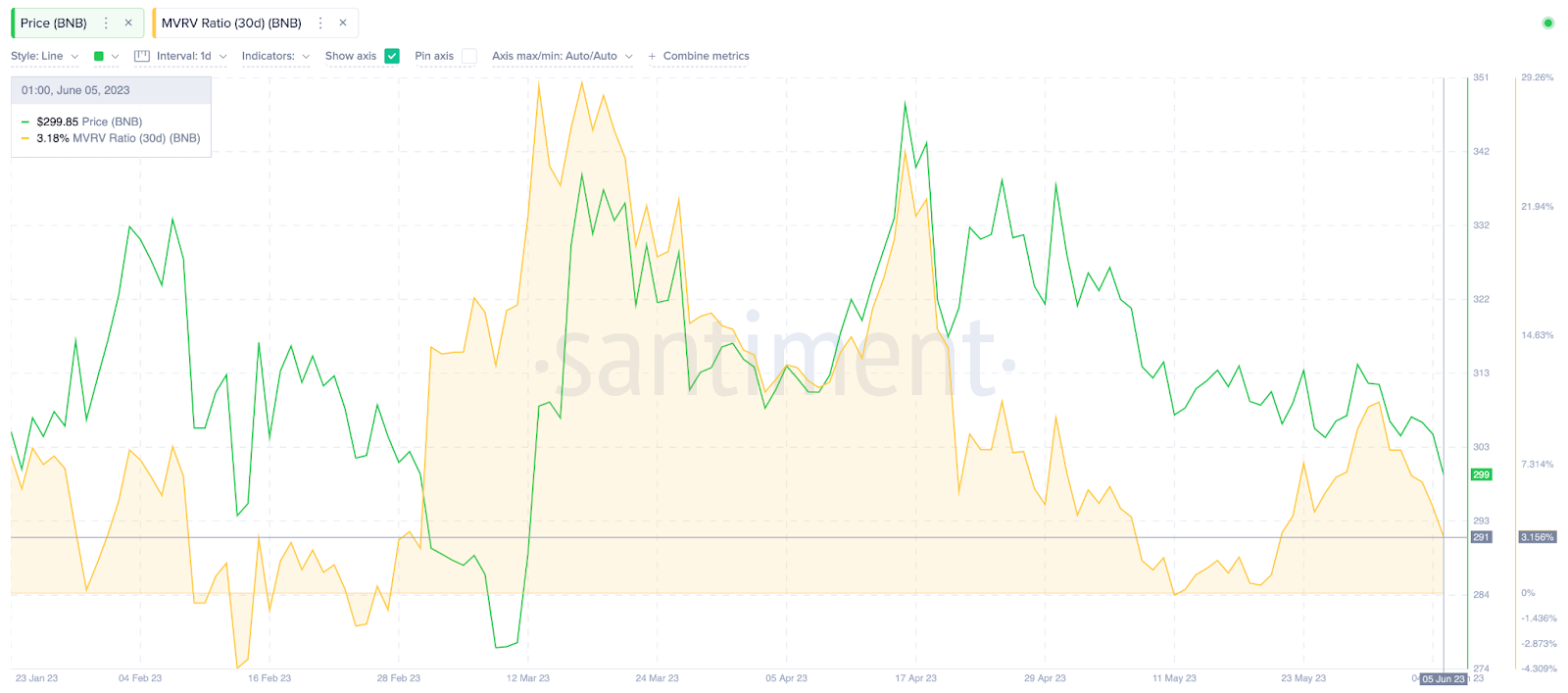

Santiment’s Market-Value to Realized-Value (MVRV) data indicates that despite the recent price drop of $300, most investors that bought BNB within the past month are still holding profits of around 3%.

Historical trading patterns suggest BNB holders will likely keep selling until they break even around $293.

And if the bearish price prediction plays out, BNB could drop 4% further, toward the $280 zone, before holders finally opt to cut their losses.

Conversely, the bulls could still flip the narrative if the price unexpectedly rebounds 5% toward $314. Nevertheless, investors looking to book profits at the $315 zone could mount a roadblock.

But if the bulls manage to scale that resistance zone, BNB could soar by another 5% to the next significant resistance level at $330.

Read More:

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.