Pacmoon (PAC), the biggest meme coin on the Blast blockchain, has moved to Solana. This comes after the coin’s recent popularity boost, which has brought renewed interest in “social farming,” where creators interact, make content, and earn rewards.

This change adds to the ongoing debate between Solana and Ethereum, with people often discussing which blockchain is better.

Pacmoon Prefers Solana to Blast

Pacmoon marketing strategist Lamboland confirmed the news: “Building on Blast has always been an uphill battle.” The marketing mastermind slammed Blast for not focusing on what makes a blockchain successful.

“They [Blast] created a system where native tokens on Blast are actively disincentivized and they provided zero social support,” Lamboland explained.

With this migration, the project will keep its team and community but will adopt a new meme, ticker, blockchain, and tokenomics. Lamboland urges all PAC holders to burn their tokens, promising equivalent compensation on Solana as the project transitions.

“We will airdrop you ARMY on Solana based on how much PAC you burn. ARMY is our second project, but we’re bringing the PAC community with us,” the marketer added.

Read more: Ethereum Layer-2 Rollups Compared

Pacmoon launched on Blast as a community coin, tapping from the community’s creativity with strategic incentives. It quickly became the face of Blast culture, reflecting innovation in the crypto space as it consistently introduced fresh approaches each season.

“Our marketing strategy is all about incentives. We believe incentives drive outcomes in crypto and Blast has the strongest incentives out of any blockchain,” Lamboland said in a recent interview.

Several projects have welcomed the PAC ecosystem, soon to be renamed ARMY, into the Solana blockchain. Nick Ducoff, head of institutional growth at the Solana Foundation, praised Solana as the better choice for the ecosystem. The ARMY airdrop is scheduled for August 15, giving PAC holders until August 14 to burn their tokens and remove their liquidity pools.

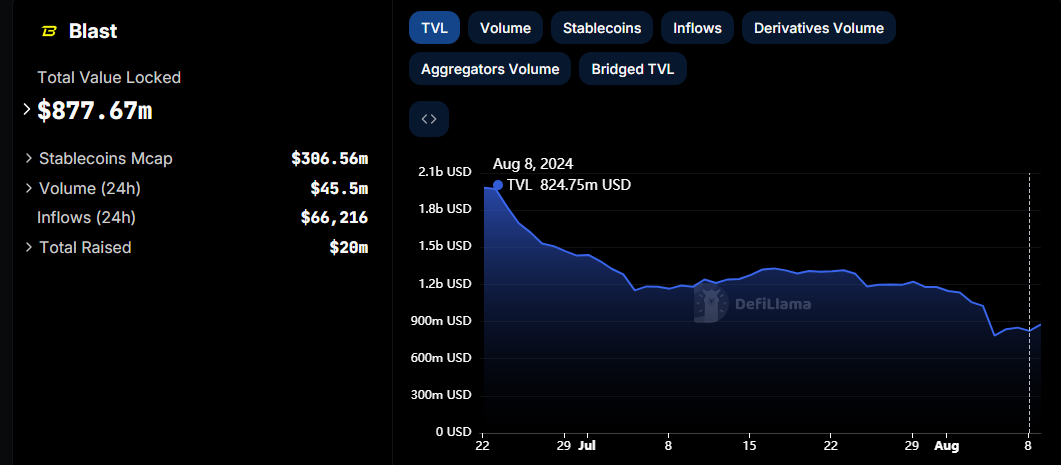

Blast is an Ethereum Layer-2 (L2) scaling solution that leverages optimistic rollup technology for fast and cheap transactions. This is while it maintains the security of the Ethereum mainnet and comes with a native yield offering for passive income to ETH and stablecoins holders.

The Total Value Locked (TVL) of Blast has increased by $52.92 million since the announcement on Thursday. However, this capital might decrease as the August 15 deadline approaches.

The Allure of Solana Over Ethereum

Pacmoon’s preference for Solana triggers the longstanding debate about Solana versus Ethereum. Parameters such as efficiency, development, and scalability have come up in the past. In December, however, Solana co-founder Anatoly Yakovenko rejected the narrative that Solana is an Ethereum killer. He said it is normal for the two technologies to have overlapping features and compete.

“Don’t bring back last cycle “eth killer” bs. It’s lame. Pareto-efficient technologies can have overlapping features and will compete, but that’s all ok. I don’t see a future where Solana thrives and somehow ETH dies. I am such a techno-optimist that I am certain that eventually Danksharding will have enough bandwidth for all of Solana’s data,” Yakovenko wrote.

Investors have also questioned the likening of Ethereum’s decentralization characteristics to Solana’s. The bone of contention is that the Solana Foundation and related entities own 20% of SOL supply, 100x more than what the Ethereum Foundation owns in ETH’s supply.

“With the Solana foundation and related entities still owning 20% of the SOL supply, I wouldn’t call it decentralized. In comparison the Ethereum foundation holds about 0.2% of the ETH supply,” wrote Steve Dakh, CTO and founding member of Ethereum.

Read more: Solana vs. Ethereum: An Ultimate Comparison

Both blockchains present strong cases, which trickles down to preference, as both already provide hubs for strong projects.