A wave of activity by large cryptocurrency investors, known as crypto whales, has flooded major exchanges with millions of dollars worth of Ethereum (ETH), Uniswap (UNI), and Space ID (ID).

This surge in transactions has captured the attention of the crypto market, raising questions about the motives behind these movements and their potential impact on prices.

Whale Activity Surges: Crypto Assets Flood Exchanges

Since April 16, 2024, cryptocurrency analysts have tracked several significant transfers. According to on-chain data, DWF Labs moved 9.2 million ID tokens worth $6.69 million to the crypto exchange – OKX. After this transaction, the wallets of DWF Labs tracked by Spot On Chain do not hold any ID tokens.

Crypto giant Amber Group also appears to be involved in selling activity. Arkham Intelligence data suggests that Amber Group has transferred 1 million Arbitrum (ARB) tokens to Coinbase, valued at $1.13 million. This follows a previous transfer of $9.43 million worth of ARB to an exchange address last month, with $3.57 million remaining.

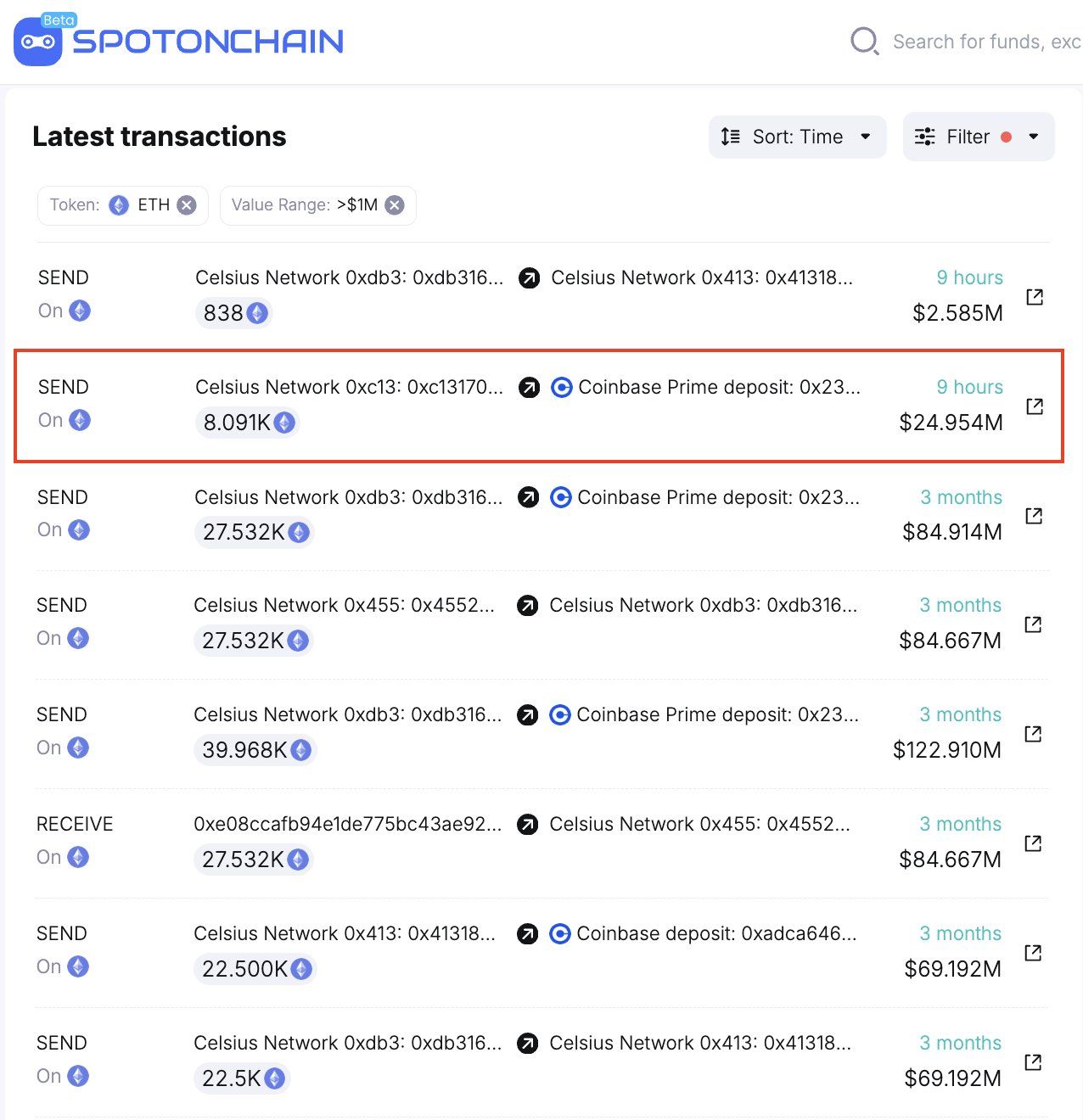

Celsius Network moved 8,091 ETH (approximately $24.5 million) to Coinbase in a separate but noteworthy transaction. Blockchain analysis firm Spot On Chain reported this transaction on April 17.

“This is Celsius Network’s largest ETH deposit in three months. Previously, from November 13, 2023 to January 31, 2024, Celsius moved 847,626 ETH (~$1.90 billion) to various CEXs, allegedly for some OTC deals,” Spot On Chain explained.

Read more: Best Crypto Exchanges With the Lowest Trading Fees

Further notable activity includes withdrawing 6,513 staked ETH from Lido by the multi-signature address 0xA97…08Ddc. The wallet owner deposited 5,100 of these ETH, worth $15.72 million, to OKX. This address still holds a substantial amount of cryptocurrency – 10,389 ETH and 50 WBTC, totaling $64.65 million.

Additionally, a Uniswap (UNI) whale accumulated tokens since October 2023 by withdrawing from the MEXC exchange and purchasing on the chain at an average price of $6.20. Finally, this whale sold their UNI holdings today for $6.83, netting a profit of $0.25 million (approximately +10%).

In another transaction, Lookonchain spotted Tron’s founder, Justin Sun, withdrawing 196 million USDT from Huobi and depositing it into Binance. However, the reason behind this transfer remains unclear.

Large-scale cryptocurrency transactions like these garner significant attention from investors. Historically, investors see major crypto whale sell-offs as bearish signals, possibly suggesting holders are taking profits.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in April 2024

Despite the possibility of selling off, some transactions simply intend to shift assets to different wallets before further distribution. It’s also important to note that major sell-offs could flood the asset’s circulation, potentially lowering its price.

While the motives behind these specific whale movements remain speculative, they highlight the fluidity of the crypto market. Monitoring large transactions is crucial as they can provide clues about potential market trends.