Binance toasts about 2,020,132.25 BNB in its 23rd quarterly burn, taking $674 million coins out of circulation as it trades at $333, about half its all-time high.

Number of BNB in Circulation Around 155.2 Million

The latest burn includes about 656 BNB ($218,000) as part of the exchange’s Pioneer Burn Program, introduced in 2020 to help users who lose assets by sending them to the wrong address.

The auto-burn adjusts the amount of BNB according to the coin’s price and the number of blocks generated on the BNB Chain. Binance’s first quarterly burn occurred in October 2017 when the token’s price was $1.52.

The latest auto-burn takes the number of BNB in circulation to 155,166,772.80.

BNB Price Outlook Bullish Following Latest Burn

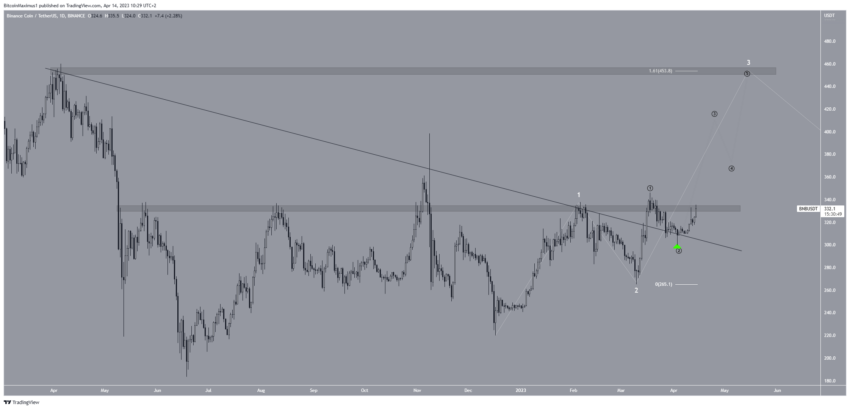

The BNB price chart looks decisively bullish for numerous reasons.

Firstly, the price broke out from a long-term descending resistance line and validated it as support (green icon). This created a long lower wick and initiated the current upward movement.

The wave count also supports the increase. It suggests that the price is in wave three (white) of a five-wave upward movement. The sub-wave count is given in black, also indicating that the price is in sub-wave three. As a result, BNB could be in the portion of the movement in which the rate of increase accelerates.

The most likely target for a top would be at $453. This is a horizontal resistance area. Reaching it would also give waves one and three a 1:1.61 ratio.

The only obstacle to the ongoing increase is the $330 resistance area. A daily close above it would confirm the bullish trend and could accelerate the upward movement. On the other hand, a rejection would lead to a retest of the long-term resistance line at $300.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.