Friday is crypto options’ expiration day, with more than $2 billion in BTC and ETH contracts poised to be settled or renewed today. Crypto markets have been climbing on spot ETF approvals this week, but can they keep going?

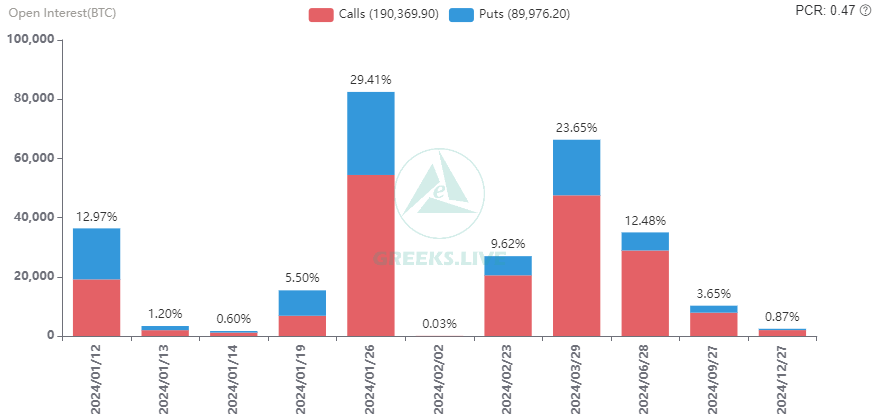

Around 36,000 Bitcoin options contracts are set to expire on January 12. The big expiry event is larger than last week’s, which saw $1 billion worth of contracts expire with little impact on markets.

Bitcoin Options Data Shows Major OI at $50,000 Strike Price

The notional value of today’s big tranche of Bitcoin contracts is around $1.68 billion.

Moreover, the put/call ratio for this batch is 0.9, meaning that the bulls and bears are evenly matched selling longs and short contracts.

Additionally, the max pain point for this set is $45,000, a little lower than the current spot market price.

According to Deribit, there is still major open interest at the $50,000 strike price with $1.2 billion in calls. With such a large concentration of call options at this price, derivatives traders are anticipating that BTC prices will rise by the end of January.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Greek’s Live commented that Bitcoin spot ETF approvals passed this week as expected. However, repeated fake news and breaking news made the market “frequently and sharply volatile.”

All major term implied volatility retreated significantly due to less-than-expected market volatility, it added.

The long-term outlook is solid, with a lot of incremental capital flowing into the crypto market, Greeks Live noted before concluding:

“But in the short term there is still significant uncertainty in the market with a number of factors at play, and sharp volatility, like this week’s, could continue for several days.”

Ethereum Options Expiry

In addition to the big batch of Bitcoin options expiring today. 262,00 million Ethereum contacts will also expire. The notional value of these options is $680 million, and the put/call ratio is 0.64.

These have a max pain point of $2,400, which is also a bit lower than current spot prices. Moreover, there is a lot of open interest with calls at $2,500 and $3,000 ETH strike prices, according to Deribit.

Crypto markets are up 1% on the day at $1.86 trillion, though they’re not likely to be impacted by the expiring options derivatives.

Bitcoin is holding at $46,262, while Ethereum, which has outperformed this week, was trading just above $2,600 at the time of writing.